The line demarcating cryptos and traditional financial instruments has become a source of rigorous debate among market participants and regulators. The US Securities and Exchange Commission (SEC) has emerged as a central figure in this conversation, primarily due to its role in regulating securities.

Recent decisions by the SEC have now firmly classified certain cryptos as securities, a move with substantial implications for investors, exchanges, and the broader industry.

Update June 6 at 09:16: The SEC has filed a lawsuit against Binance, the world’s largest crypto exchange, and its founder, CZ, over alleged securities law violations. The key issues involve Binance’s offering of unregistered securities, including their native BNB token, the Binance-linked BUSD stablecoin, and others. Amid the accusations, CZ pledged a complete and thorough response.

The SEC’s Perspective on Cryptos and Securities

The SEC has asserted that many digital tokens constitute securities, applying standards established under the Securities Act of 1933 and further interpreted by several landmark court decisions.

The pivotal case, SEC v. W. J. Howey Co., set forth the “Howey Test” criteria to determine whether a transaction qualifies as an investment contract, a type of security. This test checks if a transaction involves an investment in a common enterprise, expecting profits primarily from others’ efforts.

Applying these criteria to the cryptocurrency market, the SEC has underscored the likelihood that several tokens meet this definition, therefore requiring adherence to established securities laws.

In a significant move, the SEC has recently pinpointed several cryptocurrencies as securities. This crypto securities list encompasses:

- XRP (XRP)

- Telegram Gram Token (TON)

- LBRY Credits (LBC)

- Decentraland (MANA)

- DASH (DASH)

- Power Ledger (POWR)

- OmiseGo (OMG)

- Algorand (ALGO)

- Naga (NGC)

- TokenCard (TKN)

- IHT Real Estate (IHT)

- Kik (KIN)

- Salt Lending (SALT)

- Beaxy Token (BXY)

- DragonChain (DRGN)

- Tron (TRX)

- BitTorrent (BTT)

- Terra USD (UST)

- Luna (LUNA)

- Mirror Protocol mAssets (Multiple Symbols)

- Mirror Protocol (MIR)

- Mango (MNGO)

- Ducat (DUCAT)

- Locke (LOCKE)

- EthereumMax (EMAX)

- Hydro (HYDRO)

- BitConnect (BCC)

- Meta 1 Coin (META1)

- Rally (RLY)

- DerivaDAO (DDX)

- XYO Network (XYO)

- Rari (RGT)

- Liechtenstein Cryptoasset Exchange (LCX)

- DFX Finance (DFX)

- Kromatica (KROM)

- FlexaCoin (AMP)

- Filecoin (FIL)

- Binance Coin (BNB)

- Binance USD (BUSD)

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Cosmos (ATOM)

- SandBox (SAND)

- Axie Infinity (AXS)

- COTI (COTI)

The inclusion of Filecoin was particularly contentious, considering its broad trading base on multiple US exchanges and its previous plans for a proposed trust with Grayscale Investments. The unexpected SEC determination resulted in the termination of the trust proposal, leaving stakeholders to grapple with the implications.

“Grayscale does not believe that FIL is a security under the federal securities laws and intends to respond promptly to the SEC staff with an explanation of the legal basis for Grayscale’s position,” the company said.

Understanding the Consequences of Trading Crypto Securities

Selling unregistered securities generally constitutes a violation of US law. This regulation necessitates that securities undergo registration with the SEC before their sale to the public.

While there are exemptions to this rule—like sales to accredited investors or private placements—unregistered securities’ sale could lead to significant penalties, including fines and profit disgorgement.

In light of the SEC’s new classification, exchanges listing these tokens could face legal scrutiny. Some US exchanges already list over a dozen cryptos the SEC classifies as illegal to sell, which might trigger regulatory actions and subsequently impact their operations.

The landscape has undoubtedly become more complex for investors in these newly classified securities. The regulatory compliance required for securities trading means investors must consider factors such as securities laws and regulations.

Furthermore, the marketability and liquidity of these tokens could be affected, given their new legal status.

Investors may find that trading opportunities for these tokens become limited if exchanges delist them to avoid potential regulatory penalties. This could, in turn, reduce the liquidity of these tokens, making them more challenging to buy or sell in the market.

Crypto exchanges listing these securities face their own set of challenges. From a regulatory perspective, they risk sanctions and legal repercussions if they continue to list these securities without the necessary registration or exemptions.

