Ethereum’s network deflationary status is waning post-Dencun Upgrade, with data showing a notable increase in ETH supply since mid-April.

The Dencun Upgrade in March, while beneficial in reducing transaction fees, has affected Ethereum’s deflationary status, a key selling point for long-term holders.

Over 112,000 Ethereum Added to Overall Supply

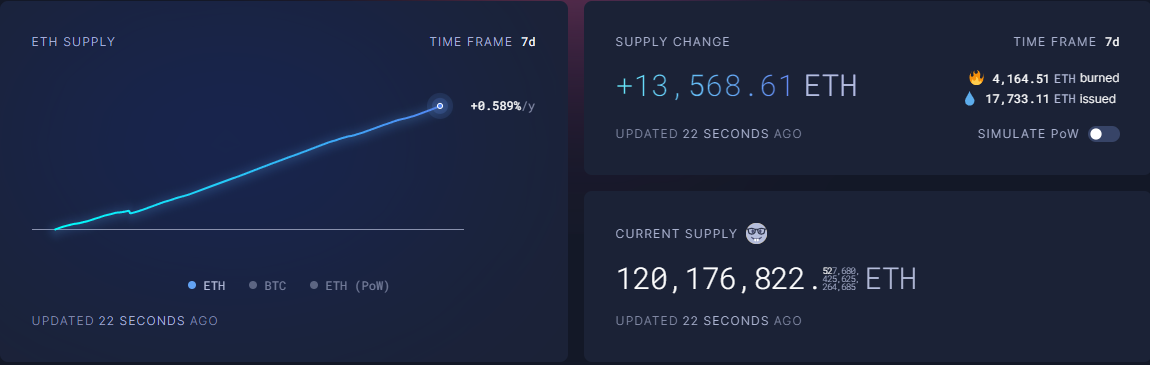

Despite initial hopes, Ethereum is now experiencing its longest inflationary period since its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). According to ultrasound.money, over 112,000 ETH have been added to the overall supply since mid-April, counteracting the anticipated deflationary effects.

The Dencun Upgrade, particularly its EIP-4844 model, aimed to solidify Ethereum’s status as “ultra-sound money.” While it successfully lowered transaction fees, it inadvertently decreased the total amount of ETH burned on the mainnet. This reduction has resulted in a slower burn rate, pushing Ethereum back into inflationary territory.

“At the current rate of network activity, Ethereum will not be deflationary again. The narrative of ‘ultra-sound’ money has probably died or would need much higher network activity to come back to life,” CryptoQuant analysts highlighted.

With the inflation rate at 0.59% per year, the “ultra-sound money” narrative is diminishing. Indeed, Ethereum is currently issuing more units than it burns, contradicting the earlier deflationary narrative.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade? Here’s A Deep-Dive

Despite these changes, the Ethereum network is witnessing significant scaling activity. zkLink CEO Vince Yang noted that the EIP-4844 upgrade is beneficial for Ethereum, especially for Layer 2 networks.

“Scaling activity on Ethereum is at its highest thanks to the significant reduction of gas costs to execute transactions on Layer-2s. Compared to earlier this month, Ethereum’s combined transactions have exploded to an all-time high from 140 to 285 TPS,” Yang told BeInCrypto.

This scaling activity is crucial for the development of new blockchain applications, positioning Layer 2 and Layer 3 solutions advantageously.

“The recent inflationary trend in Ethereum, adding over 112,000 ETH, significantly impacts the L2 ecosystem. Higher inflation could increase mainnet fees, prompting users to switch to L2 solutions with lower fees and faster transactions. Fluctuating ETH values may require L2 networks to reassess their security models for robustness and decentralization. This environment can spur L2 innovation, enhancing efficiency and user experience, attracting more developers,” Artur Gulinski, Marketing & Operations Director at Orbitt, shared with BeInCrypto.

Meanwhile, staked Ethereum is peaking, with anticipation for spot Ethereum ETFs growing. Bloomberg senior ETF analyst Eric Balchunas predicted that spot-based Ethereum ETFs might start trading by July 2, following positive comments from the US SEC on the S-1 filings.

Recently, VanEck filed Form 8-A for a Spot Ether ETF, reinforcing the sentiment of a potential launch soon. This optimism mirrors the swift approval process seen with spot Bitcoin ETFs launched in January.