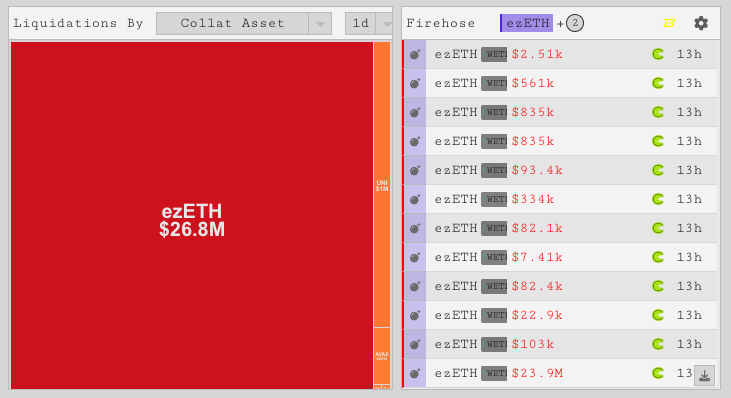

A dramatic turn of events on the decentralized finance (DeFi) platform Pac Finance led to a $26.8 million liquidation event, heavily impacting numerous users.

This financial upheaval occurred unexpectedly on April 11 and has since stirred substantial debate within the cryptocurrency community.

How DeFi Users Lost Over $26.8 Million in Liquidations?

Operating on the Blast network, Pac Finance allows cryptocurrency enthusiasts to deposit their funds to earn interest by lending. The platform secures loans by ensuring borrowers receive only up to a specified percentage of their collateral, known as the “loan-to-value ratio” (LTV).

Typically, any changes to this critical ratio are announced in advance to maintain market stability.

Unexpectedly, blockchain data from the Blast Network revealed that at 1:06 AM UTC, a wallet controlled by a developer adjusted the LTV for Renzo Restaked Ether (ezETH) to 60%. The ezETH-leveraging farmers almost instantly found themselves out of compliance with the new collateral requirements.

Consequently, this sudden change precipitated widespread liquidations among users.

Read more: What Is a Crypto Loan? A Guide to Using the DeFi Instrument

Such rapid liquidations expose the additional risks from protocol changes, which can be as severe as those from market swings. For example, recent shifts in Bitcoin’s price resulted in over $500 million in liquidations on April 2. However, those were due to price volatility, unlike Pac Finance’s protocol-triggered liquidations.

DeFi expert Kydo has recommended that other Liquid Restaking Tokens (LRTs), such as Renzo, should warn users about these high-risk ventures. Despite the attractive earning potential of staked cryptocurrencies, the unpredictable nature of administrative decisions can lead to significant financial losses.

Following the turmoil, Pac Finance acknowledged that it was aware of the incident. Moreover, the DeFi platform claims that it is developing a plan with affected users to tackle the issue.

“In our effort to adjust the LTV, we tasked a smart contract engineer to make the necessary changes. However, it was discovered that the liquidation threshold was altered unexpectedly without prior notification to our team, leading to the current issue. Going forward, we will set up a governance contract/timelock and forum for all future upgrades to ensure that discussions are planned ahead of time,” Pac Finance explained.

This incident serves as a crucial reminder of the importance of transparency and cautious protocol management in DeFi initiatives. Investors should fully understand the operational mechanisms and terms of any DeFi service and remain vigilant about any changes that could affect their investments.

Read more: Identifying & Exploring Risk on DeFi Lending Protocols

Moreover, the event highlights the vital need for effective communication between DeFi platforms and their user bases. Trust can quickly erode without prompt and transparent communication following significant financial disruptions, potentially deterring new users.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.