Dogecoin (DOGE) has recently captured the attention of cryptocurrency investors as it hovers within a bullish descending wedge pattern.

However, weak broader market cues have kept a breakout at bay, leaving many wondering whether one is imminent or if DOGE will continue to consolidate.

Dogecoin Investors Want a Rise

Despite the current price stagnation in Dogecoin’s price, investor sentiment remains largely bullish. The Global In/Out of the Money (GIOM) indicator shows that approximately 60.72 billion DOGE, valued at $5.76 billion, is poised for profits.

This supply was acquired between $0.101 and $0.130, a range that has historically acted as a crucial support and resistance zone. The optimism is further supported by the fact that DOGE’s recent price dips have been met with substantial buying interest.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

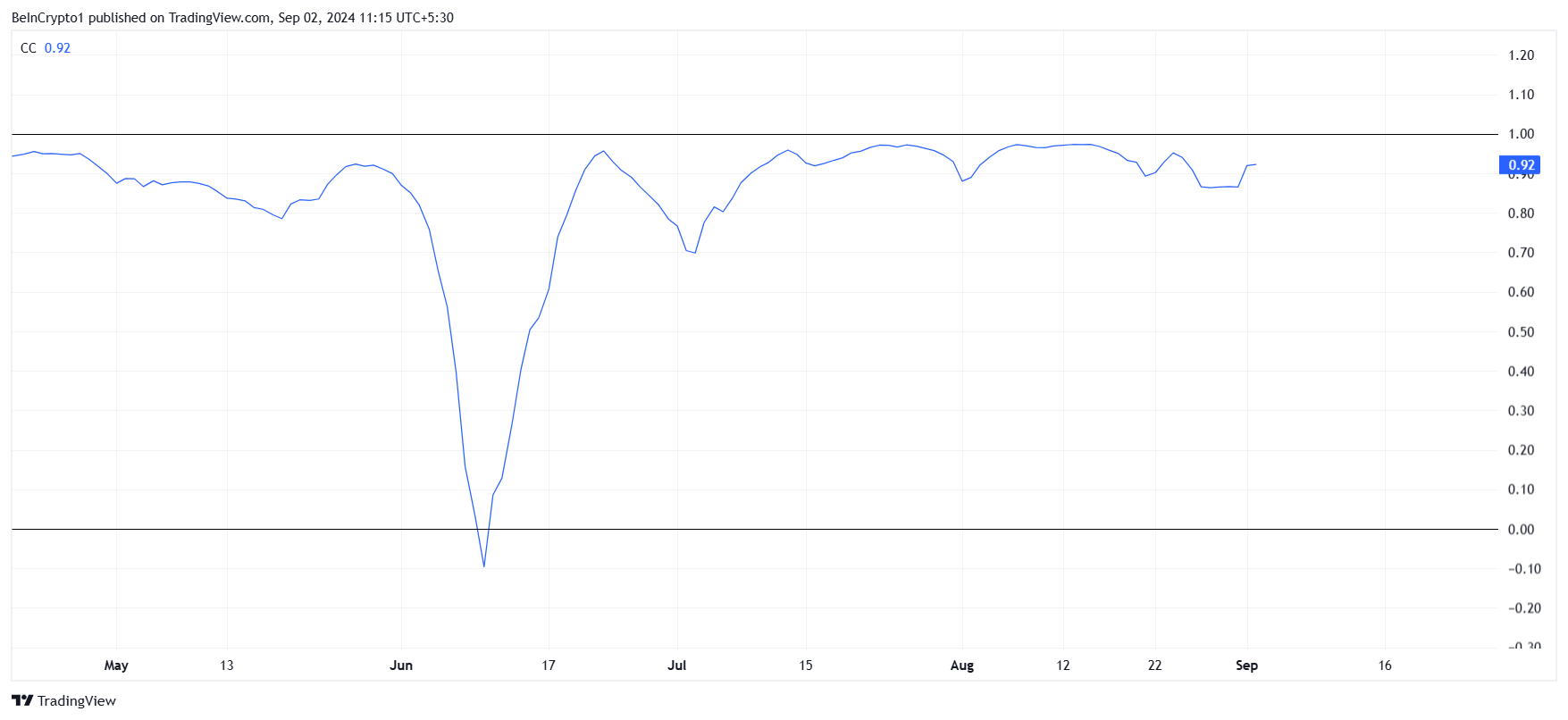

Furthermore, Dogecoin’s macro momentum is heavily influenced by Bitcoin (BTC), as the two cryptocurrencies share a high correlation of 0.92. This correlation means that DOGE’s price movements are closely linked to Bitcoin’s performance. When Bitcoin experiences price changes, Dogecoin often follows suit, albeit with varying intensity.

Bitcoin’s recent price behavior has been a mix of consolidation and minor uptrends, keeping DOGE in a similar pattern. However, a downturn in Bitcoin’s price could also dampen DOGE’s rally, making BTC’s performance a crucial factor in Dogecoin’s near-term future.

DOGE Price Prediction: Breaking out Is the Aim

Dogecoin’s price is currently holding above the critical support floor of $0.094. This level has provided a reliable base for price bounces in the past. Despite several attempts, DOGE has failed to breach the resistance at $0.118, leading to a period of consolidation.

If DOGE manages to break through the $0.118 resistance, it would also mark a breakout from the descending wedge pattern. Such a move could trigger a 65% rally, with the next target being $0.182. This price level represents a significant gain and also restores confidence in DOGE’s potential for further growth.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, the resistance levels at $0.130 and $0.118 have been tested multiple times in the past, making them formidable barriers. A failure to breach either of these levels could result in continued consolidation above $0.094. In this scenario, DOGE might struggle to gain upward momentum, leading to the invalidation of the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.