Nayib Bukele, President of El Salvador, has proudly showcased the nation’s Bitcoin (BTC) revenue sources as its portfolio soared to a remarkable $84 million profit. This announcement comes amid Bitcoin’s climb to unprecedented highs.

El Salvador’s strategic investment in Bitcoin has positioned it as a trailblazer in the digital currency sphere.

El Salvador’s Bitcoin Strategy

Since 2021, El Salvador has aggressively purchased Bitcoin, acquiring a total of 2,861 BTC at an average price of $42,599 each. Consequently, these assets are now worth over $206 million, reflecting a significant uptick of 69.09% in portfolio value. Importantly, the country’s profit isn’t solely from market appreciation. It also stems from innovative revenue streams directly tied to Bitcoin.

El Salvador’s Bitcoin revenue is derived from several key initiatives. These include the country’s passport program, conversion services from BTC to USD for local businesses, state-operated Bitcoin mining, and Bitcoin-based government service payments. Such initiatives demonstrate a holistic approach to leveraging cryptocurrency for economic advancement.

Read more: Who Owns the Most Bitcoin in 2024?

Furthermore, El Salvador has introduced policies to encourage Bitcoin investment. In December 2023, a new migration law was passed, offering expedited citizenship to foreigners who donate Bitcoin to support the country’s development.

Bukele’s re-election in February, by a wide margin, underscores the public’s support for his Bitcoin strategy. Despite prior criticisms, especially during Bitcoin’s price dips, Bukele remained unwavering. He has pointed out the media’s focus on the country’s temporary setbacks, challenging the narrative of loss.

“They lie and lie and lie, and when their lies are exposed, they go on silence mode,” Bukele criticized mainstream media.

In January, Bukele announced the complete repayment of a $800 million debt, including interest. This achievement aligns with the government’s plans to build a tax-free haven and initiate Bitcoin bonds. These projects had been paused due to market volatility but are now set to proceed.

El Salvador also aims to construct a Bitcoin City, revitalizing a proposal made during the 2021 bull market. This plan is gaining momentum, reflecting the country’s commitment to becoming a cryptocurrency innovation hub.

Crypto Investment Product Inflows

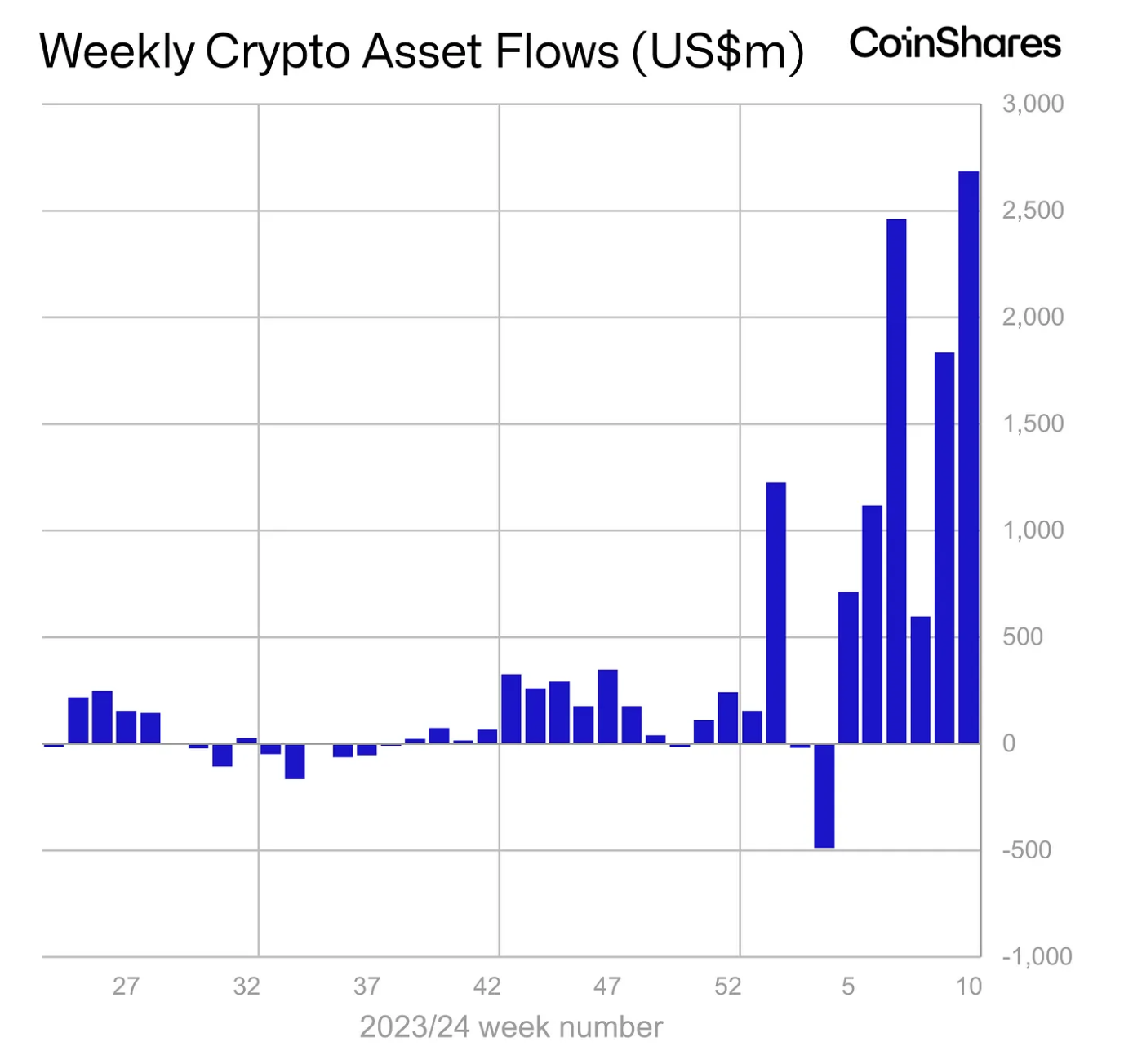

The global interest in Bitcoin and cryptocurrencies has been further highlighted by a recent crypto asset inflow report. According to CoinShares, a record $2.7 billion flowed into crypto assets last week, the bulk of which targeted Bitcoin.

This unprecedented influx is propelled by a combination of factors, including the US Securities and Exchange Commission’s approval of spot Bitcoin exchange-traded funds (ETFs) and anticipation of the upcoming halving event in April, which is expected to reduce the supply of new Bitcoin by half.

Since the year’s start, approximately $10.3 billion has been poured into crypto assets, nearing the $10.6 billion total inflow recorded throughout 2021. BlackRock and Fidelity Investment’s spot Bitcoin ETFs have significantly attracted investments into the crypto market. These offerings have helped balance the outflows from Grayscale Investments’ Bitcoin ETF since its conversion from a trust in January.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Despite the recent price surges, the report points out a continued interest in short Bitcoin positions, indicating that some investors are hedging against potential corrections.