On August 29, US District Judge Alvin Hellerstein of the Southern District of New York ruled in favor of Elon Musk and Tesla, dismissing a $258 billion lawsuit against them.

The lawsuit claimed that Musk used his influence to manipulate Dogecoin’s price with tweets and public appearances, including on NBC’s “Saturday Night Live.”

Investors Blame Elon Musk for Dogecoin’s Wild Rollercoaster

The lawsuit, led by Keith Johnson and a group of fellow investors, alleged that Musk and Tesla promoted Dogecoin as a legitimate investment while orchestrating market manipulation tactics. The plaintiffs argued that his manipulation caused a price surge followed by a sharp decline that harmed investors.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

However, Judge Hellerstein determined that the plaintiffs failed to demonstrate that Musk and Tesla engaged in market manipulation through their actions and statements about Dogecoin.

“As for Musk and Tesla’s alleged ‘pump and dump’ scheme, it is not possible to understand the allegations that form the basis of Plaintiffs’ conclusion of market manipulation, a ‘pump and dump’ scheme, a breach of a fiduciary duty amounting to insider trading, or the state law claims,” the court document reads.

Despite the lawsuit’s dismissal, Musk has long been an influential figure in the crypto market, especially with Dogecoin. He has referred to himself as the “Dogefather” and often tweeted about the cryptocurrency. These actions have consistently led to significant fluctuations in DOGE’s price.

For instance, his tweet earlier this month, which made a humorous reference to the “D.O.G.E Department of Government Efficiency,” caused Dogecoin’s price to surge by 6%. Although his comments are lighthearted, Musk’s impact on Dogecoin’s market performance is undeniable.

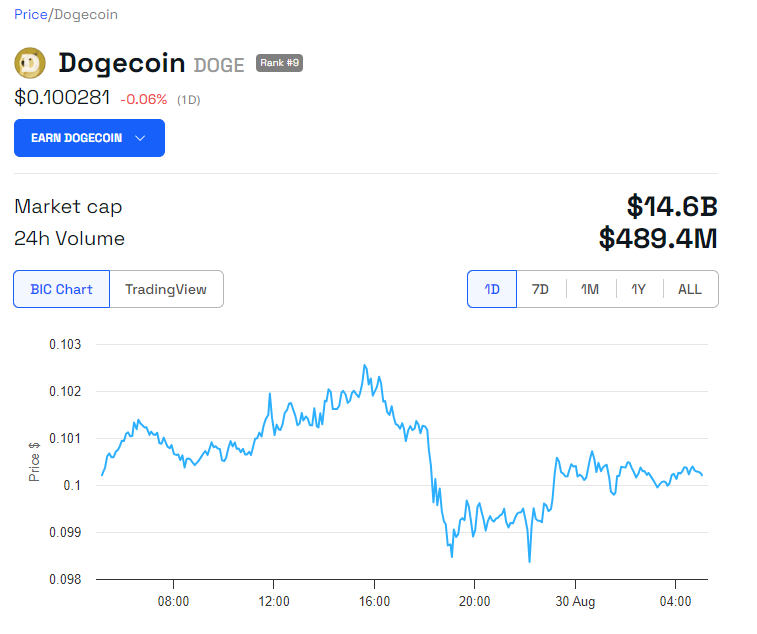

A similar situation occurred following the court’s decision. Data shows Dogecoin’s price rose modestly by approximately 2%, from $0.098 to $0.1005. However, at the time of writing, it has stabilized to $0.1002.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

While this uptick reflects a positive reaction to Musk and Tesla’s legal victory, analysts at BeInCrypto note that Dogecoin remains in an accumulation phase. This phase could set the stage for a more significant price surge if buying pressure continues to build.

Should Dogecoin break through the key resistance level of $0.109, it may rally toward $0.118, potentially signaling an end to its current consolidation. Conversely, if market conditions turn bearish, Dogecoin could slip below $0.108, extending its period of stagnation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.