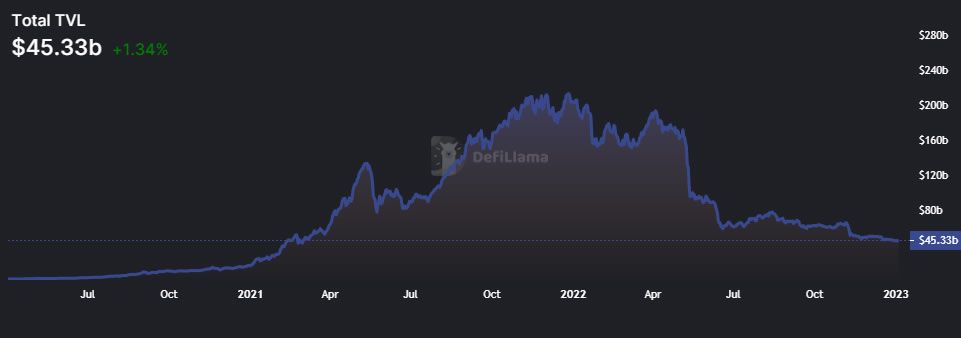

The total value locked in decentralized finance (DeFi) has recently hit a two-year low. It has shown very marginal recovery signs this week, however.

Decentralized finance has been battered over the past year as the crypto bear market bites deeper. As a result, DeFi TVL dumped to its lowest levels for almost two years on Jan. 1, 2023.

The total value locked across all DeFi protocols slumped to $44.2 billion at the weekend. This is the lowest it has been since February 2021, according to DeFiLlama. It has since recovered slightly to $45.3 billion today.

Furthermore, TVL is currently down 79% from its all-time high of $213 billion in December 2021. This is a larger decline than crypto markets which are currently down 72% from their peak of just over $3 trillion in total capitalization in November 2021.

Ethereum Still King

The DeFi TVL chart is very similar to the crypto market cap one. TVL is measured in USD, which is a factor in crypto collateral prices. Therefore, the slump may not be users dumping DeFi but an overall decline in collateral value.

The Lido liquid staking platform is the leader by market share with 13.5% and a TVL of around $6 billion. Most of this is ETH staking. However, Lido does also offer liquid staking services for other crypto assets.

DeFi pioneer MakerDAO is a very close second with a similar TVL and market share. Stablecoin yield platform Curve Finance is the third largest protocol with around $4 billion locked.

Ethereum remains the king of decentralized finance, with a 58% share of the entire ecosystem and $26.3 billion TVL. Furthermore, the Binance BNB Chain is in the second spot with $5.3 TVL giving it a share of 11.7%.

Not all networks have been losers, however. Tron, Arbitrum, and Optimism have all seen decentralized finance growth or steady TVL levels over the past year or so.

DeFi Coins Remain in The Doldrums

Tokens and coins relating to the sector have been hit harder than their brethren. DeFi asset market capitalization has tanked 80% since its all-time high, according to CoinGecko.

The DeFi token crypto market cap is $34.9 billion, with a total trading volume of $1.5 billion in the last 24 hours. High-cap coins taking a hit over the past year include Uniswap (UNI), Chainlink (LINK), Lido (LDO), Frax, and Aave. Some are on the move today, however: