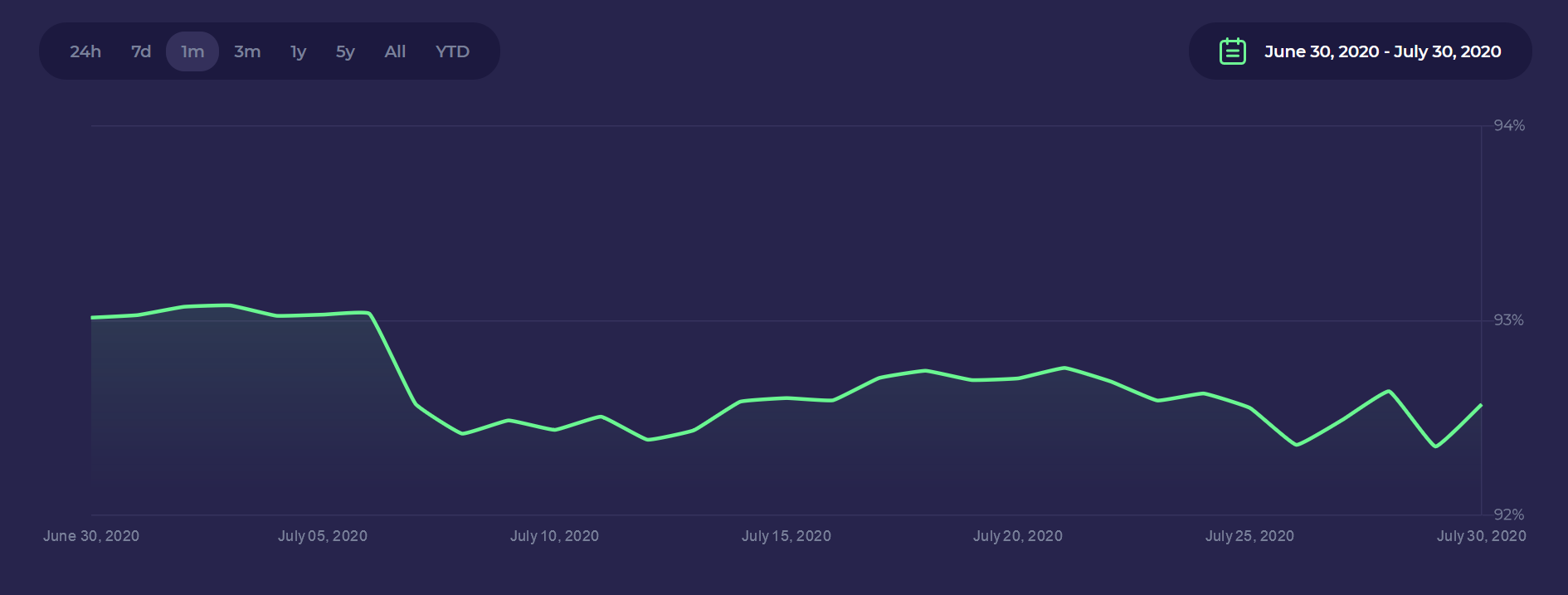

Bitcoin dominance dipped this week despite its epic run-up to $11K. But new ways of calculating dominance are making their way into crypto.

What is Bitcoin Dominance Anyway?

When people talk about BTC dominance, most pundits are likely referring to the percentage of the total market cap of all cryptocurrencies represented by Bitcoin. One exciting explanation is that low dominance indicates a weak Bitcoin that will never claw back its revered spot at the top. How could Bitcoin be dethroned? Well, smart contract blockchains like Ethereum arguably have more uses, Nano is faster, and Dogecoin is, well, just funny. But Bitcoin maximalists will argue that low dominance does not indicate a blow to Bitcoin. In fact, some argue that dominance doesn’t actually matter at all.Going Down With the Ship?

BTC bugs point out that Bitcoin is deep-seated in the public consciousness as the number one cryptocurrency, and so it will continue to be. People used to sell stamps for their monetary value, but that did not make cash disappear. So why would crypto be different? Still, others maintain that Bitcoin can adapt through initiatives like the Lightning Network.

