As the rest of the market corrected, Dogecoin’s (DOGE) price also noted a drawdown, erasing the progress made in the past 20 days.

However, the meme coin is exhibiting signs of gradual recovery that might paint it in a “consider-buying-it” light.

Should You Add Dogecoin to Your Wallets?

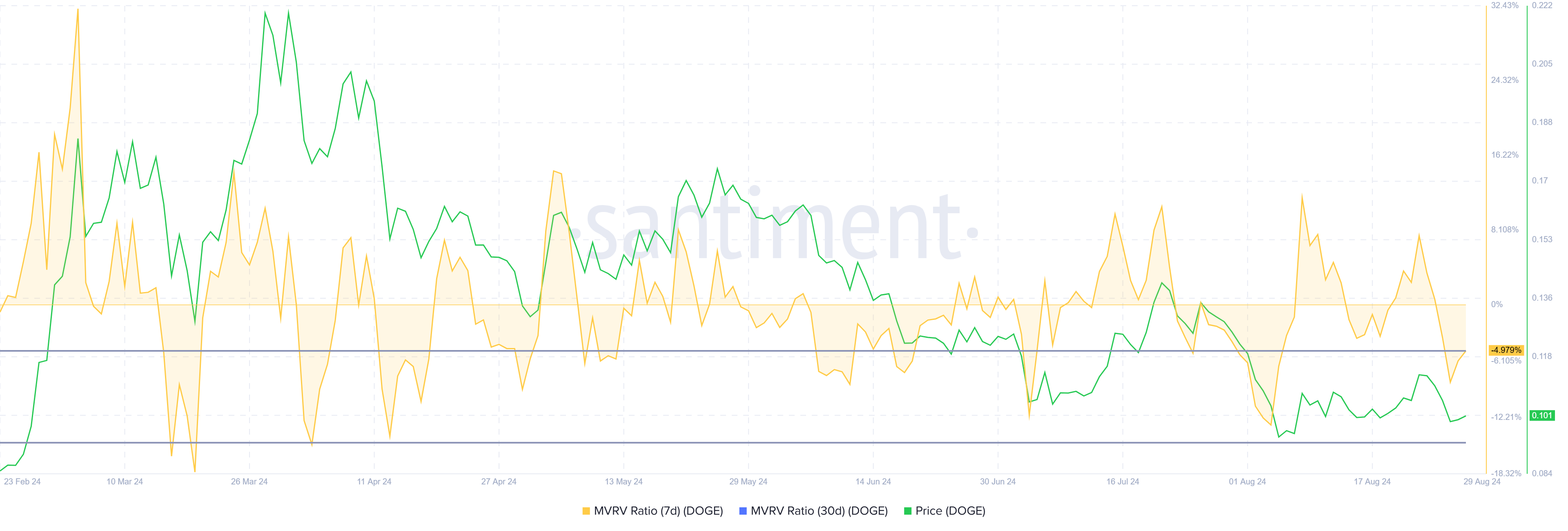

Dogecoin’s price drop this past week is seemingly a blessing in disguise for DOGE and its investors. According to the market value to realized value (MVRV) ratio, the drawdown has placed the meme coin in an accumulation zone.

The MVRV ratio evaluates investors’ profits and losses. At present, Dogecoin’s short-term 7-day MVRV is at -4.9%, signaling losses and the end of selling pressure. Historically, DOGE MVRV between -4.9% and -14.9% typically indicates the beginning of recovery rallies, marking it an accumulation opportunity zone.

Since the meme coin is at the edge of this zone, it is signaling a small window for accumulation.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

