Over the past few days, Ethereum (ETH) whales have been relentlessly selling their coins, dampening the market’s momentum. Whale inflow into cryptocurrency exchanges has surged, indicating a strong desire for profit as the coin’s price has skyrocketed by double digits over the past seven days.

The spike in selling pressure will likely limit Ethereum’s near-term upside potential. Here is how.

Ethereum Whales Take Advantage of Price Hike

Ethereum’s price has climbed by 14 % over the past week to trade at $2,644 at press time. However, this rally may face resistance due to recent sell-offs by some large holders, or “whales.”

On Monday, an early Ethereum Initial Coin Offering (ICO) participant, who received 150,000 ETH at the Genesis block — now valued at over $389 million — deposited 3,510 ETH ($9.12 million) into Kraken after more than two years of inactivity.

Over the weekend, another significant whale, known for holding large amounts of ETH, also sold off coins. On-chain analyst Spotonchain revealed in a post on X that the whale deposited 15,000 ETH ($38.4 million) into exchanges. This whale has a history of selling ETH just before market drops. In July, it sold 10,000 ETH ($34.2 million) ahead of a 7.6% price decline, and in August, it unloaded 15,000 ETH ($39.7 million) shortly before a 2.5% dip.

Read more: How to Invest in Ethereum ETFs?

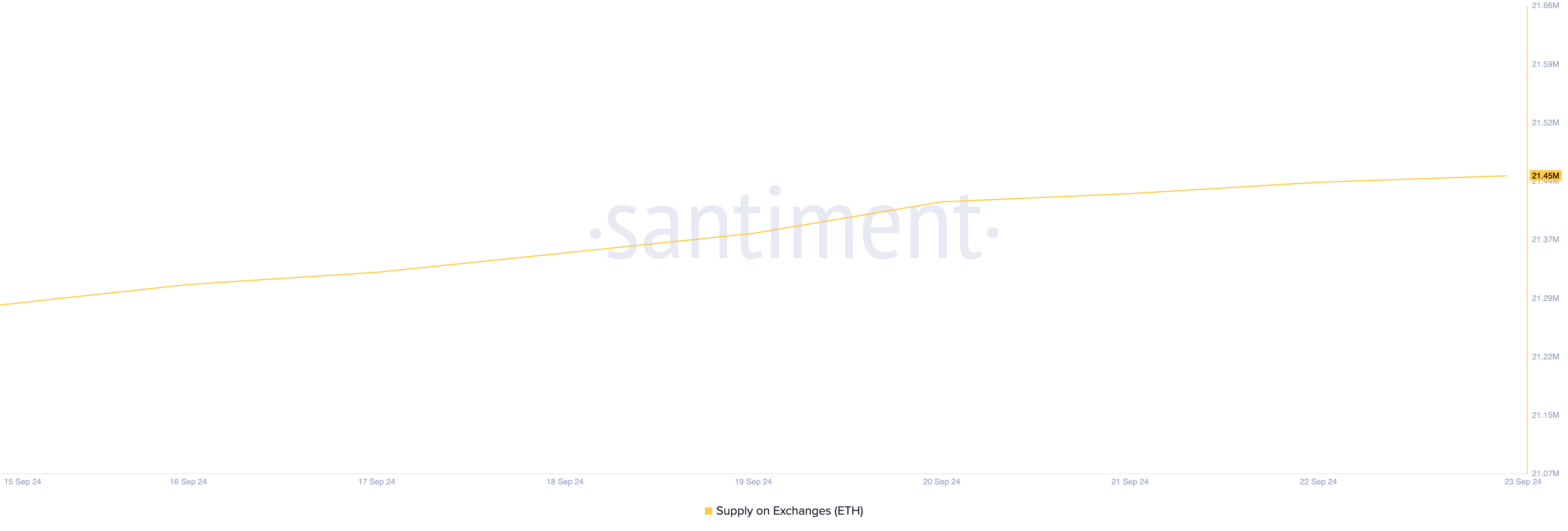

Due to the actions of these whales, the supply of ETH on crypto exchanges has risen. Currently, 21.45 million ETH, worth above $56 billion, are held across crypto exchanges. Since September 20, a cumulative of 30,000 ETH, valued at $79.20 million at current market prices, has been sent to exchanges.

