Ethereum (ETH) price has been making some strides to establish above key the $1,300 support/resistance level. However, bulls still have some obstacles to clear before the ETH price can rise further.

Nov. 23 marked the rise of the ETH price as the larger crypto market gained momentum. The Ethereum price saw a considerable jump from the lower $1,000 level appreciating by close to 15% in the last two weeks.

Now that Ethereum price has established a foothold above the $1,250 mark, investors are wondering whether it could conclude 2022 on a much higher note. Here are some on-chain observations that point towards the short-term performance of ETH.

ETH Price Action Meets Resistance

Ethereum bulls have done a pretty good job of lifting the price to the upper $1,250 level. Even though the price charted a decent run from the $1,000 to the $1,250 price range, the $1,300 resistance has played spoilsport for the coin.

ETH price saw considerable resistance at the $1,300 mark as price action appeared to flatline. One positive sign was that RSI has maintained above the 50 mark, presenting minor domination from buyers.

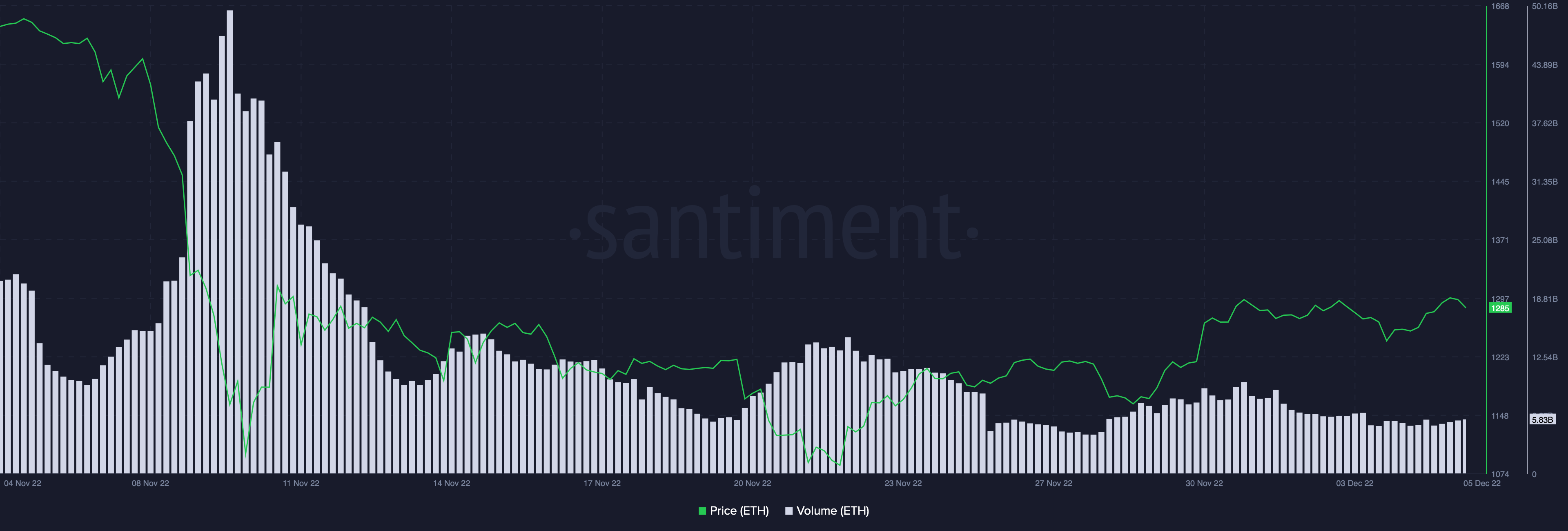

However, a look at the trade volumes for ETH suggested lower volatility in the market. Volumes have made lower highs and continued to flatten. This could mean that ETH bulls can face difficulties pushing price action up.

