Binance, the largest cryptocurrency exchange, has been experiencing record outflows over the past few days as regulators move in to clamp down on its stablecoin dealings.

Binance Coin (BNB) experienced a massive drop in price over the past week. The coin fell below the $300 mark after seeing more than a 6% correction in the past 24 hours.

The fall follows an investigation from the U.S. Securities and Exchange Commission (SEC) against crypto firm Paxos, which issued the BUSD Binance stablecoin.

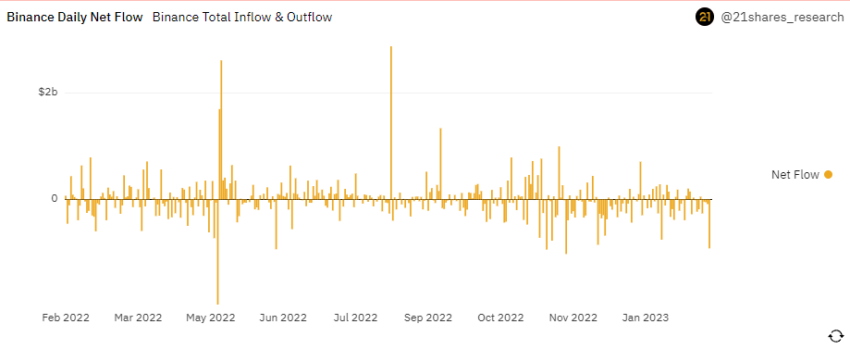

Dune Analytics data shows that Binance saw exchange outflows of $916 million on Feb. 13. This is the largest single-day outflow for the exchange since Nov. 24, as evident in the screenshot below.

Most of these outflows are likely from investors rushing to reduce their exposure following the regulatory scrutiny surrounding the Paxos-issued BUSD stablecoin. Following this, BUSD briefly lost its $1-peg and its market capitalization is currently below the $15.8 billion mark.

Nearly 342M BUSD have been burned at Paxos Treasury within the last 24 hours, according to PeckShield.

Conflicts Over ‘Security’ Classification

Paxos responded to the SEC after the regulatory watchdog issued a Wells notice, or intentions to sue, the crypto company. In this response, the Paxos team countered the regulator’s viewpoints concerning the classification of BUSD as a security.

Much of the crypto community has voiced its opinion regarding the lawsuit. Binance CEO Changpeng Zhao even added his comments on the SEC lawsuit against Paxos amid the chaos.

Despite admitting that he is “not an expert on U.S. laws” with no additional information about the case besides public news articles, Changpeng Zhao warned of “profound impacts” on the crypto industry if BUSD was classified as a security.

Interestingly, the crypto payments company Circle aired issues surrounding Binance’s stablecoin months ago. It filed a complaint with the New York State Department of Financial Services (NYDFS) against Binance last year, accusing the exchange of mismanaging the reserves for its tokens.

Circle claimed that many of Binance’s assets were massively undercollateralized and could potentially lead to investors suffering significant losses.

Industry Outlook

Considering Binance’s dominance in the crypto space, restrictions or regulations on BUSD or any of its assets would likely have a rippling effect across the entire industry.

Changpeng Zhao took to Twitter to claim that ‘all funds are #SAFU,’ and also reiterated that Paxos would continue to manage redemptions of BUSD.

During this whirlwind, Binance hired Noah Perlman, the former Chief Operating Officer of Gemini Trust, to be the exchange’s Chief Compliance Officer.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.