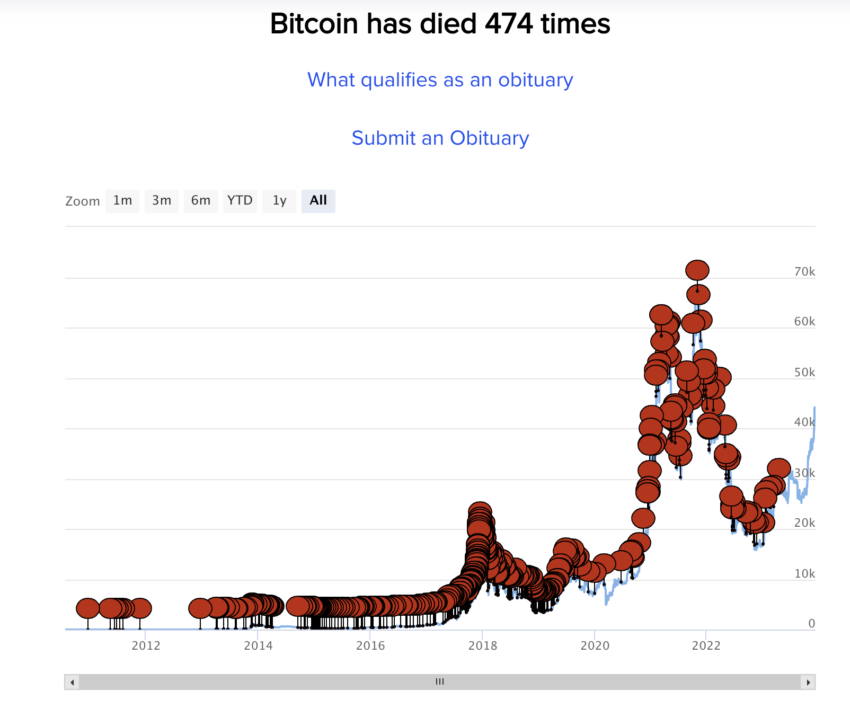

As per the 99Bitcoins platform, Bitcoin (BTC) has been officially declared “dead” 474 times since 2010. Predictions of cryptocurrency demise are most frequent during extended bear trends. However, despite these circumstances, Bitcoin’s price has consistently rebounded, reaching new all-time highs.

Tomasz Wojewoda, head of business development at BNB Chain, believes that something more extreme can lead to a complete collapse of Bitcoin and the entire cryptocurrency market. He told journalists about this combination of unique events.

What Extreme Events Can Kill Bitcoin?

Over the course of 13 years, Bitcoin has been declared dead at least 474 times. In November 2023, the well-known Indian author Chetan Bhagat wrote a column declaring that the crypto is dead. Interestingly, Bitcoin and the broader crypto-market bottomed out in the same month.

According to Wojewoda, an “extreme event” that can kill Bitcoin is when all or most of its participants forget about cryptocurrencies and never use them. According to the expert, this is unlikely because cryptocurrencies are used not only for speculation but also for regular transactions anywhere in the world. He said:

“The cryptocurrency market, like any other market in the economy, moves in waves and tends to rise or fall depending on the mood of its participants. Cryptocurrencies have experienced bearish trends many times, but in the past we have seen the industry recover from such events.”

It is important to note that a key feature of digital assets is the undeniable ownership of decentralized assets that are cryptographically secured. This means that users can set up their wallets, send coins there, and be sure that no one can confiscate them. Moreover, cryptocurrency owners can dispose of them as they wish. There is no need to seek permission from centralized organizations such as banks.

Read more: How To Set Up a Crypto Wallet

In other words, the expert is sure that there will always be a demand for cryptocurrencies. It is a convenient investment asset that is a technological breakthrough in itself.

Even if all the investors on the planet suddenly disappear, the Bitcoin enthusiasts working on its blockchain will support it. And even this fact is enough to maintain the functionality of the BTC network and carry out transactions. Hence, it is nearly impossible that these factors can kill Bitcoin.

What About Governments?

The efforts of some government agencies are also unable to stop the development of cryptocurrencies. The US Securities and Exchange Commission (SEC), led by Chairman Gary Gensler, has been particularly aggressive towards cryptocurrency companies.

According to Gensler himself, his agency filed over 780 lawsuits in 2023, which is a very serious result.

However, the SEC also lost some high-profile cases throughout 2023. The regulator lost a court case against Grayscale and also dropped charges against Ripple, whose token the Commission called a security. In both cases, the court found the regulator’s claims groundless. Well, with this, the SEC losses have only strengthened investors’ faith in cryptocurrencies and their steadfastness.

Notably, November 2023 set a record for the number of mentions of Bitcoin in SEC filings. This is primarily due to preparations for launching new ETF funds for the first cryptocurrency in the US. It is expected that this may occur in the first half of January 2024, i.e. within the next month.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Ultimately, the government and regulators must accept that cryptocurrencies are here to stay. Wojewoda believes that regulating the cryptocurrency market will continue to serve it well in the long run.

“Global regulations may impact the growth of the cryptocurrency market. But as more countries around the world discover cryptocurrencies, I don’t think legal measures will make digital assets “extinct.” Regulation in the industry is a good thing.”

Of course, all of the above does not apply to absolutely all cryptocurrencies. Useless or dishonest projects will die out, says the expert.

“Projects that had no real application died. But these coins that have really had an impact on the industry have not only survived, but are now producing good returns.”

Bitcoin Will Continue to Remain The Most Popular

The permutations among altcoins will not affect Bitcoin in any way. It has become a brand of the cryptocurrency industry and will remain so for a long time – says the representative of BNB Chain.

“Bitcoin is likely to remain the most popular cryptocurrency in terms of market share. I think we will see more ranking moves among cryptocurrencies that have real use cases.”

Matrixport’s head of research, Markus Thielen, is also skeptical that a bear market or other crisis poses a real threat to the cryptocurrency market and Bitcoin in particular. Speaking to reporters, Thielen said global downtrends should be seen as an opportunity to rebuild and improve the company. Those who survived the “crypto winter” will be able to reap well-deserved profits in the long run.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.