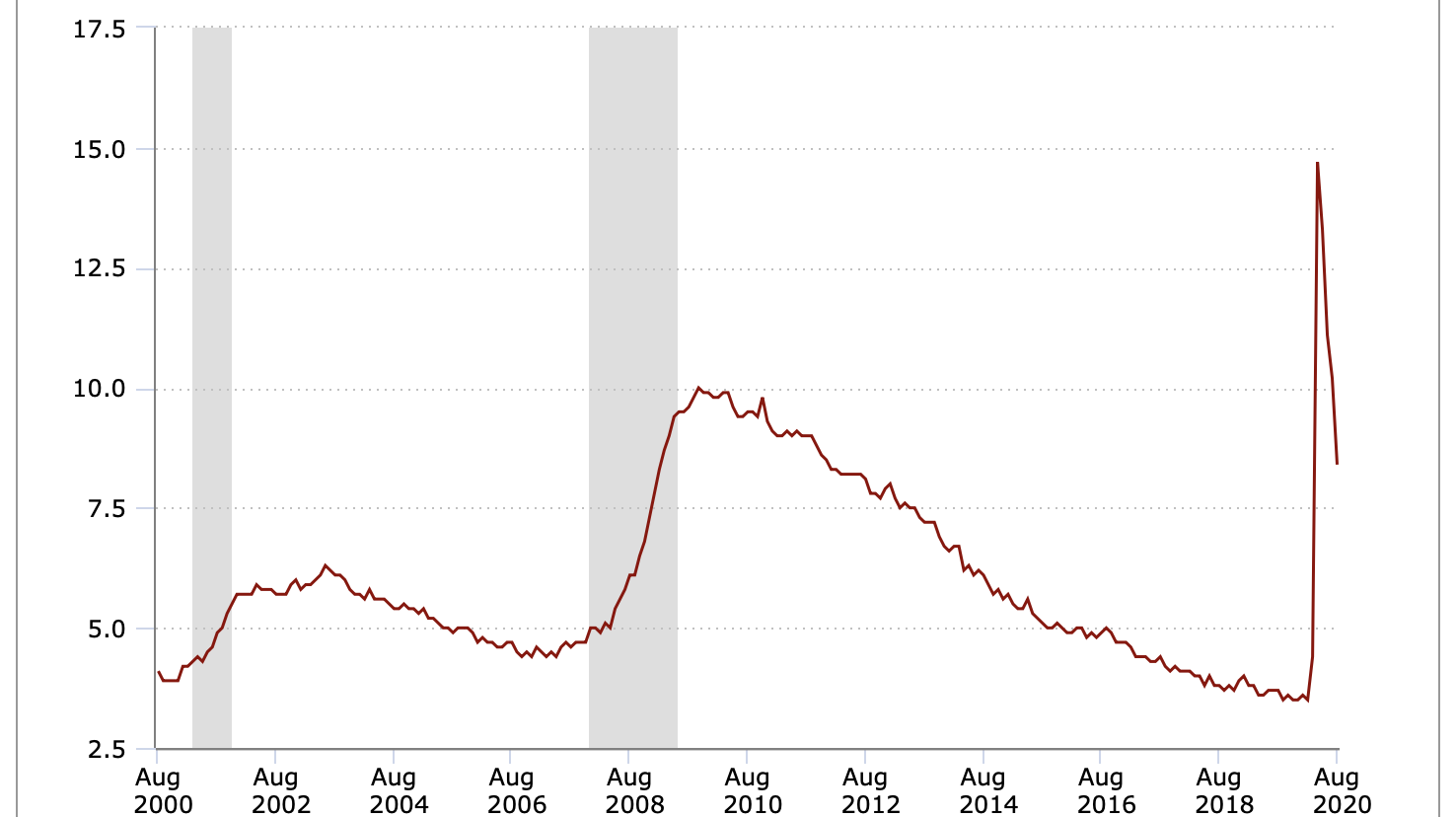

August unemployment fell to under 10% for the first time since the spike at the beginning of the COVID crisis.

The current rate of 8.4% could be a signal that the economic recovery is well on its way.

Recovery in the works

The labor numbers have been hailed by many as a sign of the strength of the recovery after the COVID crisis. Indeed, the first sign of the crisis was the massive spike in unemployment, which has inched lower ever since. However, the jobs growth was largely in the government sector, totaling 344,000 or 25% of month’s gains. Of that number, 328,000 were related to the census and are not likely long term positions. Nevertheless, other sectors also added jobs, with increases in retail, local government, and professional and business services. The number of furloughed employees also declined substantially.

Bitcoin

Bitcoin declined in correspondence with the labor numbers, which could indicate that it has taken on a reputation as a hedge against inflation. With the economy apparently recovering based on employment data, the demand for safe-haven assets may have declined. Bitcoin has been considered a risky asset, much like stocks. However, recent trading has revealed that bitcoin is functioning like gold and other hedges, working in reverse correlation to economic news.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored