The meteoric growth in the trading activity for decentralized exchanges (DEX) is not slowing down as the total volume for July exceeds $4 billion.

Monthly DEX volumes have been on a tear since the start of 2020 with increasing returns seen in the last three consecutive months.

DEX platforms continue to attract massive trading volume and their native tokens are reportedly providing greater returns than centralized exchange (CEX) counterparts.

DEX July 2020 Volume Sees 12x Year-on-Year Growth

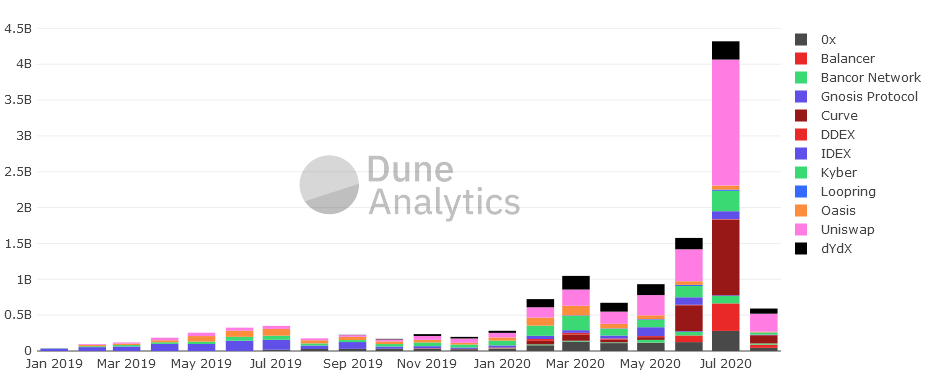

According to data from on-chain analytics platform Dune Analytics, the total DEX volume for July almost exceeded $4.3 billion, setting a new monthly all-time high (ATH). This figure amounts to about a 200% increase from the trading activity recorded in June.

Indeed, compared to July 2019, the July DEX total constitutes a year-on-year increase of over 1,100%. As of the time of writing, the current trading volume for August is already above the $0.6 billion mark. If this rate averages for the rest of the month, a new monthly ATH for August is imminent.

The increase in DEX trading volume comes amid the massive hype surrounding the decentralized finance (DeFi) market. According to DeFiPulse.com, the total value locked (TVL) in DeFi is north of $4 billion.

Of the top-10 DeFi protocols by TVL, three are DEX platforms. And with the increase in yield farm trading and the need for trustless token swaps, it’s perhaps unsurprising that monthly DEX volumes are on the rise.

Nevertheless, centralized exchanges still control the crypto trading arena. According to data from market analytics service TokenInsight, DEX volume for Q2 2020 stood at $191.4 billion compared to CEX platforms that totaled $5.25 trillion.

For context, the $191.4 billion recorded by DEXes in Q2 2020 puts them at the trading level of CEX platforms from Q2 2017.

Tougher regulations for centralized exchanges also contributes to greater trading on DEX platforms. Certain CEX platforms are geofencing tokens and thus, traders in highly-regulated jurisdictions are moving their exchange activities to decentralized exchanges.

Uniswap Dominates the Trading Landscape

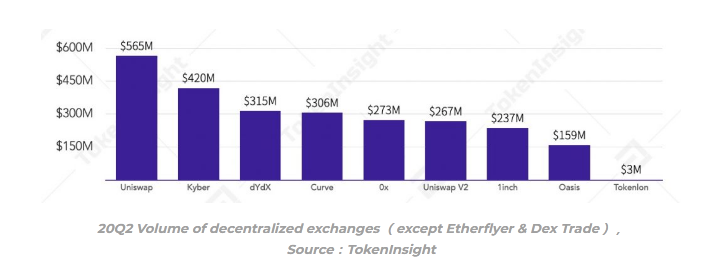

Despite having almost 50% fewer users than Kyber, Uniswap still accounts for the largest share of trading volume for DEXs. Despite the argument over whether EtherFlyer is a “true DEX,” most analysis around decentralized exchange activity usually omits the Estonian-based platform.

In July, Uniswap accounted for $1.76 billion in trading volume, about 40% of the total for decentralized exchanges during the month. Figures from TokenInsight show Uniswap recorded $565 million in Q2 2020 trading volume while Dune Analytics figures put this total at $899 million for the same period.

The growth in Uniswap trading volume means the Ethereum-based DEX has overtaken some centralized crypto bourses. Indeed, at a 24-hour volume of $88.4 million, Uniswap has handled more trading activity than Poloniex, $54.8 million, and Gemini, $26.7 million, combined.