Bitcoin is currently facing a pivotal moment as its price hovers around critical resistance levels. At present, Bitcoin is trading near $55,000, and the next few days may determine its trajectory.

Should Bitcoin fail to break above the key $58,000 resistance, a pullback towards $48,000 could be imminent.

Bitcoin Price Risks $48,000 If Support Fails

Market sentiment has been heavily influenced by macroeconomic factors, including inflation concerns, Federal Reserve policies, and broader economic indicators. The ongoing uncertainties surrounding US monetary policy, particularly the likelihood of interest rate cuts, have further muddied the waters.

As inflation remains high and the labor market shows signs of weakening, the possibility of aggressive monetary easing is increasing. Historically, such conditions have boosted demand for alternative assets, such as Bitcoin.

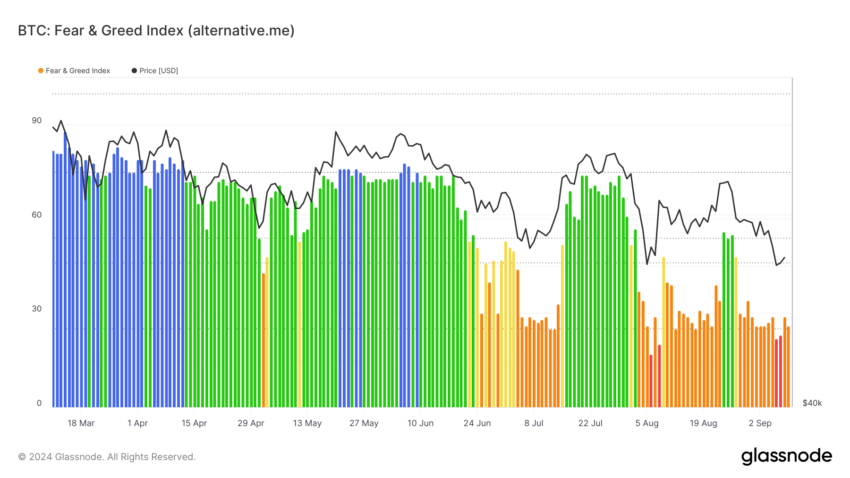

The crypto Fear and Greed Index, a tool used to gauge market sentiment, has recently dipped to 22, a figure that reflects widespread fear among investors. The last time this index was this low was during the collapse of FTX in November 2022.

As the market braces for further economic turmoil, some analysts believe this negative sentiment could trigger further declines in Bitcoin’s price before any recovery.

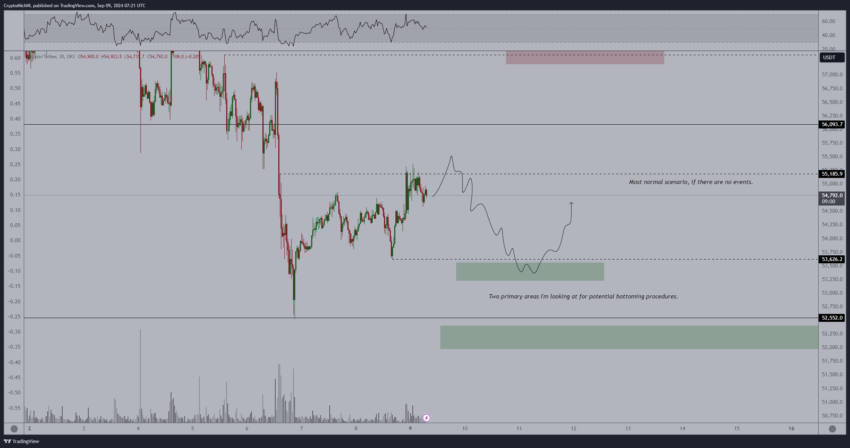

Analysts like Michaël van de Poppe and Trader XO are closely watching the $58,000 level. According to them, if Bitcoin manages to break through this barrier, it could signal a continuation of its bullish trend, potentially leading to a new all-time high.

On the other hand, failure to claim this level might send Bitcoin into a deeper correction, with $48,000 seen as the next significant support level. This would represent a 10-15% drop from current prices, in line with previous market corrections.

“If we look at the lower time frames for Bitcoin, then we can see that we are continuing to trend down. We have a few crucial levels in this regard. As long as Bitcoin stays beneath $58,000, I technically believe we’re going to see $53,000 and perhaps even $48,000,” van de Poppe explained.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

In conclusion, Bitcoin’s price action over the coming days will be crucial. With a potential drop to $48,000 looming, investors are advised to monitor macroeconomic factors and Bitcoin’s ability to break the $58,000 resistance level. Failure to do so could lead to a more prolonged downturn.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.