Too good to be true? Since Dogecoin features on the list, maybe it is. Other coins include the BTC forks, which are naturally tiny compared to their titan parent. This process could, of course, be turned on its head. If you’re looking at dominance featuring smart contract tokens against Ethereum, Bitcoin wouldn’t even show up. In other words, bitcoindominance.com picks its own comparisons to make a point.A fresh new take on Bitcoin Dominance that makes it a slightly less stupid metric. https://t.co/euoTI8ElPB

— Jameson Lopp (@lopp) July 30, 2020

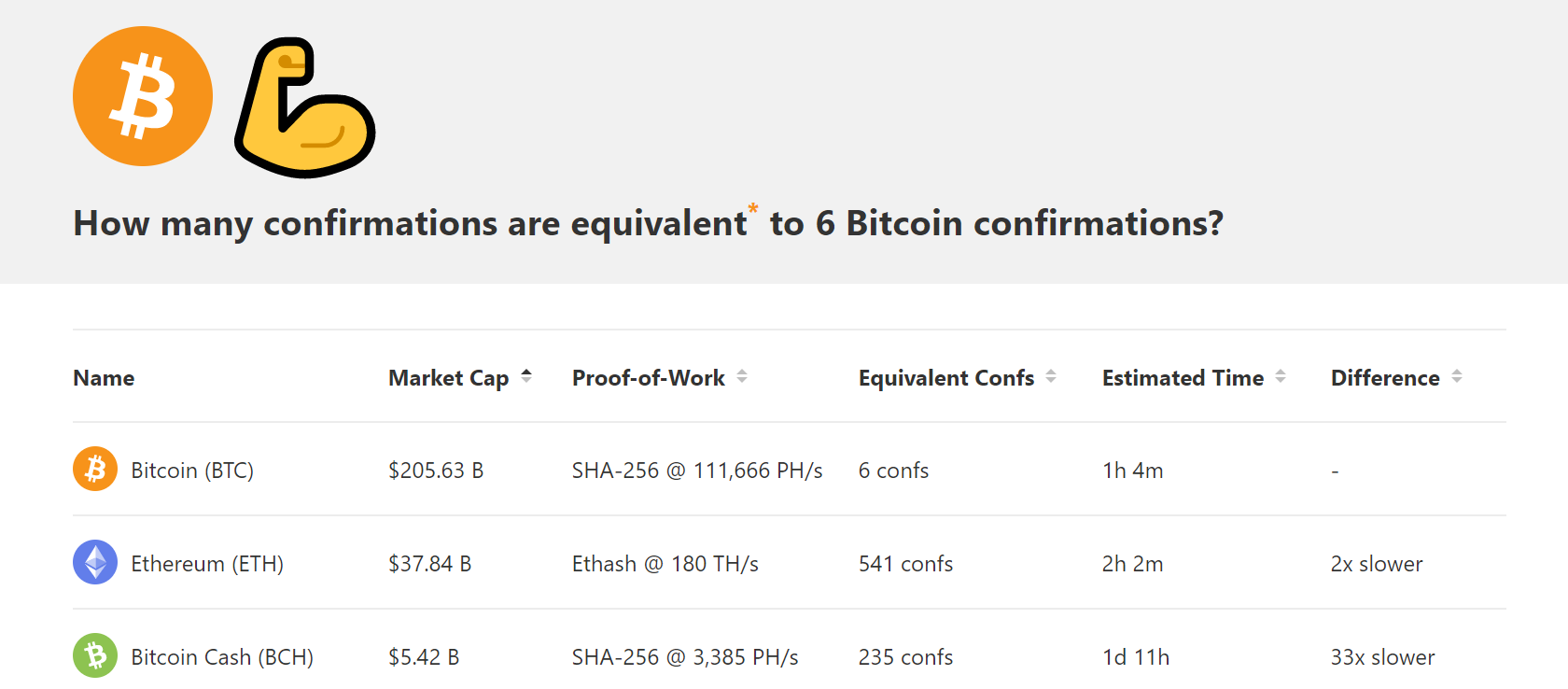

There are still other Bitcoin-centered approaches to calculating dominance. Leveling the playing field to give accurate comparisons between coins is no small task. It’s difficult because of the different hash rates, volumes, hardware, and energy usage.ETH dominance is 100% on the ETH Dominance chart I just created that removes all other coins but ETH.

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) July 30, 2020

Bullish. https://t.co/36BttOlemY

Would a Hash at Any Other Rate Smell as Sweet?

Luke Childs, a security and privacy engineer who founded Howmanyconfs, offers a solution:We can use NiceHash prices to estimate the cost in $ to secure a blockchain for a given timeframe. This is directly comparable across blockchains and should be directly proportionate to kWh/s, because after all, the energy needs to be paid for in $.Basically, this “equivalency” is calculated with the blockchains PoW algorithm, the average price per hash, and the total hashrate. Despite a few caveats, it does get a price per second metric that you can use to make comparisons.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored