Ethereum has come a long way in the past five years. To mark its anniversary BeInCrypto will take a look at what the network has been through, and what could be in store for it in the next half-decade.

The genesis block on the Ethereum blockchain was mined on July 30, 2015 — five years ago today. Back then, things were very different and the world of crypto was largely limited to a handful of tech geeks with garages full of mining rigs and grand ideas about changing the future of finance.

Bitcoin was priced at $287 and it had a market capitalization of a little over $4 billion. It was pretty much the only fruit in the world of digital assets with a market share of 86%. Ripple’s XRP and Litecoin were pretty much the only other two major cryptocurrencies in the summer of 2015 with around 9% of the market share between them.

Ethereum’s Early Days

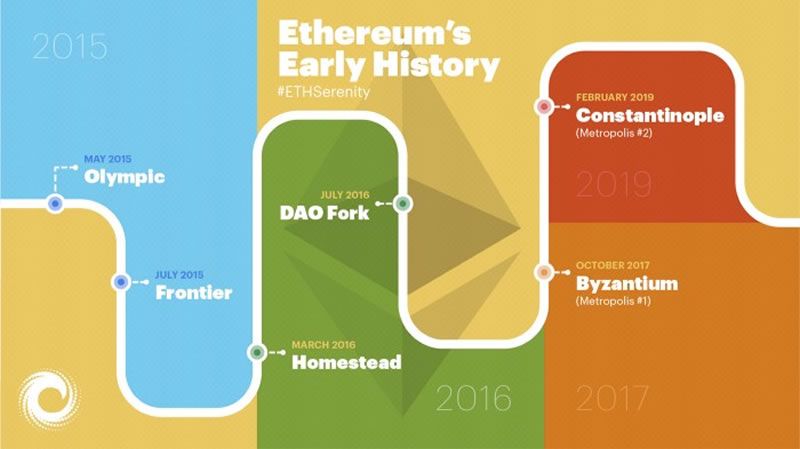

A young Russian-Canadian programmer named Vitaly Dmitriyevich ‘Vitalik’ Buterin saw the need to move on from digital cash to a platform that could operate as more than just a payment system. He was one of the founding members of the Ethereum Foundation which was formed in July of 2014. The Ethereum whitepaper described the platform as a ‘blockchain with a built-in fully fledged Turing-complete programming language that can be used to create ‘contracts’ that can be used to encode arbitrary state transition functions.’ A crowdsourcing campaign was launched in July and August of 2014 where participants were sold Ethereum tokens called ether, or ETH, to get its vision off the ground. The ICO price for one ETH at the time was $0.31. Over $18 million was raised and the first live release of Ethereum, known as Frontier, was launched five years ago today following the Olympic testnet earlier that year.

Homesteading and the DAO Hack

By March of 2016, Ethereum was leaving the relatively basic Frontier Phase and entering into the Homestead Phase. Homestead was the first ‘stable’ Ethereum release which occurred at block 1,150,000. This safer version of the network was able to deploy more complex smart contracts and create Decentralized Anonymous Organizations (DAOs). ‘The DAO’ in question that year was a specific organization created on the Ethereum blockchain by a venture team from a German company that enabled the sharing of possessions. The DAO raised over $150 million during its crowd sale phase, and this made it a big target for attackers. Flawed code allowed users of the smart contracts to withdraw more ETH than they had put in. This ‘recursive call’ exploit resulted in the loss of 3.6 million ETH, worth around $70 million at the time. It should be noted that this was not an Ethereum bug, but an error in the code that was running on the network. The DAO contained roughly 15% of all ETH at the time, so an extreme measure was needed to remedy the losses. A highly contentious hard fork was eventually adopted to roll back the attack and replace the stolen ETH. The original fork continued to operate on the base blockchain and became Ethereum Classic (ETC).

Upgrades Before the Big Boom

Two upgrades to the Ethereum network occurred in the year that followed, Tangerine Whistle and Spurious Dragon. The former was a hard fork in October 2016 that increased the gas prices of certain operations to make them reflect their actual computational complexity and limit the likelihood of denial of service (DoS) attacks. The latter hard fork occurred a month later and further hardened the network against attacks by removing empty accounts from the blockchain in order to streamline it.

Current State of The Network

In 2020, five years after it was first launched, all focus has been on the next stage in the upgrade roadmap — Serenity. Ethereum has largely been a victim of its own success with massive demands on the network, primarily from a burgeoning DeFi sector that has been driving up gas prices. Serenity will eventually bring in those long-awaited scaling solutions for ETH 2.0. However, the first ‘Phase 0,’ called Beacon Chain, will bring about a change of consensus mechanism to proof-of-stake and a whole new monetary ecosystem.

- Over 100 million total unique Ethereum addresses

- Over 8,000 live mainnet nodes globally

- Over 1.1 million peak daily transactions

- 111.8 million ETH total supply

- Over $36 billion market capitalization

- Almost 2,900 dApps running on the network

- Over 4 million ETH locked into DeFi protocols

- Over 20,000 Bitcoin tokenized on Ethereum

Ethereum Into the Future

For a platform that is just five years old, Ethereum has come a long way. The launch of ETH 2.0 is critical to the future of the network, as it must scale before it can be fully adopted. In a recent interview, co-founder Vitalik Buterin said that he is excited about mass adoption and application of Ethereum over the next five years, adding that he envisions a world “Where Ethereum is something that is just a regular part of people’s lives in a lot of different communities and a lot of different contexts,” The next year or so is likely to see an explosion of Layer-2 solutions that will operate alongside Ethereum until Phase 1 is finally rolled out. This should allow crypto gaming to evolve alongside it, and network fees to fall back to acceptable levels. In the longer term, Ethereum is hopeful to evolve into an entire financial ecosystem through staking, with institutional players coming on board to take advantage of earning opportunities. If large quantities of ETH are bought up in preparation for staking, a supply shock could well drive prices much higher than the $300 they’re at today. Ethereum is likely to play a pivotal role in the inevitable paradigm shift that must be made in order for the global economy to survive. In its current state, the world of traditional finance badly needs a savior. Happy Birthday, Ethereum!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored