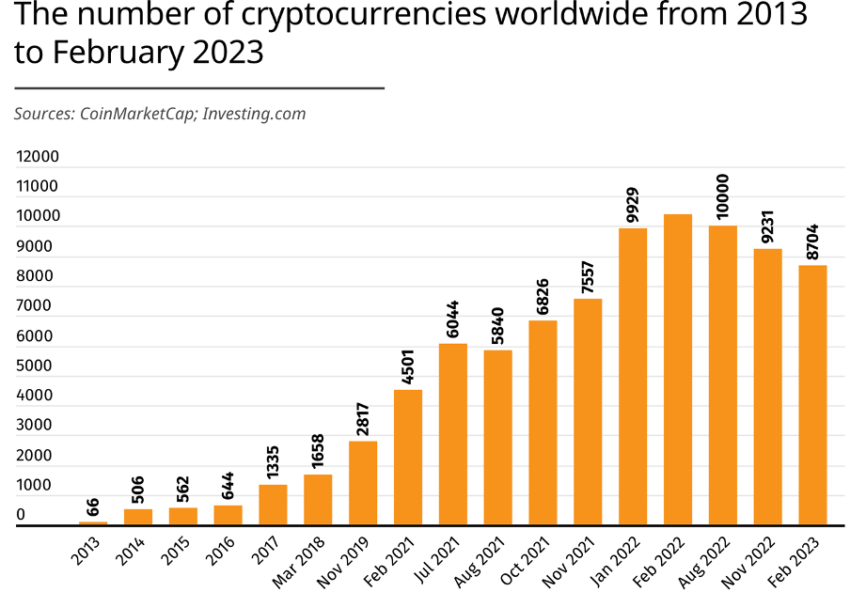

The world of cryptocurrencies has been on a rollercoaster ride in the past few years, with the number of crypto projects rising to an all-time high of almost 10,400 a year ago.

However, the prolonged crypto winter has witnessed a significant drop in their number. And the trend is continuing, with many cryptocurrencies losing value and some even disappearing altogether.

There are more than 1,700 dead coins in existence, according to figures from 99 Bitcoins. The platform lists failed projects by trading volume, poor online presence, a lack of listings on major exchanges, or all four.

Crypto Market Losing Projects

The cryptocurrency market and the underlying blockchain technology have witnessed a significant surge in traction and adoption. The trend continues to grow this year, with institutions jumping on the bandwagon.

However, despite this, the severe market conditions over the years, especially in 2022, saw multiple projects fail – victims of the crypto winter.

The total number of cryptocurrencies dropped by 1,700 year-on-year, falling to 8,704 as of Feb. 14. This is evident in the graph below that showcases the number of crypto within 10 years.

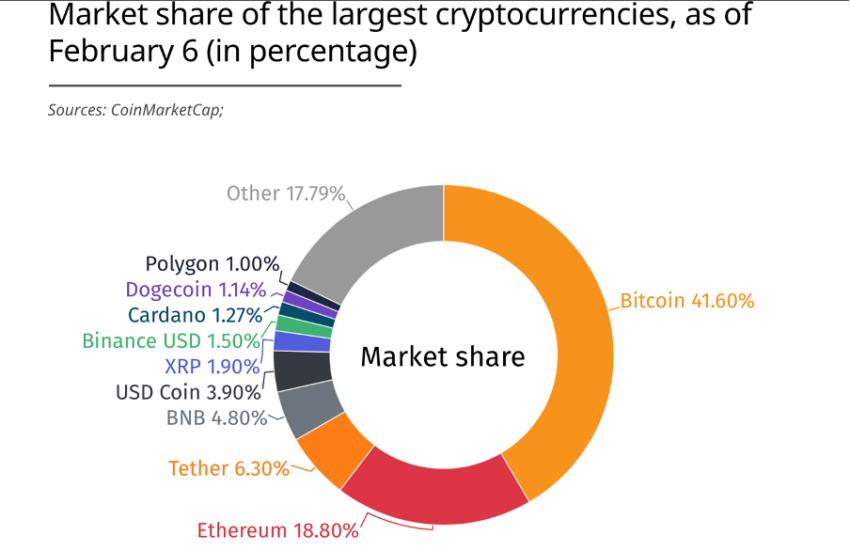

As seen above, Bitcoin (BTC) accounts for 41.60% of the global crypto market cap, with the total value of all BTC coins reaching $443 billion. Ethereum’s (ETH) market cap stood at $190 billion last week, making another 18.80% of the total market cap.

The following three cryptos, Tether (USDT), Binance Coin (BNB), and USD Coin (USDC), account for another 15% of the global crypto market value, with a combined market cap of nearly $161.80 billion.

A spokesman for BitcoinCasinos said: “Statistics show the number of digital coins circulating in the crypto slipped to around 10,000 by Aug before the crypto winter set off the biggest drop market has seen. With just over 8,700 digital coins out there as of last week, their number is falling to 2021 levels.”

Who Holds the Majority Share?

Even though more than 8,000 coins remain in circulation, only five cryptocurrencies account for 75% of the cumulative market value of $1.03 trillion. That represents a combined value of $809 billion as of last week.

This raises the question about other projects, particularly not-so-known projects that came into existence during a bull run. Social media platforms saw different narratives regarding this issue. One Redditor, when asked about the presence of several crypto projects, told BeInCrypto:

Factors Causing the Crypto Exodus

The cryptocurrency market is known for its volatility, and the prolonged crypto winter was a harsh reminder of this fact. Many investors lost significant amounts of money during this period as the value of cryptocurrencies plummeted. Several factors caused the drop in cumulative market value.

One of the main reasons for the decline in the number of cryptocurrencies is increased regulatory scrutiny. Governments worldwide are becoming increasingly aware of the potential risks associated with cryptocurrencies, including money laundering, fraud, and terrorism financing.

As a result, many countries have introduced regulations that require cryptocurrency exchanges and other related businesses to comply with anti-money laundering and know-your-customer requirements.

These regulations have made it difficult for many cryptocurrencies to survive, as they cannot comply with these requirements. Another factor contributing to the drop in the number of cryptocurrencies is the increasing competition.

With so many cryptocurrencies available, it can take time for new projects to stand out and gain traction. Many cryptocurrencies need to attract more users and investors to sustain their operations, leading to their demise.

The prolonged crypto winter has also made it difficult for many cryptocurrencies to survive. With the value of cryptocurrencies plummeting, many projects needed help to sustain their operations.

Some projects ran out of funding, while others lost the support of their users and investors. These instances have been covered extensively by BeInCrypto in the past.

Ending on a Positive Note

Overall, these factors led to a loss of confidence in the cryptocurrency market, which resulted in a significant reduction in the number of cryptocurrencies.

Despite the negative trend, the cryptocurrency market is still alive and well. And while the number of cryptocurrencies has dropped significantly, many projects are still thriving.

The market is still evolving, and new projects are constantly emerging. The market will likely continue to be volatile in the short term, but it is expected to grow and mature over a long time.

The crypto industry is innovative, and compelling use cases are continually emerging for digital assets. For instance, the number of cryptos grew more than 70 times between 2013 and 2021., from just over 60 projects to more than 4,500.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.