In the early hours of April 16, the BTC price reached a low of $6,461. However, it immediately reversed its trend and has reached a high of $7,147 within the same day.

This increase could have been caused by the printing of $120 million Tether (USDT), which occurred slightly prior to the price beginning its rapid upward movement. In addition, indicators are looking normal again, as evidenced by the return of the realized volatility to its previous levels. Without further ado, let’s take a look at some Bitcoin and altcoin charts to try and figure out where the markets will be moving.

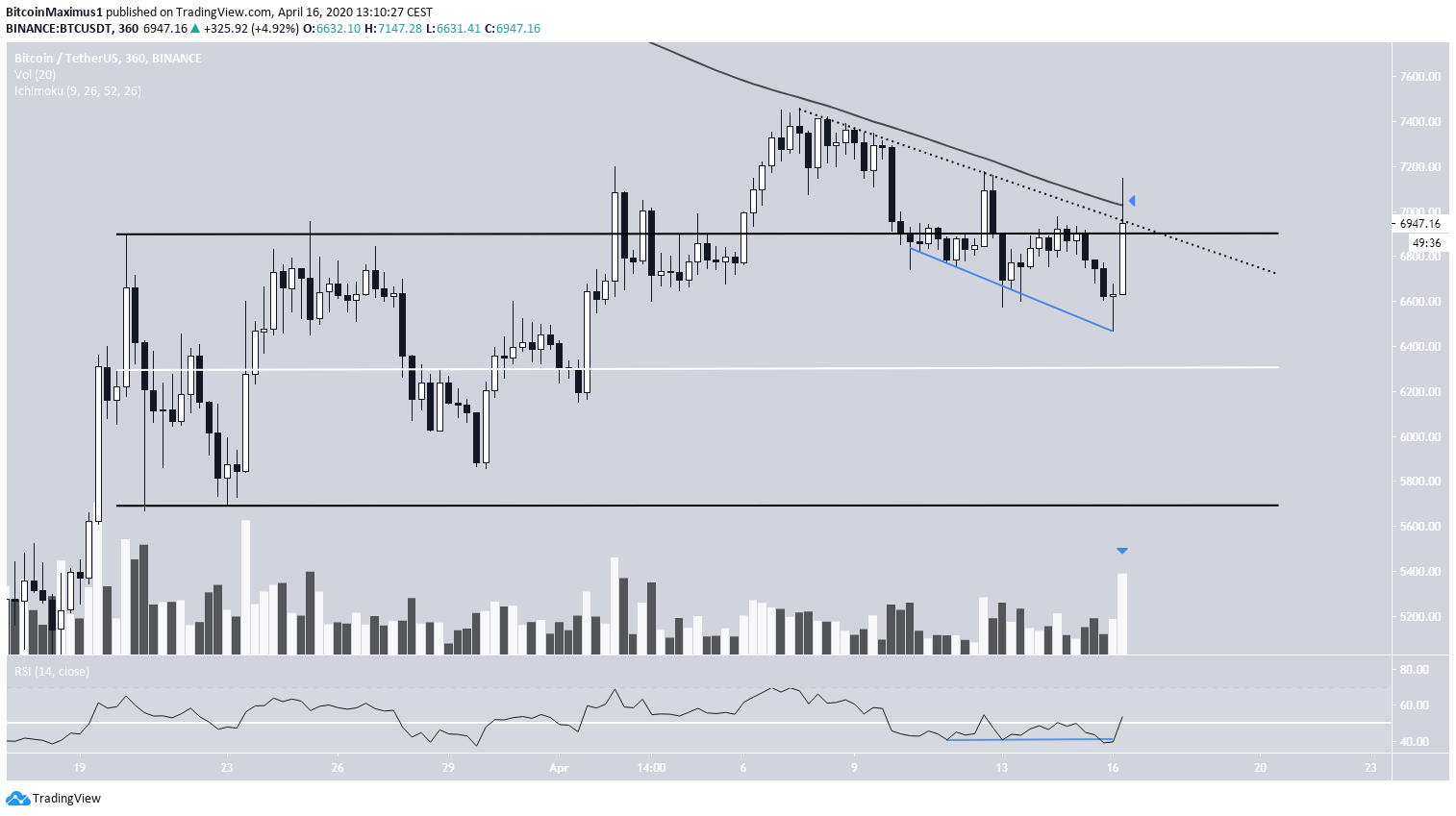

Bitcoin (BTC)

