The crypto market awaits a significant event today—the liquidation of over $1 billion in Ethereum (ETH) options. This massive contract expiration is interesting, particularly due to the approval of spot Ethereum exchange-traded funds (ETFs) in the United States.

At the same time, approximately $1.42 billion in Bitcoin (BTC) options contracts will also expire. Can the expiration cause greater volatility in the market, and will it affect the price of the two leading cryptocurrencies?

First ETH Options Liquidation After the Spot Ethereum ETF Approval

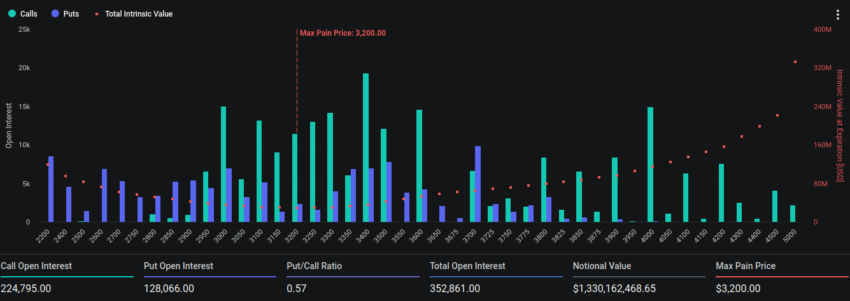

The notional value of the 352,861 expiring Ethereum contracts is $1.33 billion. Data from Deribit indicates that Ethereum’s put-to-call ratio is 0.57. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

Furthermore, the maximum pain point for these expiring Ethereum contracts is $3,200. The maximum pain point is the price at which the asset will cause the greatest number of holders’ financial losses.

Read more: An Introduction to Crypto Options Trading

BeInCrypto previously reported that before the Securities and Exchange Commission (SEC) officially approved the spot Ethereum ETFs, crypto investors and traders showed optimism because analysts increased their approval odds from 25% to 75%. The renewed optimism is evident in ETH’s price, which increased nearly 20% after the analysts expressed their confidence.

Ahead of the approval, options trading tool provider Greeks.live shared their insights for the options market. Greeks.live analysts highlighted that BTC experienced a pullback as anticipated, contrasting sharply with the strong support observed for ETH’s price. They also noted that ETH’s current weekly weighted Implied Volatility (IV) still surpasses 100%, while BTC’s weekly IV stands at merely 50%.

“The primary reason for this rare phenomenon is of course the uncertainty of the approval of the ETH ETFs. In the last two days there have been so many of these mega short-term spreads and calendar spreads that shows the market is extremely divergent. Judging by the structure of the market’s positions and the current IV structure, the current level of divergence has already exceeded that during the period of the ETH to PoS,” they explained.

However, ETH’s price has been showing relatively muted performance post-approval. It has remained relatively stable in the last 24 hours and is trading at $3,806, marking an increase of 0.9%.

In addition to Ethereum options, 21,057 Bitcoin contracts will also expire. The tranche is slightly larger than the 18,183 settled expiring contracts settled last week. Today’s expiring Bitcoin contracts have a notional value of over $1.42 billion, a put-to-call ratio of 0.88, and a maximum pain point of $67,000.

Read more: 9 Best Crypto Options Trading Platforms

While option expirations can cause sharp price movements, the impact is usually temporary. The market generally stabilizes the next day, offsetting initial fluctuations. Nevertheless, traders should carefully analyze technical indicators and market sentiment before making investment decisions in this volatile environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.