Corbu LLC’s Chief Economist Samuel Rines says companies driving inflation by testing consumer tolerance to price increases could render hawkish Fed policy toothless.

On the Bloomberg Odd Lots podcast, Rines said investors reading too much into U.S. economic data for decisions might follow a false narrative.

Companies Are Using Macro Events to Increase Prices

Rines added that price increases contributing to U.S. inflation are caused by companies using macroeconomic events to test consumers’ tolerance.

He argued that PepsiCo used its 4% Russian revenue loss from the Ukraine war to excuse double-digit price increases. Competitors Coa-Cola, Dr. Pepper, and Snapple soon followed.

According to Rines, aviation-themed chicken wing chain Wingstop used rising chicken wing prices to increase the cost of their food. They pushed increases even when the raw ingredient price fell 50%, testing how much the consumer would pay. He said that Middle American businesses, like Cracker Barrel, test consumers with wages and higher menu prices.

While hotel and cruise ship occupancies haven’t returned to pre-pandemic levels, Rines points out that the rate per room and booking volume has risen significantly.

Are Crypto Investors Being Spooked by a False Narrative?

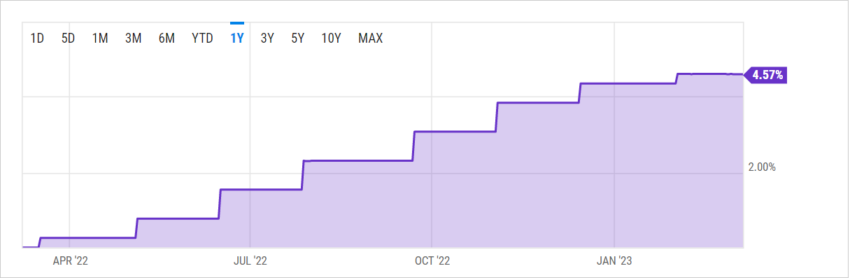

In speeches before congressional committees earlier this week, Federal Reserve Chair Jerome Powell said that the Fed might need to revise its terminal rate to bring inflation back down to 2%, with the CME’s Fed Watch tool increasing the likelihood of a 50 basis increase in March 2023.

He also added that the Fed might adjust the pace of rate hikes should inflation defy rising interest rates.

However, Rhines argues, ignoring rampant corporate profiteering could mean that the Fed never gets out of the rat race. Accordingly, even crypto investors could adjust their portfolios based on a mirage. The reaction is seen in market dumps when inflation numbers come in hot.

“Because it’s going to be very difficult in my mind for the FOMC to get off of, we call it 25 [basis points] for life, until they begin to actually see corporations decelerate pricing,” he told hosts Joe Weisenthal and Tracy Alloway.

“It’s going to be easy to read in a little too much to CPI and PCE readings over the next few months and be really excited that maybe the Fed doesn’t have to go to 550, 575, and then all of a sudden get caught a little off guard when corporations continue to push pricing,” he warned.

Bitcoin critic Peter Schiff also argues that rate hikes are pointless if they do not encourage people to continue saving.

Chair Powell had previously said that the U.S. Consumer Price Index and the Personal Consumption Expenditure Index would influence by how many bases points the Federal Reserve will raise the federal funds rate at the next Open Markets Committee Meeting.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.