The decentralized finance (DeFi) boom of 2020 has not been without risks. A great deal of money was made and lost through various pumps, rug pulls, and vulnerability exploits. DeFi Pulse has recognized this trend and launched a safety index to rank risks for various platforms.

The new offering has been developed in partnership with the Gauntlet Network, which is a simulation platform for DeFi and blockchain protocols. The Economic Safety Grade aims to allow users to identify and compare the risks they face using on-chain protocols.

The analytics provider added that many DeFi protocols can be overly complex for average users who may also struggle to identify the risks they could face when using these platforms.

1/ Introducing the DeFi Pulse Economic Safety Grade

— DeFi Pulse (@defipulse) October 13, 2020

Created in partnership with the fine folks at @gauntletnetwork, economic safety grades allow users to more easily quantify and compare the risks they face using on-chain protocols. pic.twitter.com/9Iaw8xrOF0

Simulating DeFi Risks

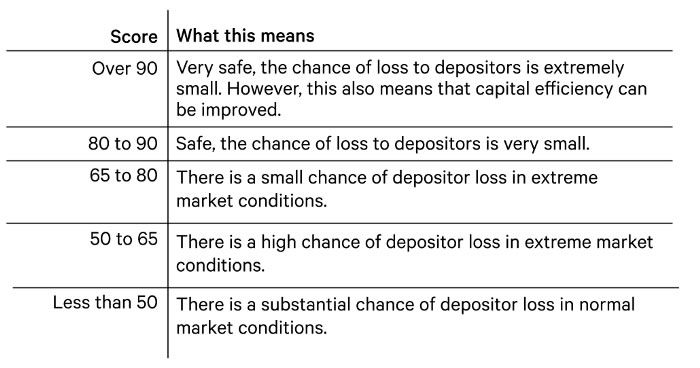

The index will operate by running simulations on the Gauntlet Network, utilizing data from centralized and decentralized exchanges combined with on-chain user data to estimate market risks. It will then grade protocols based on ‘economic safety’ for investors. It has used Aave and Compound as its guinea pigs for the rating system, adding that the grades are formed by analyzing the historical liquidity and volatility data to find the ‘riskiest collateral.’ Aave got a rank of 95% while Compound was a little lower at 91%. The leading two DeFi protocols, Uniswap and Maker, had yet to be ranked at the time of press.“The risk of the system for users borrowing stablecoins against this collateral is estimated and normalized to create the 1 to 100 grade you see on DeFi Pulse.”Gauntlet went on to fully explain how risks are calculated and provided the rubric that was used to determine what the rankings mean;

Building a Beta System

For the alpha release, the grade calculations have omitted cases when the protocol is illiquid. The beta release will be an improved raking system that takes into account extreme network congestion, protocol reserves such as Maker’s Dai, and liquidation analysis for multi-asset collateral. When asked about composability, which addresses the inter-relationships of components of various protocols, Gauntlet added that it’s in the works and that this release only deals with risks due to cascading liquidations. DeFi Pulse believes that safety is key to sustaining the growth of the embryonic industry, concluding;“Educating and informing users of risks helps them make safer decisions and makes for a healthier ecosystem.”DeFi Watch founder, Chris Blec, wasn’t impressed and claims that’s these scores just compare DeFi projects relative to one another. He suggested that what is needed is a DeFi risk score that compares each project to the risks of investing in Bitcoin.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored