Ethereum on-chain activity and prices have moved higher with just a week to go before the Shanghai upgrade.

Ethereum prices are not the only thing edging higher this week. On-chain activity for the world’s largest smart contract network has also increased.

According to Etherscan, the number of active daily Ethereum addresses has increased this month. There has been an uptick of around 10% in addresses since the weekend.

The number of daily active addresses for the network currently stands at 443,292 as of April 4. It has been relatively flat for the first three months of the year, showing a slight uptick in recent weeks to remain above 400,000.

Furthermore, daily transactions have mirrored this movement, with an increase of 9% since the weekend. The number of daily transactions on Ethereum is currently 1.07 million, though it has been around this level for most of the year.

Ethereum Shanghai Upgrade on April 12

The recent minor upticks in activity are likely to be related to ETH price movements. Furthermore, the highly anticipated Shanghai upgrade is just a week away, scheduled for next Wednesday, April 12.

Shanghai, also known as Shapella, will combine changes to the Ethereum Virtual Machine (EVM) and the ‘Capella’ consensus layer. It will enable the phased release of ETH staked on the Beacon Chain since December 2020.

According to the Ultrasound.Money tracker, the network has been deflationary since mid-January. Additionally, the supply has shrunk by more than 78,000 ETH since the Merge in mid-September. At current prices, this is valued at around $149 million.

On April 5, market intelligence platform Decentrader reported that the Ethereum funding rate was “functioning perfectly as a leading indicator for the multiple moves higher.”

Furthermore, Ethereum’s Open Interest is also increasing, suggesting shorts have been opening and are currently paying for the position to remain open.

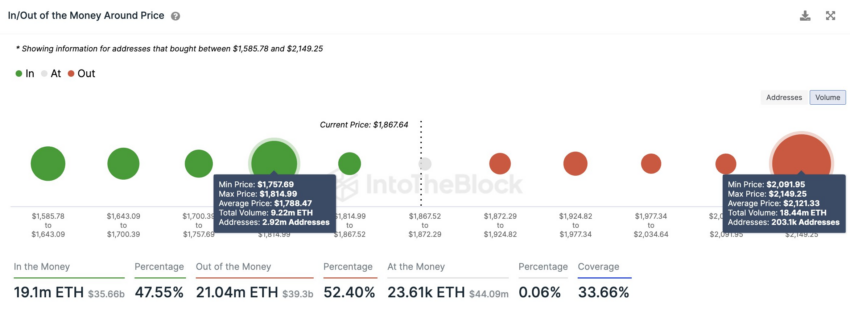

On-chain data revealed that the next critical resistance area is between $2,100 and $2,150. This is where over 200,000 addresses had previously purchased more than 18 million ETH.

Ethereum Prices Top $1,900

Ethereum prices tapped a seven-month high during the Wednesday morning Asian trading session. As a result, ETH reached $1,920 a few hours ago before holding just below this level.

Moreover, the asset is currently up 22% over the past 30 days.

There is very little in terms of resistance between current price levels and the psychological $2,000 barrier.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.