The Ethereum (ETH) price failed to sustain its long-term breakout and has now fallen below a crucial horizontal area.

While the outlook is strongly leaning bearish, there is a possible wave count that suggests the upward movement can resume soon. But, a further decrease in the ETH price will invalidate it.

Ethereum Price Fails to Hold on to Above Support

The long-term readings for the Ethereum price are mixed. On the bullish side, the price broke out from a long-term descending resistance line that had been in place since the all-time high. Breakouts from such long-term structures usually mean that the previous movement has come to an end and a new one has begun in the other direction.

Moreover, the weekly Relative Strength Index (RSI) gives a bullish sign. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions, and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. Since the RSI is above 50, this means that the trend is bullish.

However, the ETH price failed to sustain its breakout last week. Rather, it decreased and fell below the $1,930 horizontal support area. This is considered a bearish sign since the price failed to sustain the breakout.

This is considered a bearish sign since bulls failed to keep the price up. If the decrease continues, ETH could fall to the previous resistance line at $1,500 while the next resistance is at an average price of $2,550.

ETH Price Prediction: Which Count Will Prove True?

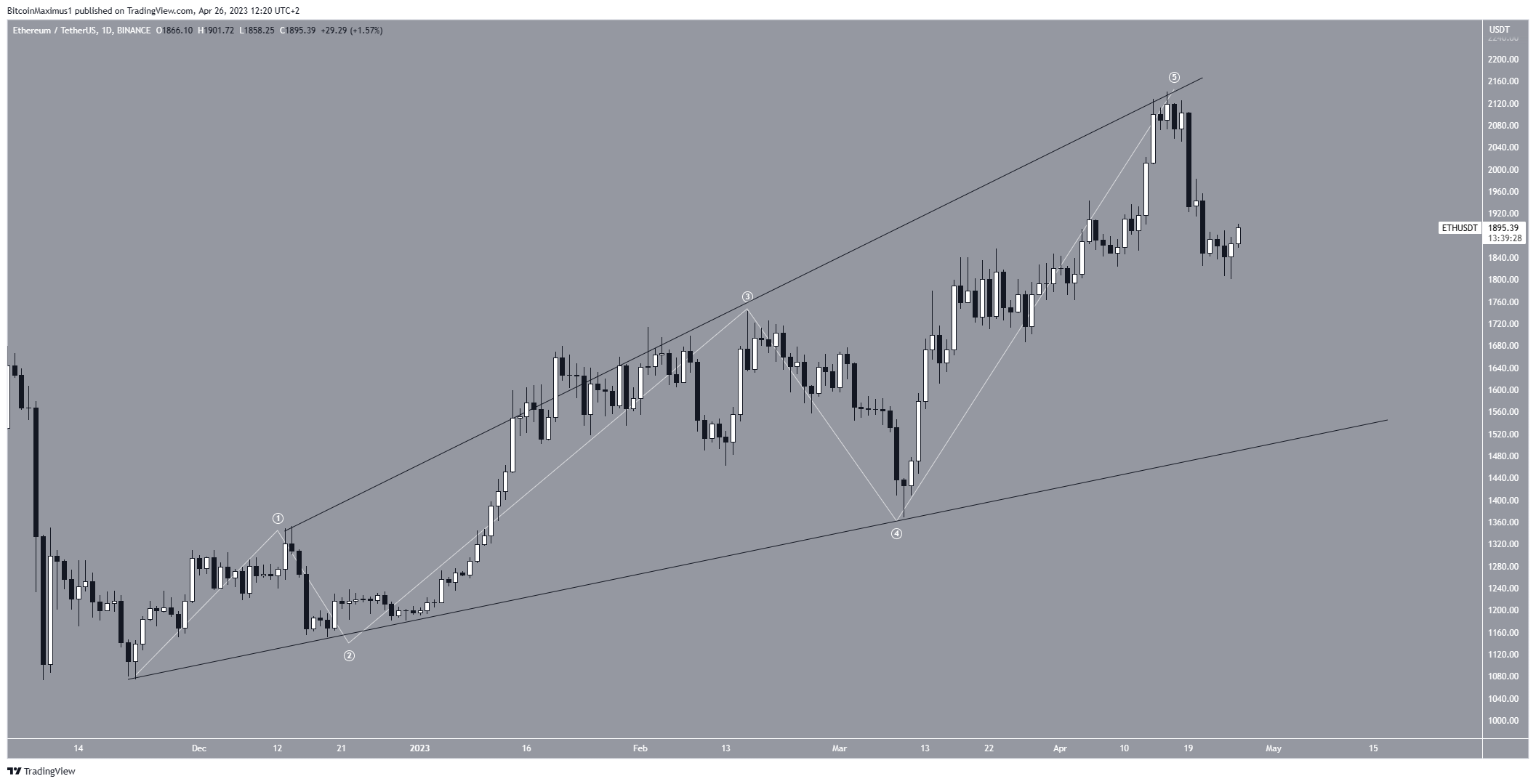

A closer look at the technical analysis from the daily time frame shows that there are two possible counts in play, thus giving an undetermined ETH price prediction. The main one is bearish while the alternative is bullish.

