Curve Finance plunged further in July due to a drop in the demand for cryptocurrencies by individual whales and institutional investors.

Curve reached a new low in July as the month proved to be one of the worst periods in the history of the decentralized exchange (DEX).

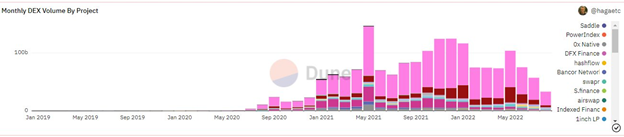

The exchange recorded approximately $8 billion in volume throughout July, according to data from Dune Analytics.

Despite being just $2 million shy of $10 billion, this figure was a 48% decrease from June.

Curve volume for June was around $15.5 billion.

Despite July’s plunge, Curve saw a 53% increase year-over-year in trading volume from the same period last year.

In July 2021, trading volume was in the region of $5.17 billion.

Overall, the latest statistic was also a $14.74 billion plunge from the yearly high volume of $22.65 billion in January.

What caused the fall in volume?

A lack of investor interest in altcoins across centralized exchanges (CEXs) and DEXs was credited for the massive drop in volume.

Aside from Curve, other DEXs which are known to record high volumes such as Uniswap, Synthetix, Balancer, DODO, Shibaswap, and SushiSwap also dipped to new lows.

CRV price reaction

Curve DAO token (CRV), the native asset underpinning Curve Finance, opened on July 1, with a trading price of $0.6843, reached a monthly high of $1.56, tested a monthly low of $0.6677, and closed the month at $1.32.

Overall, despite a dip in volume, there was a 93% increase between the opening and closing price of CRV in July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.