When an asset’s supply on exchanges climbs, especially with significant deposits from the whales, it indicates profit-taking activity. This may put downward pressure on the asset’s price, as more sellers in the market can lead to oversupply, especially if new demand does not enter the market.

ETH Price Prediction: Price May Rise To $2,868 Or Fall To $2,111

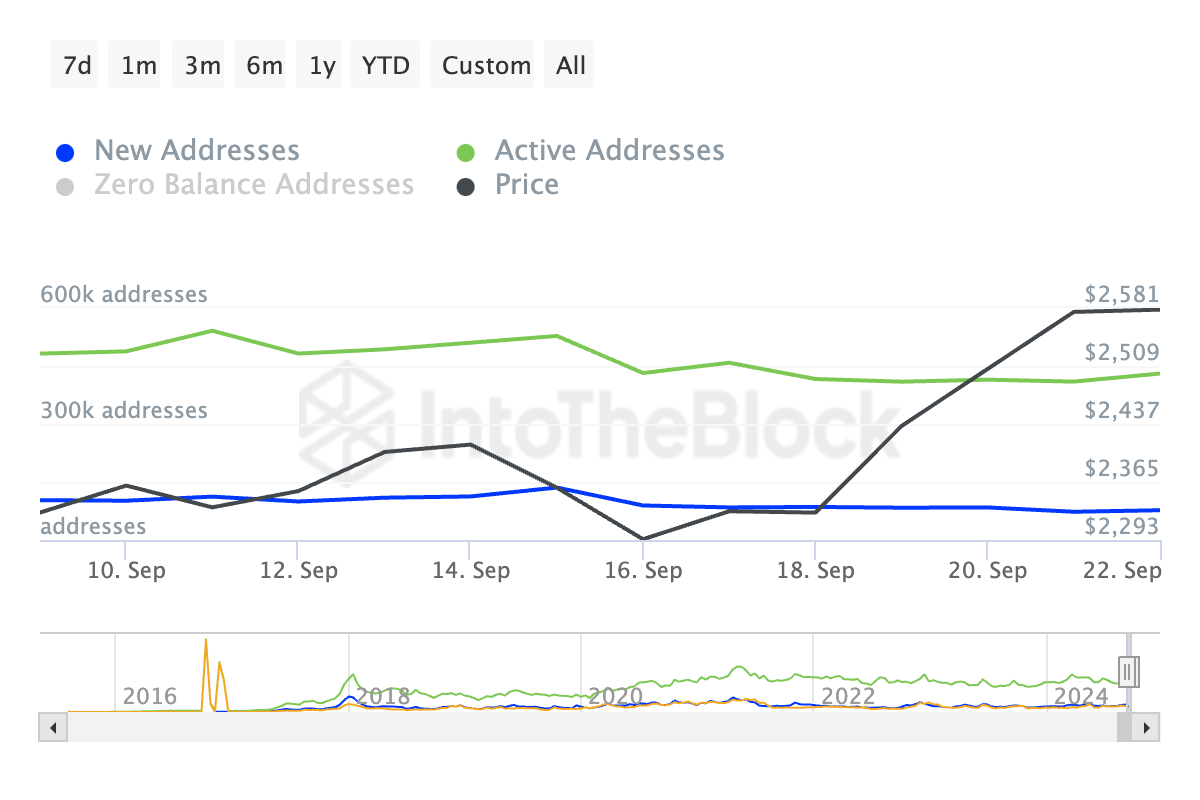

The decline in the number of new addresses created to trade ETH over the past week supports this outlook. IntoTheBlock’s data has revealed a 43% decline in new addresses that have traded the altcoin over the past seven days. During the same period, the active address count on the network has also plummeted by 18%.

When an asset’s active address count drops, it may put downward pressure on its price. Reduced network activity can lead to less demand for the asset and increased selling from holders looking to exit their positions in fear of losses.

Ethereum’s recent 14% surge pushed its price above the $2,579 resistance level. However, continued profit-taking by ETH whales could make it difficult for the coin to reclaim the $2,868 mark.

If the broader market also begins offloading coins, Ethereum’s price may retest the $2,579 level. Should this support fail, the price could drop by 18%, potentially hitting the August 5 low of $2,111.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Conversely, if whales stop selling and new demand enters the market, Ethereum could rise by another 8%, with a strong chance of breaking past the key $2,868 resistance.