Ethereum’s (ETH) price has disappointed investors, falling from nearly $4,000 to below $3,500.

This has led to many holders moving their ETH to the exchanges to minimize their losses.

Ethereum Investors Lose Confidence

Ethereum’s price drop is causing ETH holders to become increasingly skeptical, with many moving to sell their holdings to offset their losses.

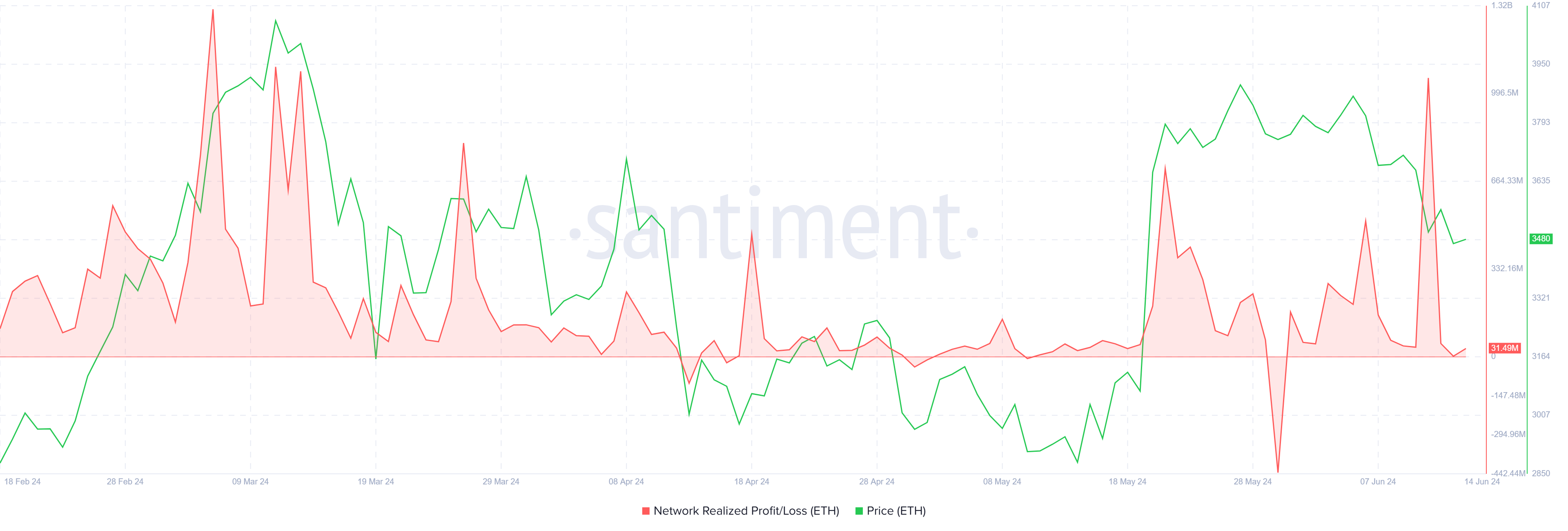

Looking at the network realized profit and loss indicator, profit-taking has surged over the last few days. The spike in the metric is the largest in three months, with the last such selling observed back in March when ETH was rallying. But this is being done due to the declining optimism pertaining to further profits.

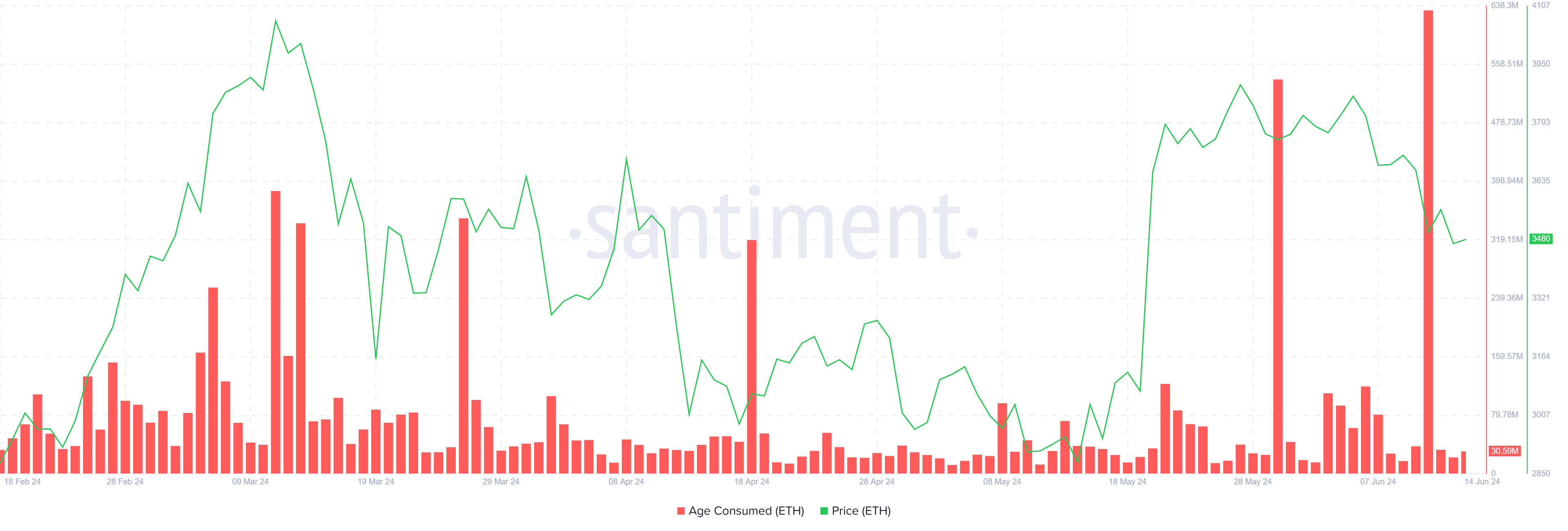

The ones selling on the network that created the most concern were the long-term holders. These investors tend to hold on to their assets for more than one year. Their HODLing during declines exhibits conviction and confidence in recovery. On the other hand, their selling leads to bearishness rising rapidly, causing a further drop in price.

This is evident in the Age Consumed of ETH, as a spike shows increased supply movement within addresses. This tends to exhibit a rising decline in conviction among investors.

In the case of Ethereum, this indicator spiking is not a good sign for the crypto asset. It shows long-term holders are uncertain of recovery in the future.

Read More: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

ETH Price Prediction: Another Dip

Ethereum’s price, trading at $3,578, faces resistance from the 50% Fibonacci Retracement level. With investors’ increasing bearishness, this resistance could get stronger, forcing ETH to fail the breach.

The likely decline will stop at $3,400, just above the 38.2% Fib level, which has been tested as support multiple times in the past.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, a successful breach of the 50% Fib line marked at $3,582 and flipping it into support will invalidate the bearish thesis. This will enable Ethereum’s price to reclaim the losses and climb back to $3,800;