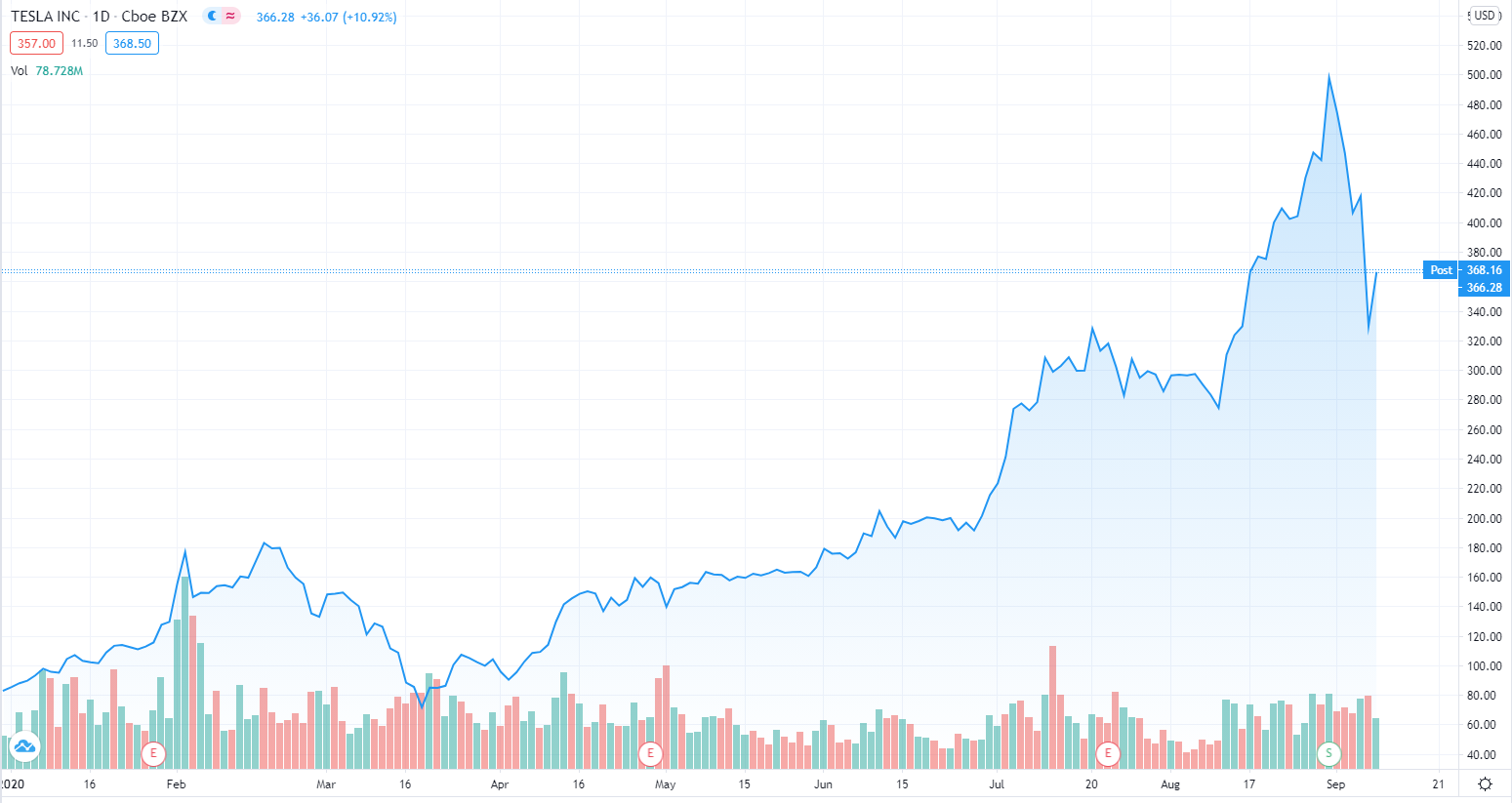

When it comes to market cap, however, TSLA more closely resembles the flagship cryptocurrency bitcoin. The electric vehicle maker’s market cap is currently at $341 billion compared to bitcoin’s $189 billion and Ethereum’s $39.7 billion.Tesla #TSLA share price is about the same as #Ethereum right now. Which would you prefer to buy & hold to profit later?

— eToroX (@eTorox) September 9, 2020

ETH vs. TSLA

ETH has had a banner year as once again its network became the platform du jour for the latest crypto craze. This time, instead of ICOs, it’s DeFi, for better or for worse. The price has grown from $130 at the start of the year to a 2020 high of nearly $500.

A Flippening

On-chain market data site Santiment pointed out that there has been a flippening in the crypto space, one in which the market cap for ERC-20 tokens has “flippened the ETH market cap since the Black Thursday crypto dump” that happened in March. The flippening happened on Sept. 3, and according to Santiment it represents the “highest market cap differential of ERC-20 coins over ETH of all time.”While it might not be the “flippening” that some in the Ethereum community had in mind, it’s no doubt a reflection of the total value locked in the DeFi market, which is currently over $7 billion, according to DeFi Pulse. Coins like YFI and COMP are currently on Santiment’s top-20 ERC-20 asset list.The ERC-20 market cap has '#flippened' the $ETH market cap since the Black Thursday #crypto dump. After first crossing in mid-March, it occurred again on Sep 3rd. This is currently the highest market cap differential of ERC-20 coins over $ETH of all time! https://t.co/9tAtfPe06d pic.twitter.com/vTH7mD6JWm

— Santiment (@santimentfeed) September 9, 2020

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.