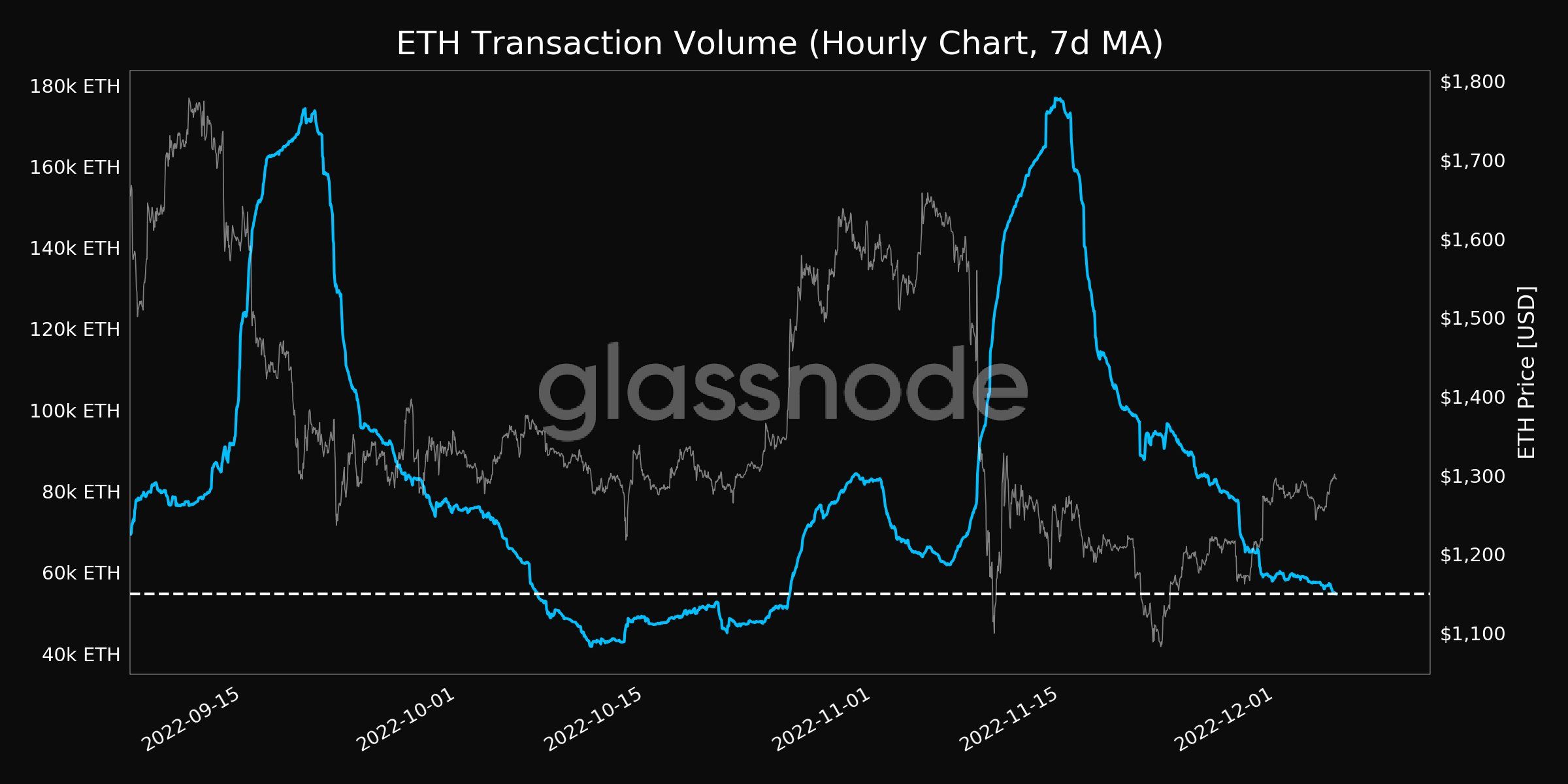

The on-chain outlook suggested that Ethereum volatility and vibrancy had dwindled. Ethereum transaction volume (7D MA) reached a one-month low of 54,673.636 ETH.

