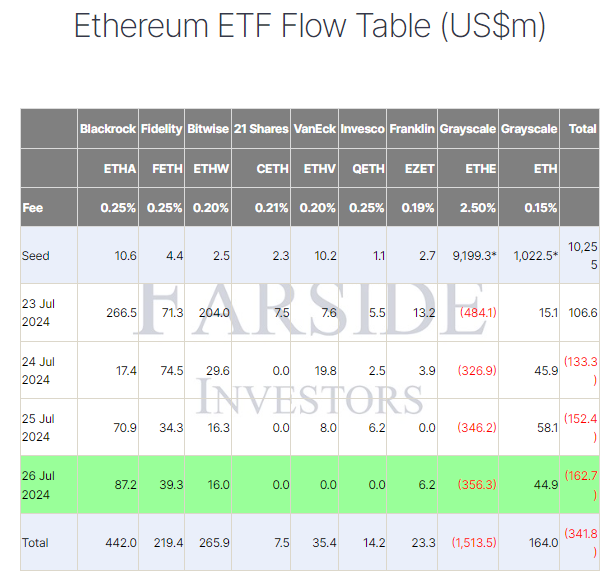

Spot Ethereum exchange-traded funds (ETFs) saw a net outflow of $340 million in their first week of trading, primarily due to substantial outflows from Grayscale’s converted Ethereum Trust (ETHE).

Despite this, analysts remain optimistic about the performance of these new products.

Grayscale Outflows Dominate Ethereum ETFs Flows

Data from Farside shows significant inflows for the newly launched ETFs in their first week. BlackRock iShares Ethereum Trust ETF (ETHA) led with $442 million in four days, followed by Bitwise’s Ethereum ETF (ETHW) with $265.9 million in inflows. Fidelity’s Ethereum Fund (FETH) completes the top three with $219 million.

The other products, including VanEck Ethereum ETF (ETHV), Invesco Galaxy Ethereum ETF (QETH), Franklin Ethereum Trust (EZET), and 21Shares’s CETH, saw around $80 million in cumulative inflows.

Read more: How to Invest in Ethereum ETFs?

Meanwhile, Grayscale’s new Mini ETH ETF, designed with lower fees to counteract the outflows from ETHE, saw net inflows of $164 million during the week. However, the original Grayscale ETHE, converted from a trust to an ETF, saw outflows of $1.5 billion during this period.

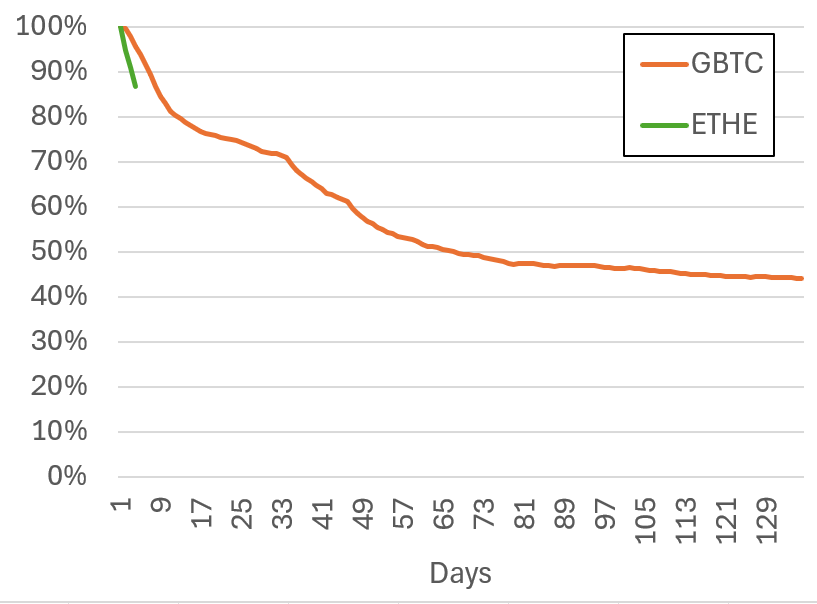

Analysts attributed ETHE’s outflows to its high fees of 2.5%, compared to an average of 0.25% charged by others. This pattern was similar to that of the firm’s Bitcoin Trust (GBTC), which also experienced strong outflows following its conversion in January.

“In percentage terms, after just three days, ETHE seems to be losing assets much faster than GBTC. On the positive side, the rate of decline may taper off sooner,” Farside Investors said.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Market analysts believe that despite these outflows, the new products have had an impressive start. Bloomberg ETF analyst Eric Balchunas noted that the “New Eight” Ether ETFs were not as strong as the “New Nine” Bitcoin ETFs in offsetting Grayscale’s outflows. However, he emphasized that their inflows and volume remained healthy and expected the intensity of the ETHE outflows to decrease soon.

Similarly, Nate Geraci highlighted the success of these ETFs, noting that the newly launched products — excluding Grayscale’s ETHE — saw over $1 billion in inflows in just four days.

“Well over $1 billion came into spot ETH ETFs this week. A portion was recycled from ETHE, but it wasn’t the primary driver. This shows a highly successful debut. Investors clearly wanted over $1 billion in ETH exposure via traditional financial channels in just four days,” Geraci said.