A recent $11 million transfer of stolen Ethereum (ETH) has raised concerns over a potential market selloff.

The funds, linked to the July hack of crypto exchange WazirX, were moved early Monday, September 9, by a North Korean hacking group to Tornado Cash, a service known for anonymizing crypto transactions.

Ethereum Price Plunge Feared After Big Transfers

Data tracked by blockchain intelligence firm Arkham revealed that 5,000 ETH, worth over $11 million at current prices, was transferred to a new address at 07:19 UTC. Shortly after, $1.2 million was sent to Tornado Cash in five separate transactions.

Tornado Cash allows users to obfuscate the origin and destination of funds on the blockchain. It is a popular choice among cybercriminals. While the service itself is not illegal, its use in high-profile hacks like this has drawn scrutiny.

This latest transfer follows a $4 million move last week from the same North Korean hacker’s address. It still holds over $107 million in various cryptocurrencies. The stolen assets, including $100 million in ETH, represent a substantial portion of WazirX’s reserves.

The exchange is currently undergoing restructuring to manage the fallout from the attack, which remains one of the largest attacks on an Indian exchange to date.

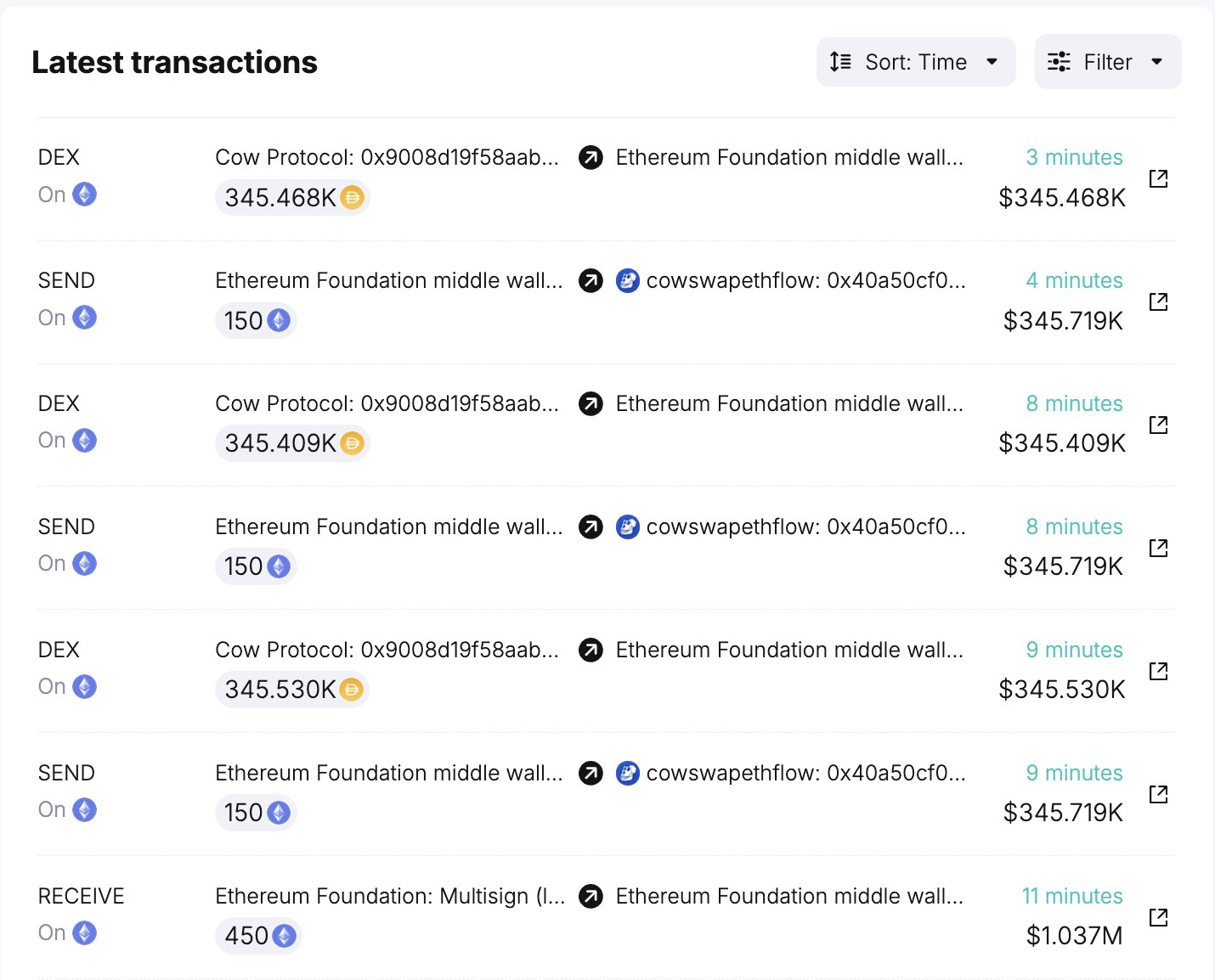

The recent transfers come amid growing market anxiety, compounded by recent significant Ethereum sales by prominent figures. For instance, Ethereum co-founder Vitalik Buterin moved 3,800 ETH, worth roughly $10 million, in two batches on August 9 and 30. Buterin’s wallet has been gradually offloading ETH, recently selling 760 ETH for $1.83 million in USDC.

Additionally, the Ethereum Foundation sold 450 ETH for $1.03 million in DAI, further stoking fears of price pressure.

The timing of these large transfers has fueled concerns about further downward pressure on Ethereum’s price. Ethereum, which is currently trading at $2,320, is already in a vulnerable position after a series of price corrections in August.

The cryptocurrency has been hovering between $2,200 and $2,350, with BeInCrypto’s technical analyst Victor Olanrewaju reporting that a drop below $2,200 could lead to a significant price decline, potentially driving Ethereum down to $2,048 or even $1,577.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

With Ethereum’s Relative Strength Index (RSI) signaling bearish momentum and selloffs continuing across both spot and perpetual futures markets, traders are bracing for more volatility in the coming weeks. As the hacker continues to offload stolen ETH, market sentiment could turn more pessimistic, driving the price lower.