Ethereum (ETH) has been on a remarkable run, hitting its yearly high and leaving investors and analysts speculating whether a $3,000 price tag is within reach.

Many factors, including the recent breakout of staked Ethereum’s realized price over $2,000, the intensifying deflationary phenomenon, and the narrowing premium gap in Grayscale Ethereum Trust, have driven this price surge.

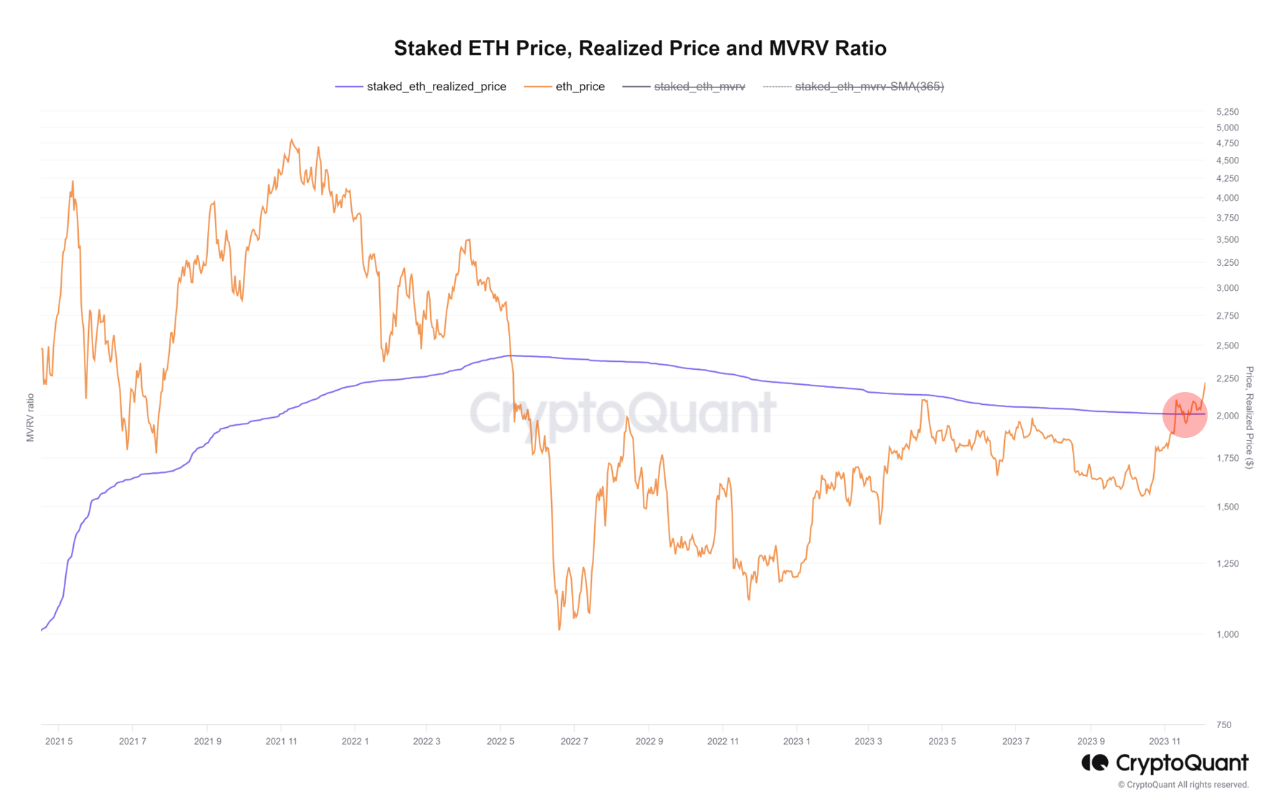

Staked ETH Breaks $2,000 Average Unit Price

According to the Head of Research at CryptoQuant, the average unit price of ETH staked on the Ethereum network recently broke through the $2,000 mark. He noted:

“The average unit price for investors who want to hold ETH for the long term broke through $2k a few days ago and most of the long-term investors have turned to profit, which is likely to act as a key support.”

This breakout indicates that most long-term investors have now turned a profit, potentially providing a solid base for further growth.