The reduced transaction and trade volumes could be one reason behind the coin’s weakened price momentum. Lower retail euphoria from participants has reflected in slowed down price momentum.

However, with outflows still dominating, it was evident that confidence in the market was still intact. Daily on-chain flow suggested $92.1 million outflows in ETH.

Ethereum Whales Being Cautious

Whale movement has often replicated price action. In the last one-month, the most price-correlated whale cohort holding 100,000-1,000,000 coins reduced their holding by over 2 million ETH.

The aforementioned whale cohort has acted in tandem with the price, accumulation from this cohort can lead to a price uptick for ETH in the short term.

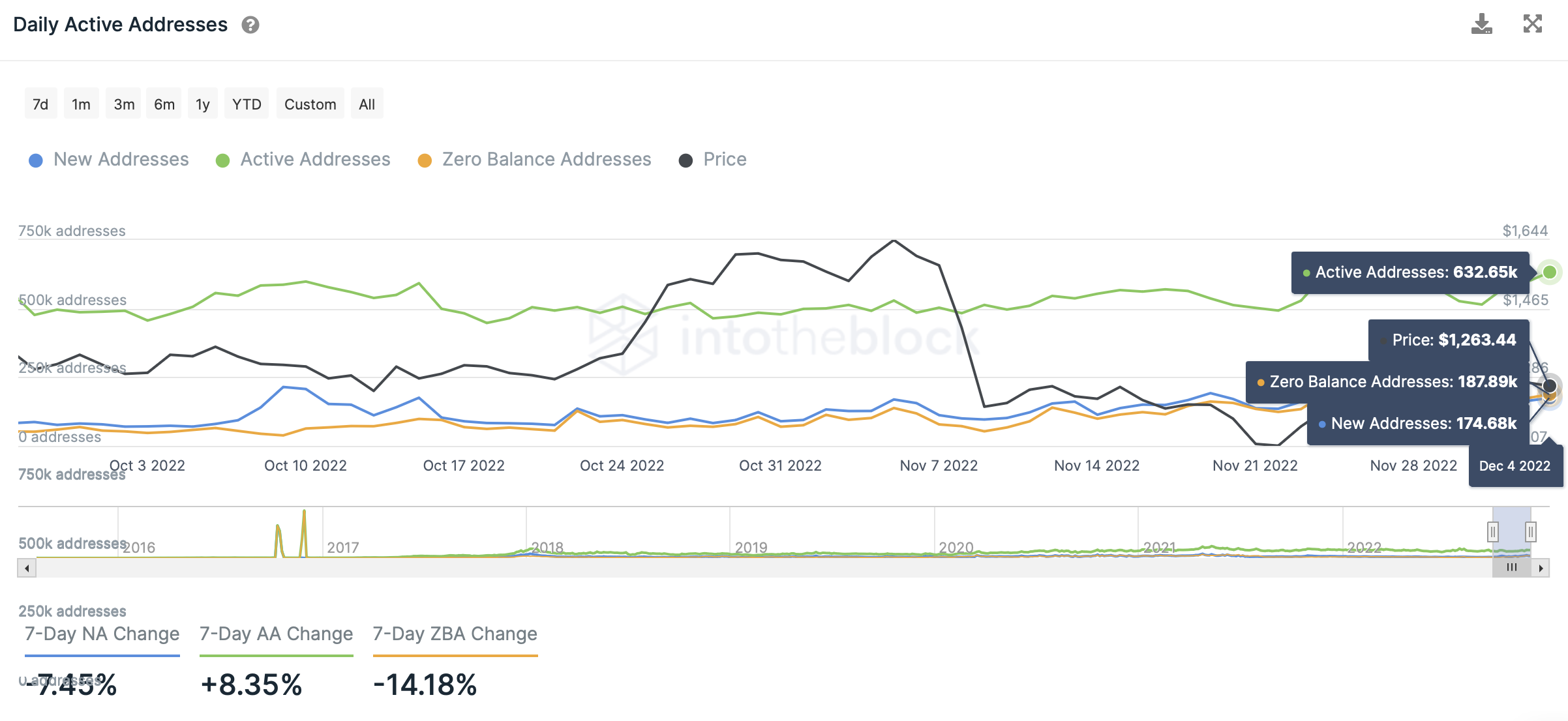

A look at the ETH daily active addresses suggested that seven-day new addresses dropped by 7.45%. Even though active addresses saw an over 8% rise, the drop in new addresses showed that fewer new participants entered the network.

