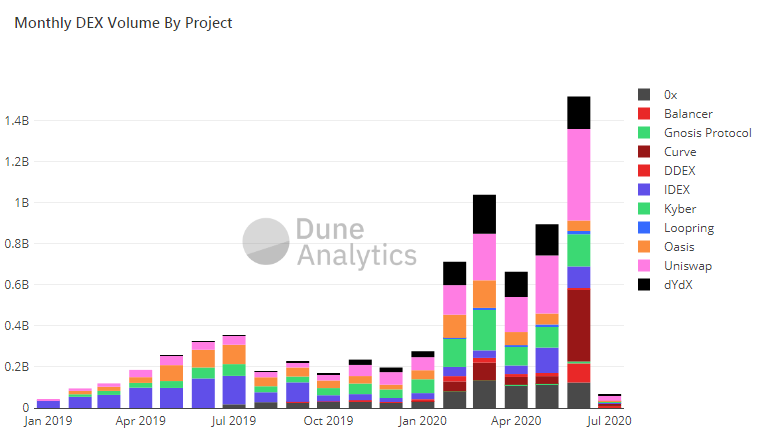

New data shows DEX volumes at their peak, with 2020 recording $5.1 billion in the first half of the year. This number far eclipses volumes from the same period in 2019 and bodes well for the DeFi space, which has already shown signs of sustained growth.

Decentralized exchanges are showing tremendous growth, as data from Dune Analytics reveals that DEX volume in the first six months of 2020 was five times greater than in the same period in 2019. The year 2020 has seen $5.1 billion in volume on DEXs, recording $1.5 billion in June alone.

A Coming of Age for DEXs?

DEXs have long been heralded as being the next step in the cryptocurrency market, bringing faster trades, negligible transaction fees, and greater security. However, the relatively complicated technical nature of the exchanges has prevented wider adoption, though some, like the recent release of 0x’s Matcha, have attempted to overcome that particular hurdle.

DeFi Underscoring Its Role as A Cornerstone of the Market

Several platforms and launches have contributed to the incredible surge of the DeFi space in 2020, not the least of which are yield farming programs launched by the likes of Compound Finance, Balancer, and Synthetix. bZx is also expected to launch a similar program. At the time of publishing, the total value in DeFi stands at $1.7 billion, according to Defi Pulse. While Ethereum’s price has gone sideways many expect the DeFi niche to spark price growth. That said, the related protocols are still relatively new, and developers and founders have warned that there is still much refining to be done. An exploit in the Balancer protocol recently led to the theft of $500,000 in Ethereum.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored