The Ethereum (ETH) price broke out from a descending resistance line. It is possible that momentum has turned bullish due to the upcoming Ethereum Shanghai upgrade. Reclaiming the $1,650 area could further accelerate the rate of increase.

Ethereum news last week was decisively positive. The Ethereum supply has turned deflationary once more. The current supply of 120 million ETH tokens is 2,000 less than at the time of the release of Ethereum 2.0 in Sept. 2022, and the switch to a proof-of-stake (PoS) consensus mechanism.

Ethereum is possibly rising due to the upcoming Shanghai Upgrade, the next planned update for the blockchain. While the upgrade will not tackle the issues with gas fees or improve smart contracts, it will allow for the phased withdrawal of Staked ETH, which have been on the Beacon Chain for more than two years.

Ethereum Price Finally Breaks out

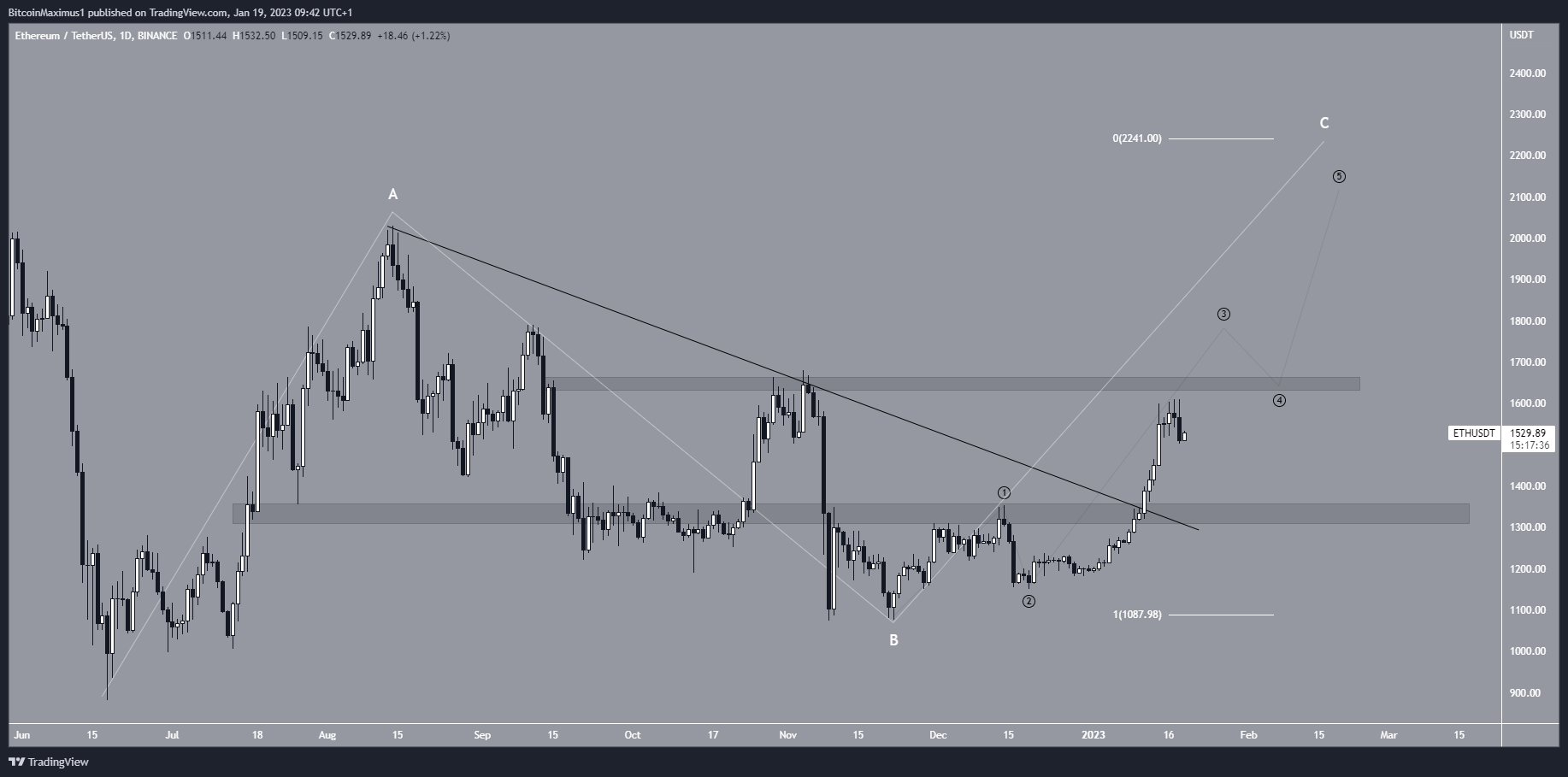

The Ethereum price has increased at an accelerated rate since the beginning of the year. On Jan. 11, it broke out from both the $1,350 resistance area and a descending resistance line that was in place since Aug. 2022. So far, the ETH price has reached a high of $1,611.

The main resistance area is at an average price of $1,660, created by the 0.618 Fib retracement resistance level and a horizontal resistance area. A movement above it could take Ethereum to $2,000. In case of a downward movement, the $1,350 area would provide support.

Wave Count Predicts Ethereum Above $2,000

Like the price action, the wave count for the Ethereum price is bullish. It suggests that the ETH price is in an extended third wave (black) of a five-wave upward movement.

The sub-wave count is given in red, showing that ETH is correcting inside sub-wave four. The most likely level for the wave to end is $1,440, at the 0.382 Fib retracement support level (red). The reason for this is that wave fours are often shallow. If correct, the price could reach the area within the next 24 hours.

Therefore, a decrease below the 0.618 Fib retracement support level at $1,340 would make this count unlikely, while a drop below the wave one high at $1,244 would outright invalidate it. In that case, the ETH price would drop below $1,200.

The longer-term wave count suggests that the ETH price is trading inside an upward A-B-C corrective structure (white). The five wave upward movement outlined prior creates this C wave.

Giving waves A-C a 1:1 ratio would lead to an ETH high of $2,241.

A movement above the $1,650 resistance area and its validation as support would go a long way in confirming that this is the correct count.

To conclude, the most likely ETH price analysis supports an upward movement toward $2,240. A decrease below $1,244 would invalidate this price projection and suggest that the Ethereum price could fall below $1,000. The release of the Ethereum Shanghai upgrade could further increase bullish momentum.

For BeInCrypto’s latest crypto market analysis, click here.