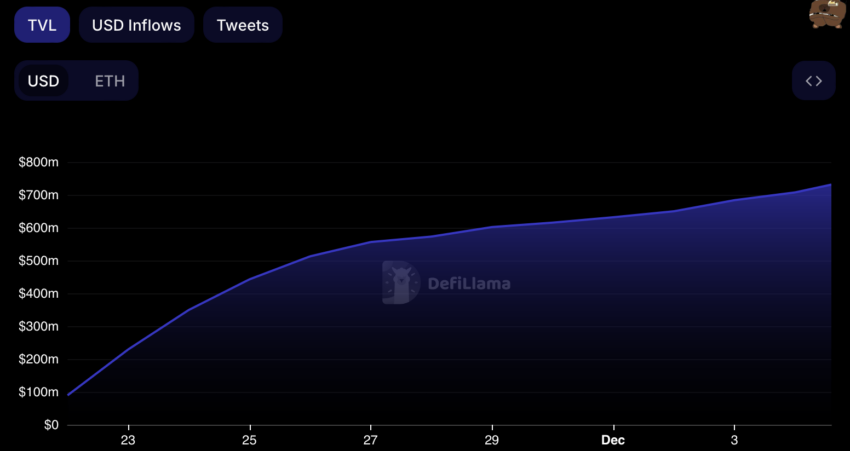

Last week, the world of decentralized finance (DeFi) welcomed the Blast Network. The protocol quickly reached a milestone of $400 million in total locked value (TVL), and $600 million in seven days.

Since then, the total value locked has risen to $722 million. A somewhat surprising feat, given rants against the project’s centralization.

Blast Scores $600 Million TVL in Mostly Staking Deposits

The success story of Blast is told in the numbers. It racked up a TVL of $400 million in four days and $600 million in seven days, quickly growing into a notable force in DeFi. TVL measures the value of assets locked, primarily through staking, in a DeFi protocol.

The Blast Network offers yields on Ethereum and stablecoins. It is successful partly because of the high returns it offers those who lock their assets for an extended period. A high TVL also suggests that users trust the security and robustness of a network.

Allegations of Centralization

An impressive launch has not deterred criticism that the Blast network is too centralized. Jarrod Watts, a developer at Polygon Labs, tweeted about it earlier this month.

Watts thinks the ability to upgrade smart contracts (bits of code that carry out critical functions in decentralized finance) using a wallet posed a security risk. Stolen private keys can give hackers access to the $400 million-plus assets on the network.

In Watts’ view, Blast is not a true Layer 2, a network that adds transaction speed and throughput to another blockchain. Rather, it is simply a platform that accepts tokens for staking.

Read more: Layer 2 Crypto Projects for 2023: The Top Pick

Blast rebutted, saying it is pursuing decentralization. On its website, its makers tout it as “the only layer two of Ethereum with fair rates of return for ETH and stablecoins.”

Blast users can automatically reinvest their crypto. Stablecoin deposits are converted to USDB, a stablecoin that is automatically reinvested in the MakerDAO protocol, a decentralized autonomous organization (DAO). MakerDAO said in September that it would back its DAI stablecoin with US government bonds.

Read more: How is Ethereum Leading the Decentralized Finance Revolution?

Do you have something to say about how DeFi protocol Blast exceeded $600 million in TVL or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.