ETH’s Price Rises Amid BlackRock ETF and Increased Institutional Interest

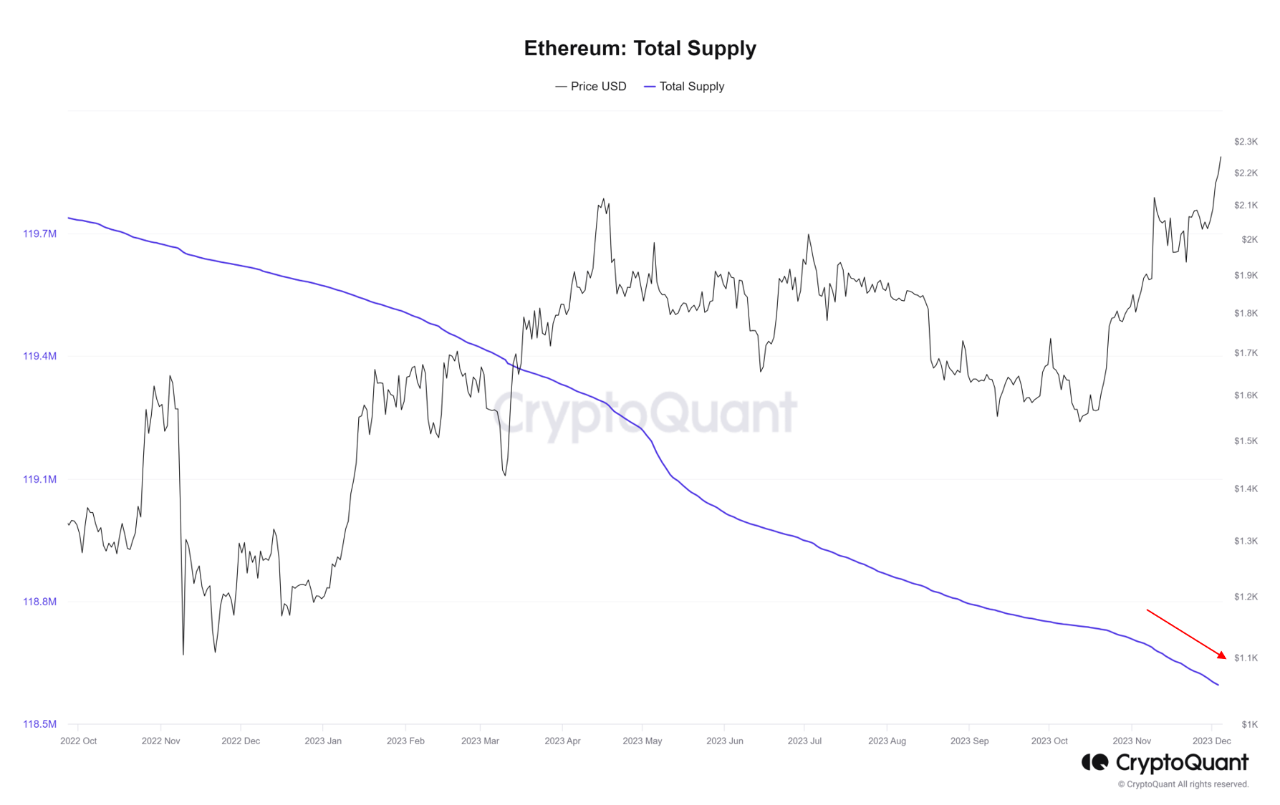

Adding fuel to Ethereum’s price rise is the intensifying deflationary phenomenon. Following BlackRock’s filing for an ETF spot with the SEC on November 10, the total number of ETH transactions began to surge. As did the amount of fees burned. This has led to a sharp decline in the total supply of ETH. With the total supply decreasing by -82,861 ETH since the news was announced.

Moreover, the premium gap in Grayscale Ethereum Trust, which had fallen to -59.49% in December ’22, has been narrowing due to institutional buying. This is seen as a sign of institutional investors’ massive buying of trust products, pushing ETH higher.

Brazil’s Itau Unibanco Enters Crypto, Boosting Ethereum Adoption

Institutional involvement in Ethereum is also set to increase, with Brazil’s largest bank, Itau Unibanco, launching a cryptocurrency trading service. Initially offering Bitcoin and Ethereum, the bank aims to expand to other crypto assets in the future. This depends on how crypto regulation in the country evolves.

This move puts Itau in direct competition with other local players such as crypto exchange MB and investment bank BTG Pactual’s digital assets unit Mynt, as well as global giants like Binance.

Leading Ripple Case Lawyer Favors Bitcoin, Ethereum Amid Regulatory Haze

In an unexpected twist, attorney John E. Deaton, known for his involvement in the Ripple vs. SEC case, revealed his crypto portfolio leans more towards Bitcoin and Ethereum. Deaton stated on X:

“At the time [when the SEC filed suit], I owned 3 tokens, and XRP was my smallest investment behind BTC and ETH.”

This revelation indicates investor confidence in these assets despite regulatory uncertainties.

