The Uniswap Foundation has detailed its strategy for the forthcoming Uniswap Version 4 (V4) protocol. This next iteration aims to set new benchmarks in security within the decentralized exchange (DEX) ecosystem.

Slated for the third quarter of 2024, the V4 upgrade aims to transform the decentralized finance (DeFi) scene with its meticulously audited code. This signifies an important evolution for Uniswap.

Uniswap Foundation Announces Roadmap for V4 Launch

To ensure the highest security standards, the Uniswap Foundation has laid out a comprehensive roadmap for V4. This plan includes extensive audits by multiple firms and a community audit contest.

“From community-built Hooks, to events, to Twitter Spaces, the momentum for V4 has been growing! At the same time, we believe V4 should be the most rigorously audited code ever deployed on Ethereum,” the Uniswap Foundation wrote.

Since its 2018 inception, Uniswap has been one of the leaders in the automated market maker (AMM) domain, introducing a novel trading mechanism through liquidity pools. This method contrasts with traditional order books, streamlining trading and enhancing liquidity and access for a global user base.

Read more: How To Use Uniswap — The Complete Step-by-Step Guide.

The V4 upgrade’s timing hinges on the successful deployment of Ethereum’s Dencun hard fork, which is anticipated in March 2024. This dependency highlights the collaborative progress inherent in the blockchain ecosystem.

From its launch to the present V3, introduced in May 2021, Uniswap has prioritized advancement and adaptation. In fact, the introduction of “concentrated liquidity” in V3 marked a pivotal innovation, allowing liquidity providers to focus their capital in specific price ranges to optimize fee earnings.

Moreover, V4 is set to elevate Uniswap’s functionality with a modular design incorporating “hooks.” These smart contracts will enable unprecedented customization in liquidity pools, facilitating dynamic fees, on-chain limit orders, and specialized on-chain oracles for enhanced adaptability and efficiency. Furthermore, V4 will introduce “flash accounting,” a feature expected to reduce liquidity providers’ fees significantly.

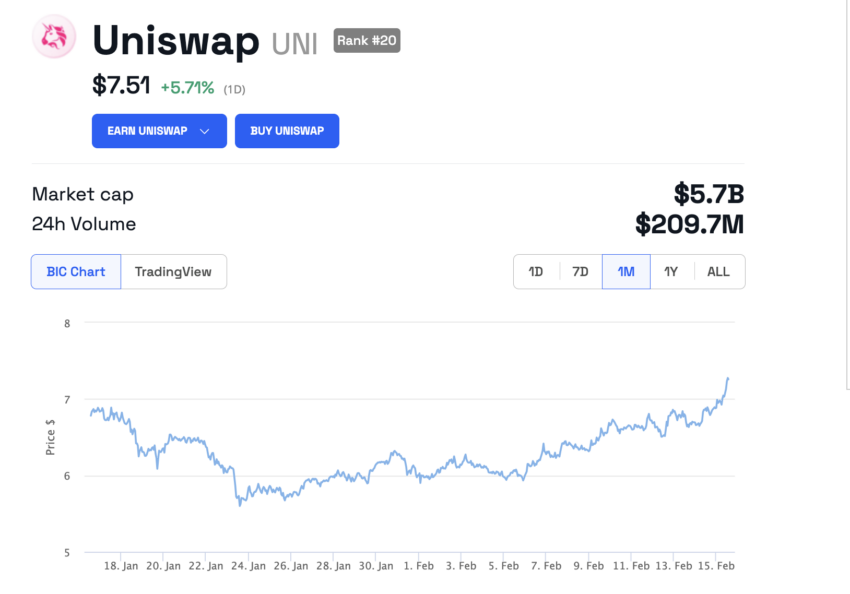

Amidst these developments, Uniswap’s native token has shown positive price action. As of writing, it is trading at $7.51 after surging nearly 6% in the past 24 hours. While the decentralized exchange announced tentative data on February 15, 2024, it made the draft code of V4 publicly available for feedback last year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.