ERC-404 token standard, the crypto industry’s latest narrative, has stirred considerable interest. But recently, this initial excitement waned significantly.

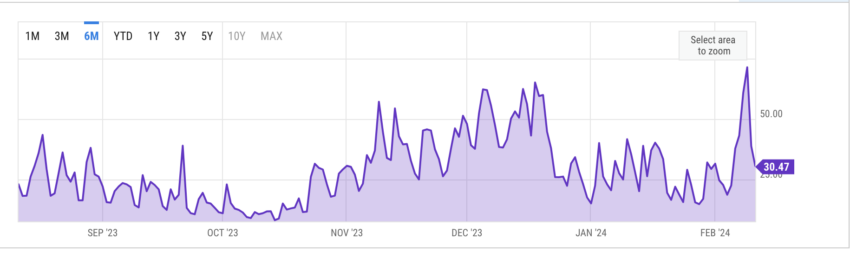

The pioneering token utilizing this standard, Pandora, witnessed a staggering 40% decline in market capitalization over just three days.

Is ERC-404 Narrative Losing the Hype?

Pandora, the first to adopt the ERC-404 standard, achieved a meteoric rise with a 12,500% increase last week, blending the fungibility of ERC-20 tokens with the uniqueness of rare non-fungible tokens (NFTs). This innovative approach promised a new tokenization era, with Pandora tokens reaching an all-time high of $32,836.

Yet, the sharp downturn has left investors and enthusiasts questioning the sustainability and future of ERC-404 tokens.

Read more: ERC3643: The Token Standard For Real-World Assets (RWAs)

The ERC-404 standard, developed by the pseudonymous duo “ctrl” and “Acme,” remains experimental and lacks formal vetting through the Ethereum Improvement Proposal process. Its novelty reverses traditional NFT fractionalization by constructing whole ERC-721 tokens from smaller ERC-20 fractions.

Critics, however, have voiced concerns over the standard’s practicality and efficiency. A developer known as “quit” highlighted potential vulnerabilities in lending pools not configured for ERC-404, potentially enabling users to exploit the system and withdraw high-value NFTs instead of their fungible fractions. Such criticisms underscore the experimental nature of ERC-404 and the unforeseen challenges it faces in real-world applications.

The surge in Ethereum gas fees following the adoption of ERC-404 tokens further complicates its adoption. The increased transaction costs, attributed to the burning and re-minting of NFTs on the Ethereum mainnet, have highlighted inefficiencies within the standard’s implementation. This has led to skepticism regarding the economic feasibility of ERC-404 tokens, particularly in a market sensitive to transaction fees.

“An average ERC-404 transfer is 125,000 gas units. More than 3x the gas of an average ERC-721 transfer. This is nightmare fuel,” Pop Punk, a pseudonymous X user said.

Read more: When Are Ethereum Gas Fees Lowest?

Despite these challenges, the ERC-404 standard has garnered interest for its unique approach to NFT fractionalization. The ability to trade fractions of tokens on decentralized exchanges made NFTs liquid.

This idea was new for NFTs, treating them like regular ERC-20 tokens. Still, the price drop of Pandora and other ERC-404 tokens like DeFrogs (DEFROGS) and Monarch (MNRCH) casts doubt. It questions the long-term success and acceptance of this standard in the crypto community.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.