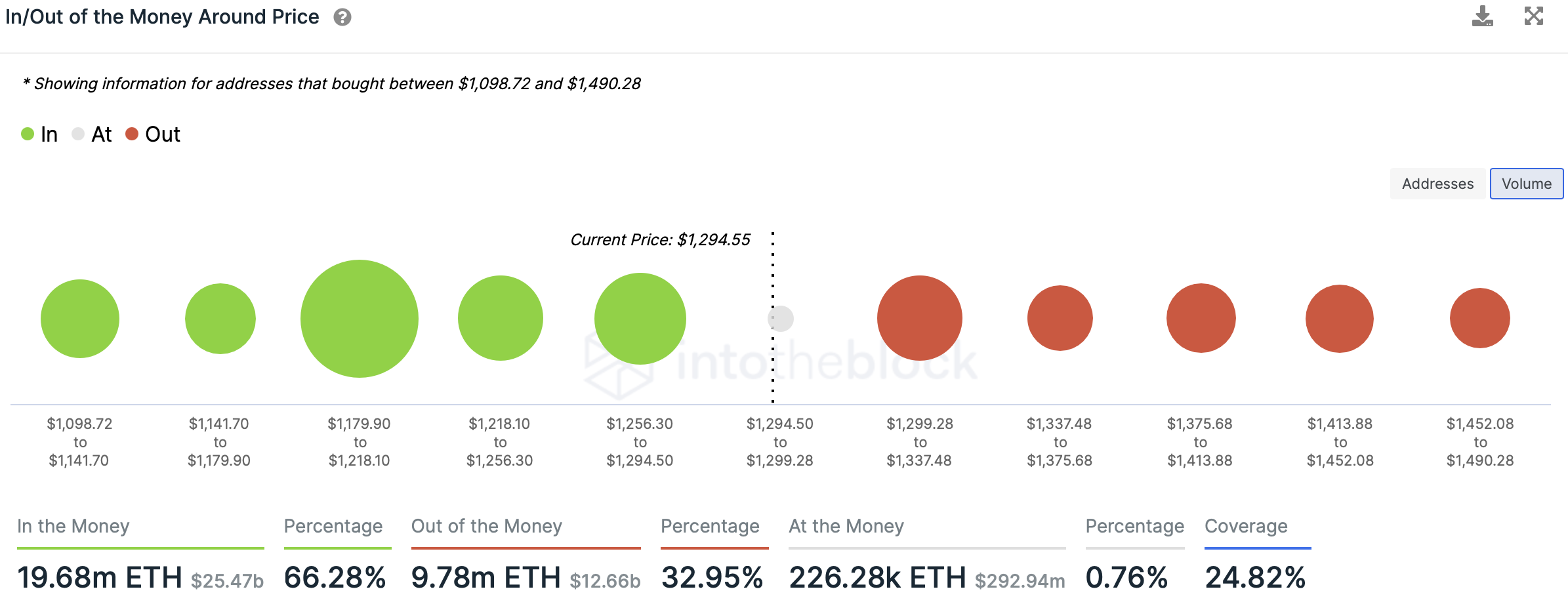

IntoTheBlock’s In/Out of Money Around Price Indicator suggested that a significant barrier lies for ETH price at the $1,317 level, where 1.82 million addresses hold 3.33 ETH.

While there were not many significant barriers ahead for ETH price, bulls were at major crossroads. A volatility swing from retailers can push the price ahead, but clearing the $1,350 resistance could be key for the ETH price.

Analyst Michaël van de Poppe also stresses the importance of the $1,350 mark for the ETH price trajectory.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.