Sequoia Capital, a 51-year-old venture capital firm, has been navigating choppy waters in a tumultuous year. Known for its marquee investments in tech startups like Apple and Google, the firm experienced setbacks that have raised eyebrows in the investment community.

First, Sequoia Capital bet big on cryptocurrency exchange FTX, which folded in 2022, wiping out a $225 million investment. Then, the firm poured resources into Twitter after Elon Musk announced his takeover, a decision currently undergoing scrutiny.

Sequoia Capital Makes Questionable Bets on FTX and Twitter

Sequoia’s missteps echo wider skepticism among its VC brethren. This rings particularly true regarding cryptocurrency ventures, which have dramatically declined in investor interest this past year.

After FTX’s collapse, Sequoia downsized its fund dedicated to investing in crypto companies from $600 million to $300 million. Yet the firm remains optimistic, reflecting on its half-century-long track record of robust performance as a resilience factor.

During a critical period this summer, Roelof Botha, Sequoia’s chief, met with over 50 of the firm’s largest limited partners (LPs) across New York, Boston, and the Bay Area. The discussions were not focused on fundraising but aimed at assuaging concerns among the various financial institutions, pension funds, and family offices invested in Sequoia.

A key message was the firm’s renewed commitment to being a top-performing investment partnership, as emphasized by Botha.

Moreover, Sequoia unveiled strategic changes designed to weather the ongoing storm. New investment vehicles aim to deepen ties with start-up founders, allowing Sequoia to invest in companies from inception through post-IPO.

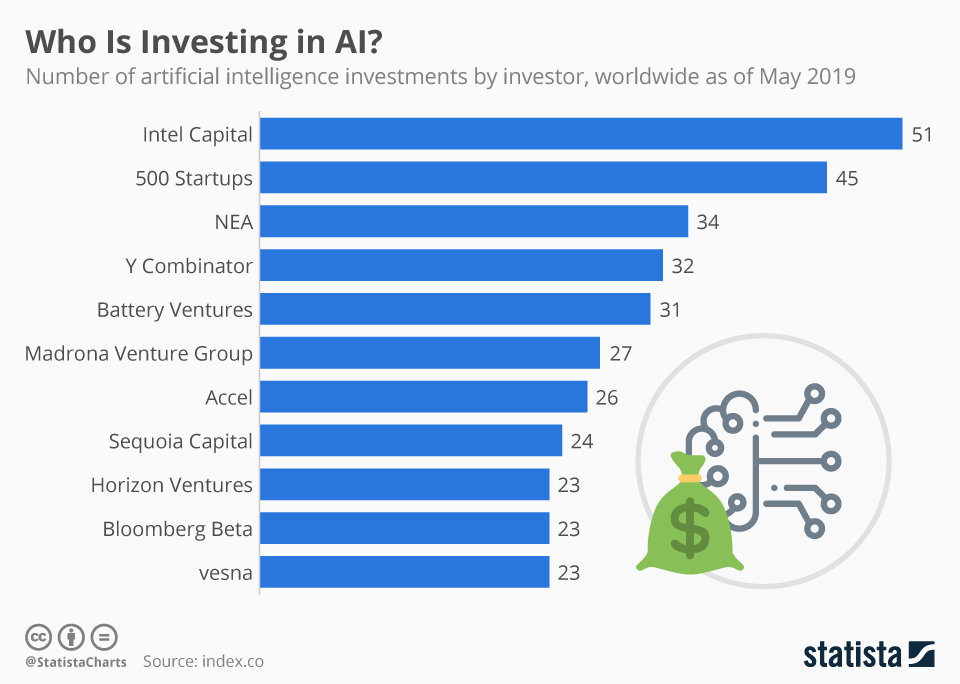

These adjustments align Sequoia to capitalize on the emerging boom in artificial intelligence despite the past year’s volatility.

Evolving and Adapting Strategies

The firm’s commitment to strategic evolution is not limited to domestic adjustments. Earlier this year, Sequoia spun off its highly profitable Chinese arm, a move aimed at resolving a mounting political headache amid increasing tensions between Washington and Beijing over technology investments.

This move undoubtedly disrupts a lucrative profit-sharing model but refocuses Sequoia’s attention on its core competency: identifying and nurturing groundbreaking technology ventures in the United States and Europe.

Sequoia Capital’s misadventures with FTX and Twitter could have easily shaken less-tenured firms. Despite the setbacks, Sequoia demonstrates resilience. The firm is backed by a 51-year history and recent strategic shifts aimed at both risk mitigation and future growth.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Even with the loss of key partners like veteran Michael Moritz and the decoupling of its Chinese arm, Sequoia Capital is in no mood to cede its reputation.

It’s still too early to gauge the ultimate impact of Sequoia’s current strategy. However, it’s clear that the firm is not leaning on its laurels but proactively adapting to meet new market realities. The legacy and future of Sequoia Capital may just depend on its ability to maneuver through this delicate phase, maintaining investor confidence while resetting its strategic compass.