The Bitcoin price is in the process of creating a bullish engulfing candlestick in the six-hour time-frame. However, it has already begun to decrease prior to reaching a close and has created a long upper wick.

Outlook

The BTC price is expected to decrease towards the midpoint of the range at $6,300.Ethereum (ETH)

On April 16, the Ethereum price broke out from a descending resistance line that had been in place for two months. It has been increasing ever since, with the current daily candlestick shaping up to be a bullish engulfing one.

Outlook

The price could decrease towards the ₿0.0225 support and then gradually increase towards resistance.XRP (XRP)

The XRP price has been following a descending resistance line since Feb. 18, having validated it four times until now. The price movement is quite unusual due to the lack of a support line. While there is a support area found at 2,550 satoshis, the price has broken down below it multiple times, only to reclaim it shortly afterwards.

Outlook

Until the price breaks out/down from the resistance/support levels outlined, we are maintaining a neutral outlook for XRP.Bitcoin Cash (BCH)

The BCH price is trading inside a very important support area that is found at ₿0.033, being very close to its 200-day moving average (MA). While the price briefly decreased below this support level yesterday, it has rallied quickly to reclaim it since.

Outlook

The BCH price is expected to move towards the closest resistance area at ₿0.0375.Bitcoin Cash SV (BSV)

The BSV price has been following an ascending support line since the beginning of the year. On March 19, the price broke out above its descending resistance line and has been gradually increasing at the slope predicted by the support line since.

Outlook

The price is expected to gradually increase until it breaks out above ₿0.03. The rate of increase is likely to accelerate afterward.Litecoin (LTC)

On April 6, the Litecoin price broke out from a descending wedge that had been in place since March 11. It reached a high inside the ₿0.00645 resistance area three days later and has been decreasing since.

