The Federal Reserve’s latest rate cut has sent Ethereum (ETH) soaring. Trading at $2,428 as of this writing, the altcoin’s value has spiked by over 5% in the past 24 hours.

However, it seems not everyone is celebrating. Ethereum spot exchange-traded funds (ETFs) experienced outflows yesterday despite the price surge.

Ethereum ETF Holders Remove Their Funds

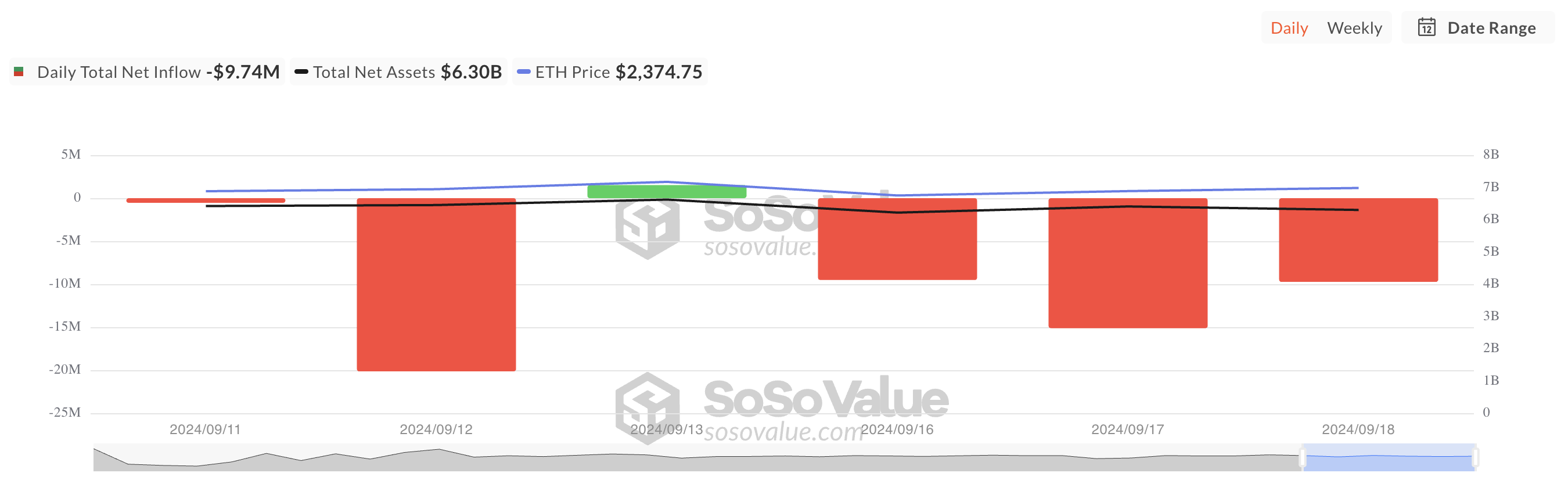

According to data from SosoValue, ETH spot ETFs recorded a net outflow of $9.74 million on Wednesday, bringing the week’s total outflows to $30.36 million. This funds removal occurred despite the broader market rally witnessed after the Federal Reserve cut interest rates by 50 basis points, its first reduction since early 2020.

This could be attributed to several factors. ETH’s price increase in the past 24 hours may have led ETF holders to sell their shares for profit. Additionally, the recent rate cut might have encouraged some investors to hold ETH directly.

Lower interest rates typically foster a more risk-on sentiment, making investors more inclined to take on riskier assets, such as ETH, in hopes of securing higher returns.

Read more: How to Invest in Ethereum ETFs?

The surge in ETH’s trading volume over the past 24 hours confirms that its price hike is backed by sufficient demand from market participants. Totaling $21 billion during that period, it’s up by 29% in the past 24 hours.

Additionally, in Ethereum’s derivatives market, open interest — representing the total number of active futures or options contracts — has surged by 8% in the same period. This increase signals that more traders are entering the market and opening new positions rather than closing existing ones.

The combination of Ethereum’s price rally and rising open interest suggests that the uptrend is gaining momentum, with new buyers fueling the market.

ETH Price Prediction: Coin Must Cross Key Moving Average

Ethereum’s price, as seen on the one-day chart, shows it is on track to break above its 20-day exponential moving average (EMA), which tracks its average price over the past 20 trading days.

If buying pressure continues, Ethereum could rally past this key level. A break above the 20-day EMA often indicates strengthening short-term momentum, signaling the start of an uptrend or the continuation of an existing one. If the uptrend holds, Ethereum’s price could breach $2,579 and aim for the crucial resistance level at $2,868.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if buying pressure weakens and selling intensifies, Ethereum’s price may dip below the 20-day EMA and move toward $2,111.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.