Mitigating the Risks: Legal Advice is Crucial

Given the legal complexities surrounding the sale of unregistered securities and the specific exemptions that might apply, obtaining professional legal advice has become essential for all stakeholders in this space. Investors, project creators, and especially crypto exchanges must equip themselves with a nuanced understanding of the regulatory environment to navigate these evolving dynamics successfully.

Critics argue that the SEC’s recent enforcement actions and interpretive decisions could stifle blockchain and crypto industry innovation.

“Regulation by enforcement doesn’t work. It encourages companies to operate offshore, which is what happened with FTX,” said Coinbase CEO Brian Armstrong.

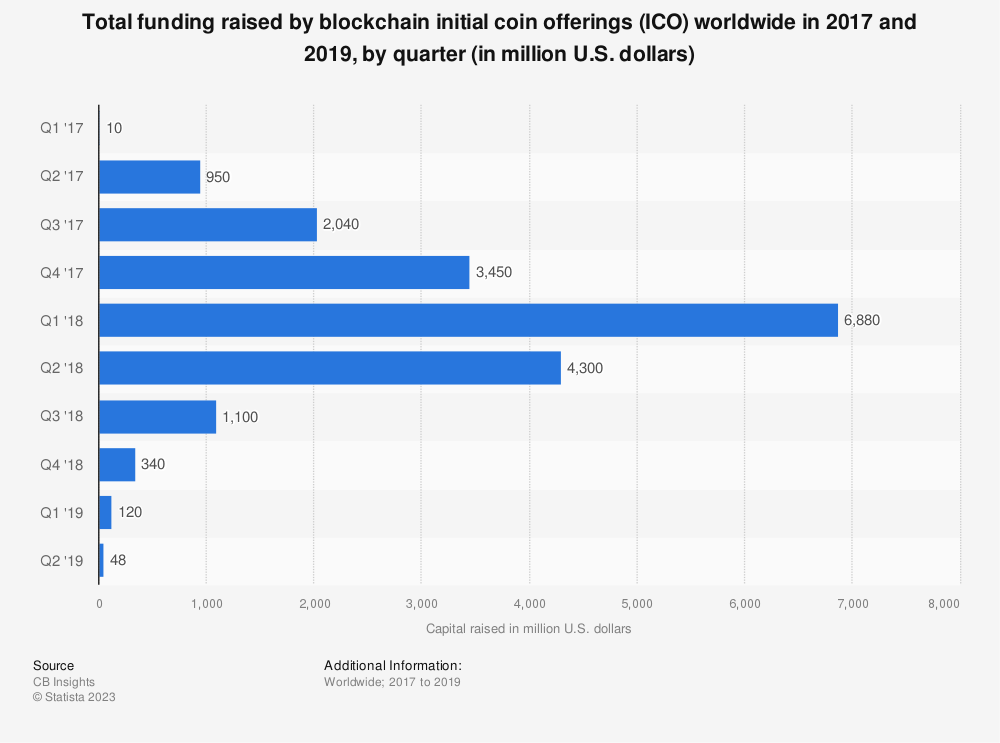

Blockchain projects often raise funds through initial coin offerings (ICOs), which would be deemed securities offerings under the SEC’s interpretation. Therefore, these projects must adhere to strict regulatory requirements, often cumbersome and expensive, discouraging smaller innovative projects.

The SEC’s approach may shift some activities to more lenient jurisdictions. However, given the global nature of cryptos, US investors could still be indirectly affected.

For instance, a project may block US investors from participating in an ICO to avoid the reach of US securities laws. This could limit US investors’ opportunities to participate in innovative blockchain projects.

Crypto Securities: Looking Ahead

The recent actions by the SEC in classifying certain cryptos as securities represent a significant shift in the regulatory landscape. Indeed, the fallout of these determinations is likely to have far-reaching consequences, not just for the digital tokens in question but also for the broader crypto industry.

Reclassifying these cryptos as securities could lead to reduced liquidity, limited market access, and potential legal repercussions for unregistered securities’ trading. Therefore, this presents challenges for individual investors and exchanges and could impact innovation within the industry.

The precise ramifications of the SEC’s determinations will depend on various factors. These include the legal strategies affected parties adopt, potential regulatory environment changes, and the broader market’s response.

The intertwining of cryptos and securities laws underscores the importance of understanding the regulatory landscape in which these digital assets operate. While the recent SEC decisions have introduced additional complexity to the equation, they also underline the necessity of regulatory clarity in this fast-evolving field.

Through professional legal advice and a proactive approach, stakeholders can address the challenges posed by these developments and continue to participate in the dynamic crypto market.