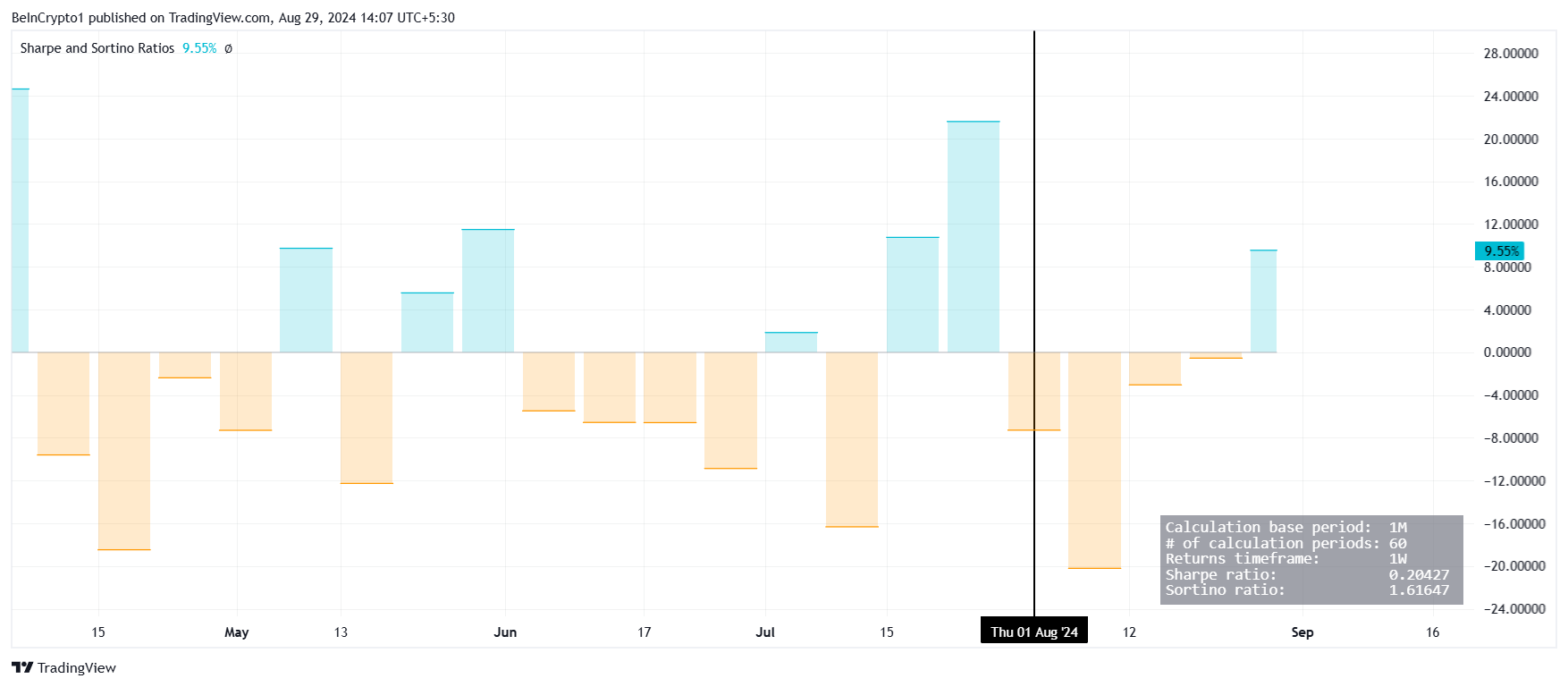

However, the question arises whether adding DOGE to the portfolio at the current price will prove profitable. The answer comes from the Sharpe Ratio, which measures the risk-adjusted return of an investment.

It does so by comparing its excess return (over the risk-free rate) to its volatility. A higher Sharpe Ratio indicates a more favorable risk-reward profile. At the moment, Dogecoin’s Sharpe Ratio is at 9.55% on the weekly timeframe.

This is also the first time the Sharpe Ratio has turned positive since the beginning of this month.

DOGE Price Prediction: Escaping Consolidation

Dogecoin’s price has been hovering under the barrier of $0.108 for the majority of this month. Despite the recent rise, the meme coin ended up falling by 12%, slipping below this resistance, currently changing hands at $0.100.

If the accumulation kicks in, it could trigger a rise in Dogecoin’s price, pushing it beyond $0.109. Once this barrier is breached, DOGE could rise upwards towards the resistance of $0.118, helping the meme coin escape consolidation.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

On the other hand, if the breach fails or the market turns bearish, a drawdown below $0.108 is likely. This would place DOGE in consolidation again, invalidating the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.