On-chain sleuths have reported that the decentralized finance (DeFi) protocol Euler Finance is undergoing an exploit.

Hackers stole over $195 million from the noncustodial DeFi protocol Euler Finance in the flash loan attack. The team confirmed the hack and assured users that they were working with security professionals and law enforcement.

The blockchain security firm informed Euler Finance that they located the root cause and invited the team to work together. It is the largest exploit in 2023 so far.

Euler Finance Attackers Stole Ethereum (ETH) and DAI Stablecoins

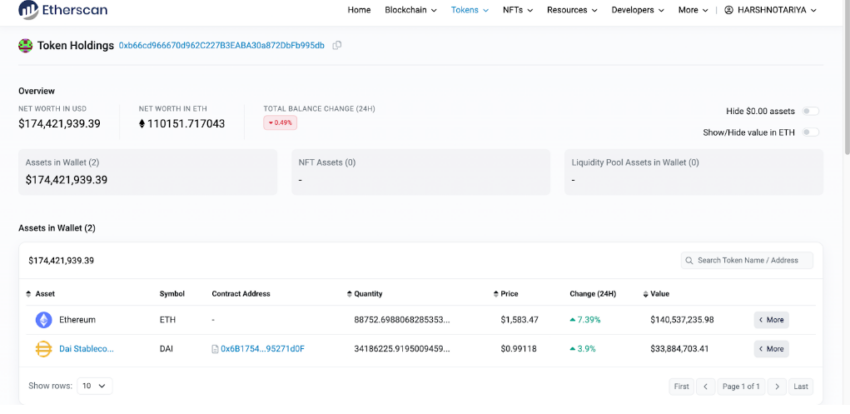

The hackers transferred the funds from the protocol to two fresh wallets. One of the wallets has 88,752 Ethereum (ETH) and 34,186,225 DAI stablecoins. At the same time, the other one has over 88,77,507 DAI tokens.

On-chain sleuth ZachXBT believes that “they were exploiting some random protocol on BNB Smart Chain (BSC) a few weeks ago.”

Flash Loan Attacks

In February, another platform, Platypus, was also hit with a flash loan attack, draining over $8.5 million.

The DeFi protocol Aave developed flash loans in 2020, which made lending and borrowing simpler without collateral. In layman’s language, a crypto loan is taken out and repaid within the same transaction in a flash loan.

But, this facility attracted bad actors to take huge loans and then use the amount to manipulate the market in their favor. Such malicious activity is referred to as a flash loan attack.

Got something to say about the Euler Finance hack or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.