Bitcoin (BTC) experienced a sharp decline today. On April 2, 2024, at 02.45 UTC, Bitcoin’s price briefly dipped below $67,000, triggering over $500 million in trader liquidations.

The downturn comes after BTC managed to climb back to $71,000 yesterday.

Should Bitcoin Investors Watch Out for Further Corrections?

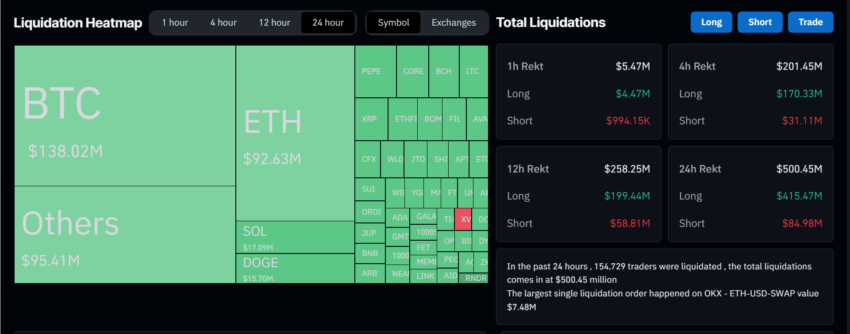

Based on the data provided by CoinGlass, in the last 24 hours, the cryptocurrency market witnessed a significant amount of liquidation. The total liquidation amount reached a staggering $500.45 million, leading to the liquidation of 154,729 traders.

It is worth noting that the majority of these liquidations, around 84.19%, were from long positions. Among all the cryptocurrency exchanges, Binance and OKX witnessed the largest liquidations, with $202.84 million and $176.48 million, respectively.

Read more: 10 Best Crypto Exchanges and Apps for Beginners in 2024

Further compounding the market’s woes is the notable outflow from Bitcoin ETFs, amounting to $85 million. The Grayscale Bitcoin Trust (GBTC) significantly contributes to this outflow, with $302.6 million moving away from the fund.

GBTC has experienced significant outflows, with total outflows reaching $15.07 billion to date. This is in stark contrast to the positive cumulative flows of other SEC-approved spot Bitcoin ETFs.

Cryptocurrency analyst Jason Pizzino has cautioned that Bitcoin’s price may continue to fall based on its recent market performance.

“Watch the emotional fireworks if Bitcoin breaks $68,300 and for many altcoins to continue grinding lower vs BTC pairs at the moment,” Pizzino said.

Pizzino’s analysis highlights the potential for a broader market correction as Bitcoin’s price action often influences other cryptocurrencies. Indeed, the total cryptocurrency market capitalization has dipped to $2.63 trillion, equal to 6.1% down for the last 24 hours.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in April 2024

Specifically, Ethereum (ETH) has witnessed a decline of 6.4% in the last 24 hours. Similarly, Solana (SOL) has experienced a sharper drop of 9.2% in its value. The meme coins category faced even greater drops. In the same period, Dogwifhat (WIF) was down by 12.8%, and PEPE was down by 15%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.