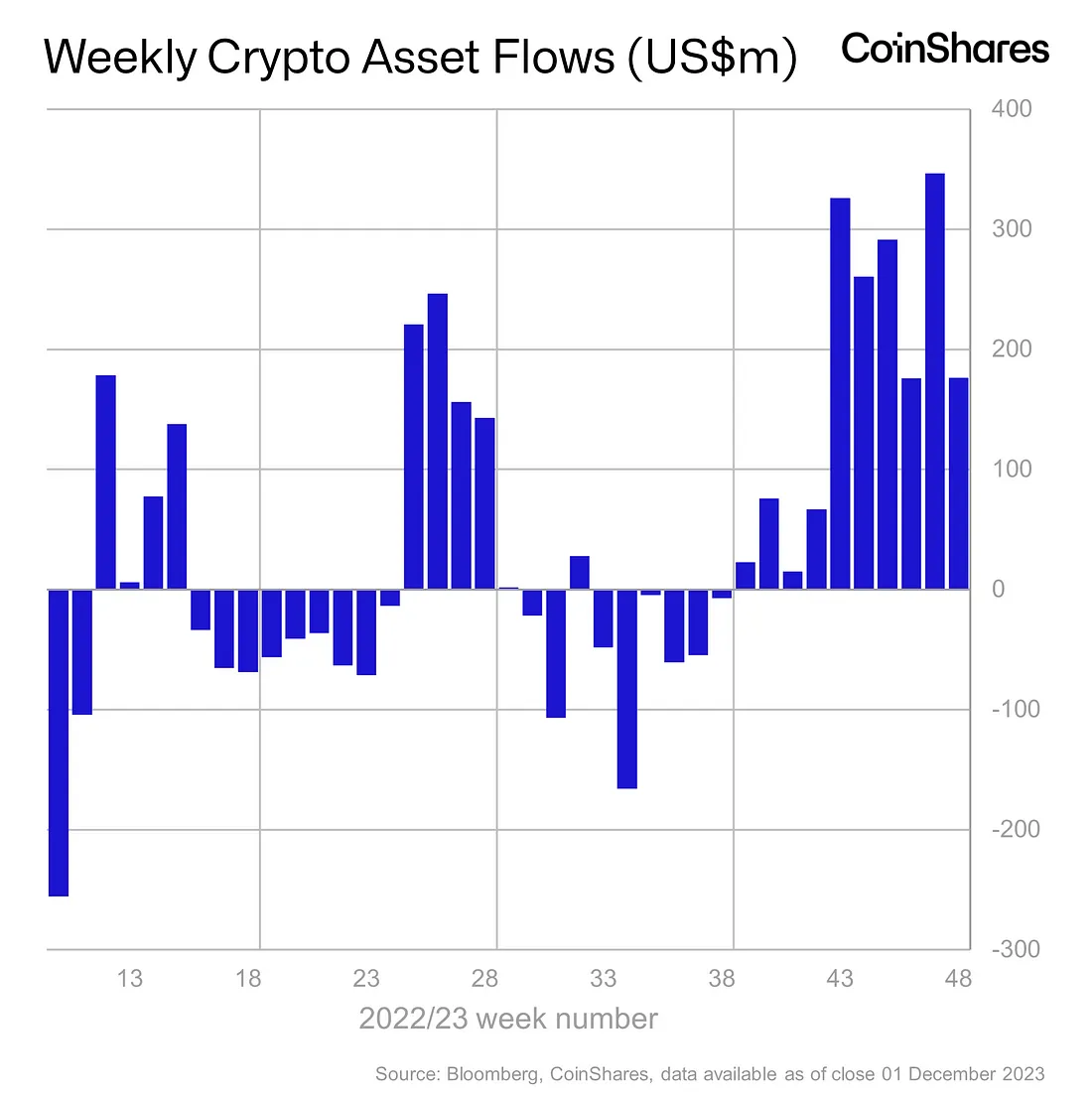

10-Week High in Digital Asset Inflows Fueled by Ethereum and Bitcoin

Finally, digital asset inflows, led by Bitcoin and Ethereum, totaled $176 million last week. Marking a 10-week high since October 2021, according to CoinShares. This indicates growing market interest and investment in these cryptocurrencies.

Ethereum alone saw a further $31 million inflows last week, bringing this 5-week run to $134 million, and for the first time this year, net flows are now positive at $10 million.

As Ethereum continues its upward trajectory, fueled by a potent mix of on-chain dynamics, institutional interest, and bullish investor sentiment, the $3,000 price point seems less a question of if and more a question of when.