Outlook

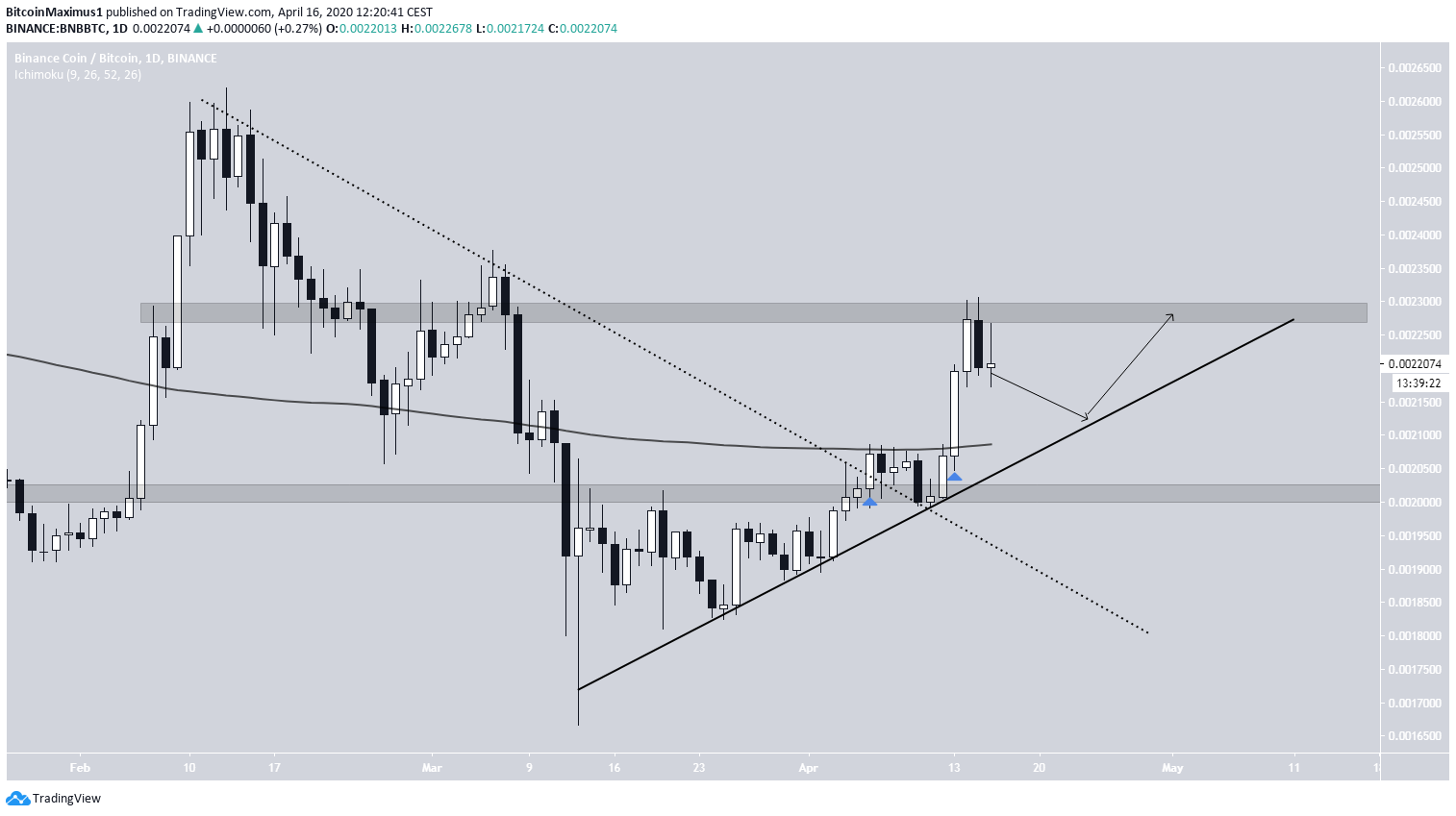

The LTC Price is expected to increase towards the resistance area at ₿0.00645.Binance Coin (BNB)

On April 6, the BNB price broke out from a descending resistance line that had been in place since Feb. 11. It followed this with another breakout on April 13, this time from the 200-day MA.

Outlook

The BNB price is expected to drop and validate the ascending support line once more. Afterward, a move towards the resistance area of ₿0.0023 is anticipated.EOS (EOS)

On April 6, the EOS price broke out from a descending resistance line that had been in place since Feb. 18. The price has been gradually increasing since, most notably on April 16.

Outlook

The price is expected to drop towards the support area of 3,400 satoshis. Afterward, an upward move towards the resistance area seems likely.Tezos (XTZ)

On April 7, the XTZ price began an upward move. It broke out above the main resistance area at 0.0002750 shortly afterward and validated it as support. The price has created a symmetrical triangle.

Outlook

The XTZ price is expected to break out from the symmetrical triangle and move towards the resistance areas outlined above.ChainLink (LINK)

On April 7, the LINK price broke out from a descending wedge. The price continued to increase until April 13, when it reached a high of 51,379 satoshis.

- An ascending wedge, which is known as a bearish reversal pattern.

- Bearish divergence in the RSI, which often precedes trend reversals.

Outlook

The price is expected to find support at 44,000 satoshis and begin an upward move towards the resistance at 52,000 satoshis.Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

#Cryptocurrency News

#News about Bitcoin (BTC)

#Altcoin Analysis

#Bitcoin (BTC) Analysis

#News About Ethereum (ETH)

#Binance Coin (BNB) News

Sponsored

Sponsored