To determine the direction of a trend, technical analysts use the Elliott Wave theory, which involves studying recurring long-term price patterns and investor psychology.

The bearish count suggests that the price has completed a five-wave upward movement (white). If so, a significant correction will now ensue.

Even though wave four overlaps with wave one, the price movement has the shape of an expanding wedge, hence making this a valid pattern.

Therefore, the count suggests that a drop to the pattern’s support line at $1,550 is the most likely scenario. This also coincides with the long-term descending resistance line.

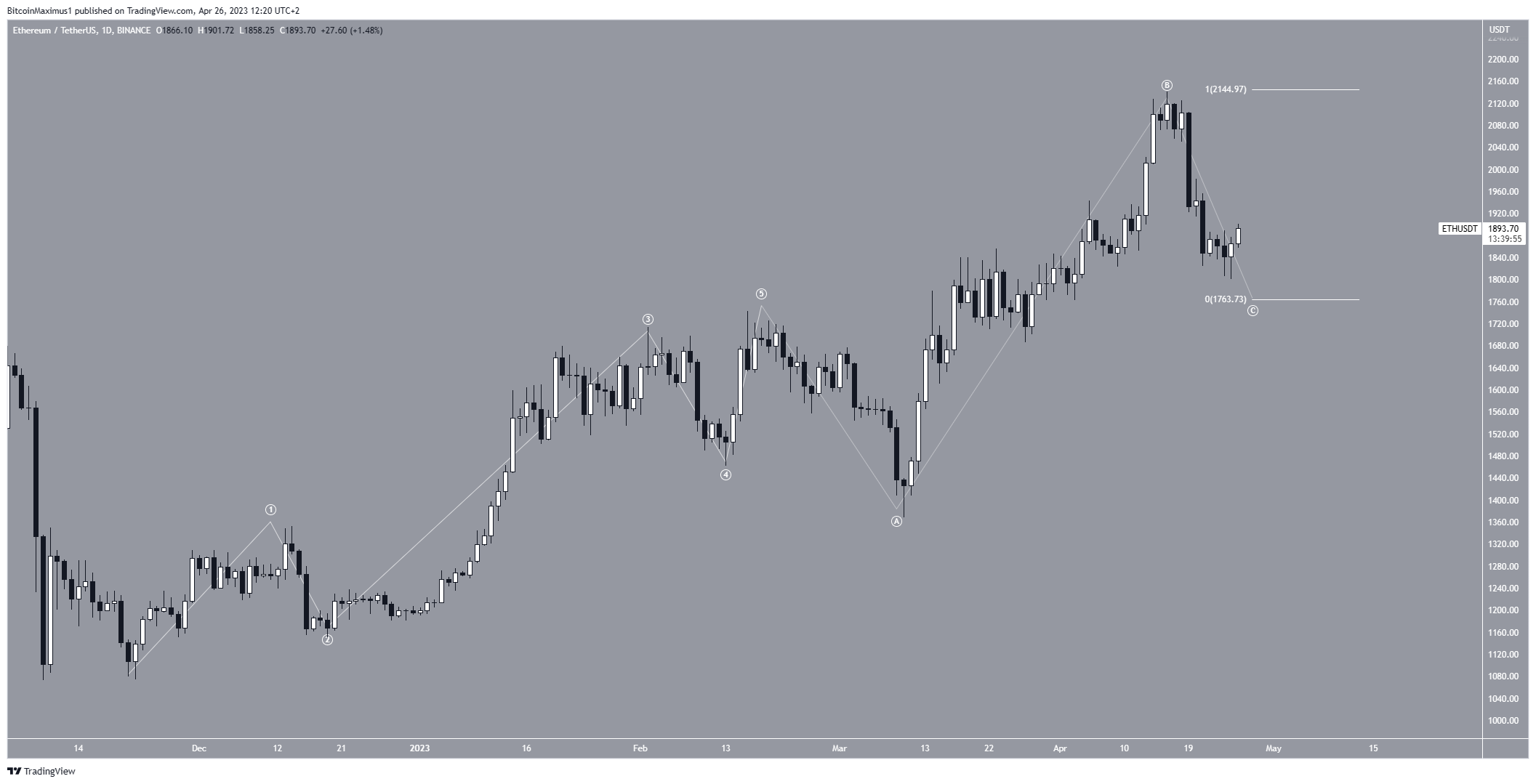

The bullish count suggests that the price is nearing the end of its correction and will soon resume its upward movement.

However, the count is extremely unusual due to the elongated wave B, which goes considerably below the wave A top. Since the length of wave B is less than 2.61 times that of wave A, this is still a valid pattern, but it is extremely rate.

If the pattern is correct, waves A:C will have a 1:1 ratio and the price will reach a bottom at $1,760.

In any case, despite the signs pointing to a bearish Ethereum price forecast, an increase above $2,140 will invalidate the bearish outlook. Then, the ETH price could move to the next resistance at $2,550.

For BeInCrypto’s latest crypto market analysis, click here