Leading meme coin Dogecoin (DOGE) has trended within a horizontal channel since August 8. Over the past few days, it has inched closer to the resistance level in an attempt to break above it.

However, a negative divergence has emerged between its price and trading volume, which may prevent the breakout from happening.

Dogecoin Encounters Roadblock

When an asset trades within a horizontal channel, it moves sideways, staying within a defined range due to a balance between buying and selling pressures. The upper line of the channel marks resistance, while the lower line acts as support.

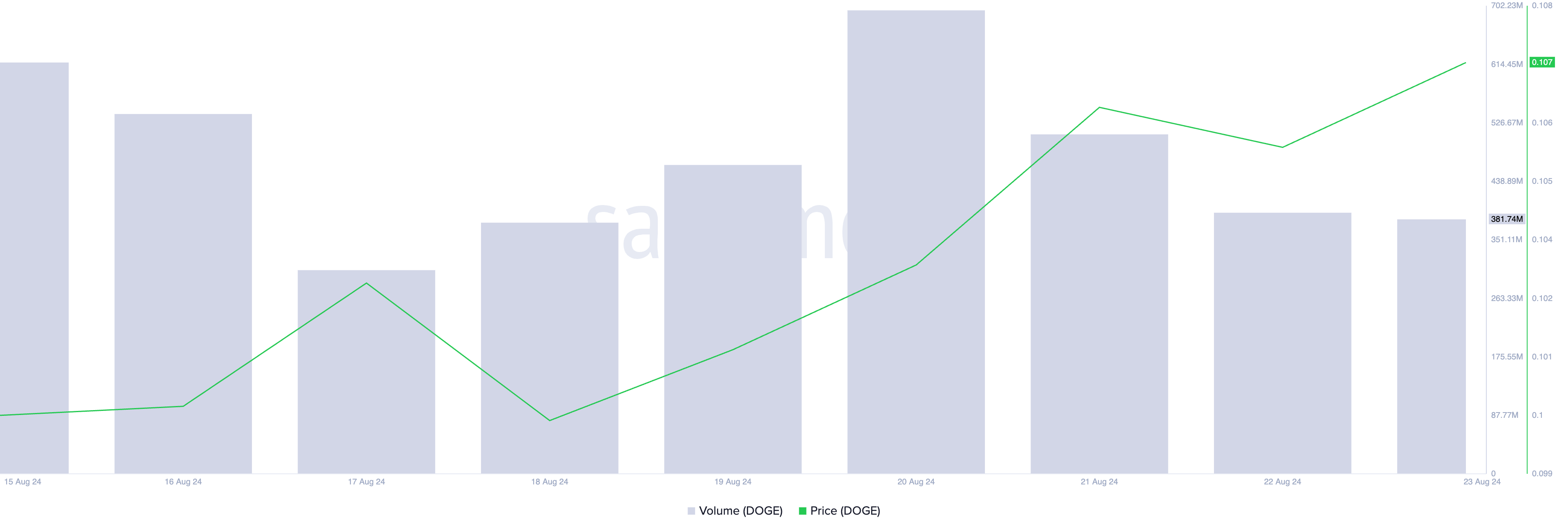

Since August 8, DOGE has encountered resistance at $0.10 and found support at $0.09. The recent rally toward the resistance line has been driven by a 4% price increase over the past seven days.

However, during this period, daily trading volume has dropped by 37%, creating a negative divergence between price and volume. This divergence suggests that the rally may lack strength, potentially leading to a price decline.

In a healthy uptrend, an asset’s price increase is typically supported by rising trading volume, signaling that more participants are buying the asset. However, when the price rises while trading volume declines, it indicates weakening buying momentum. This suggests that only a limited number of traders are driving the rally, making it vulnerable to exhaustion, which could lead to a price drop.

The risk of this scenario is heightened for DOGE, as it currently lacks strong whale activity. Large holders have reduced their trading involvement over the past week, as shown by a 100% drop in large holders’ netflow, according to IntoTheBlock.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

When an asset’s large holders’ netflow drops, it is a bearish signal. It means that its whale addresses are selling their holdings, putting the price at risk.

DOGE Price Prediction: The Bulls Are Putting Up a Fight

Despite the negative divergence between DOGE’s price and daily trading volume, along with the recent drop in whale activity, bulls are working to regain market control. This is evident from the positive readings on DOGE’s Elder-Ray Index since August 20, after previously showing only negative values.

The Elder-Ray Index assesses the strength of buyers versus sellers in the market. Positive values indicate increasing bullish power. Currently, DOGE’s Elder-Ray Index stands at 0.0037, signaling a potential shift in momentum toward the bulls.

Additionally, although DOGE has traded sideways in the past few weeks, the dots of its Parabolic Stop and Reverse (SAR) indicator has rested below its price since August 10. This indicator tracks an asset’s price direction and identifies potential reversal points. When its dots are under an asset’s price, buyers are in control, pushing prices higher.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

If DOGE successfully breaks above the upper line of its horizontal channel, its price will climb to $0.11. Conversely, a failed breakout could see the price retreat toward the $0.09 support and potentially fall below it to $0.08, invalidating the bullish projection.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.