Ethereum data analytics firm Dune Analytics has reported that weekly trading volume among decentralized exchanges (DEXs) has increased by 145% since last week. 2019 has been an important year for P2P trading, as users turn to it for increased security, lower fees and quicker settlement.

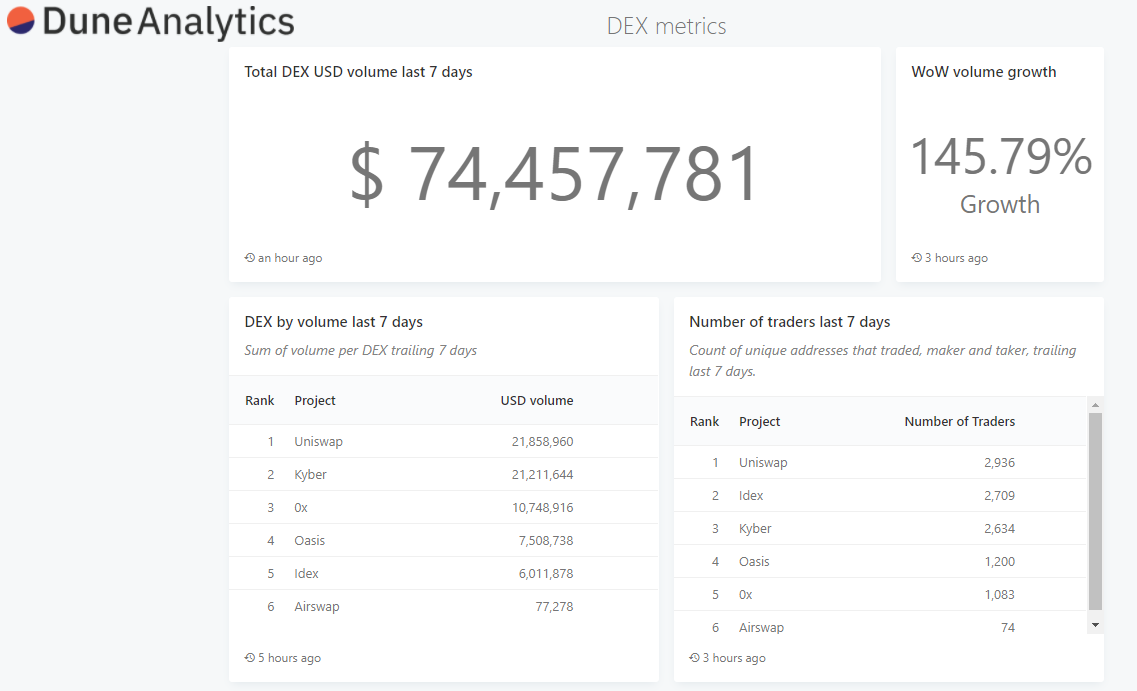

Ethereum data analytics platform, Dune Analytics, has revealed that the week over week trading volume on decentralized exchanges (DEXs) has increased consistently, with a 145.7% increase since last week. The past week has seen over $74 million worth of P2P trades, with Uniswap and Kyber leading with volumes of $21.8 and $21.2 million respectively.

Decentralized Exchange Volume Surging

The platform includes the six top DEXs for its analysis: Uniswap, Kyber, 0x, Oasis, Idex, and AirSwap, while the platform plans to soon add Bancor’s DEX. It analyzes various aspects of trading, including weekly trading volumes, week over week growth, number of unique traders on the aforementioned platforms, and their respective market shares. Decentralized exchanges, a relatively recent phenomenon in the cryptocurrency market, are widely considered to be better than their centralized counterparts. Trades occur at a lower fee, and perhaps the greatest benefit is that it is far more secure, as there are no centralized parties holding funds.

A Transitional Year

The advantages of DEXs has likely played a big part in its growth. Besides stablecoins, DEXs have proven to be a noticeable talking point in 2019. While centralized exchanges still account for about 99% of cryptocurrency trading, DEXs have shown respectable growth, as several reports have indicated. The validity of decentralized exchanges as a trading medium is strong enough that even a platform as big as Binance launched its own DEX in March of this year. That’s not to say that DEXs are not without their challenges. Liquidity is one of the more obvious issues, but this has been changing, as evinced by the data provided by Dune Analytics. Another notable issue is the lack of fiat trading, something that many of the largest exchanges in the world offer, and which is an important feature in order to attract new investors.Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored