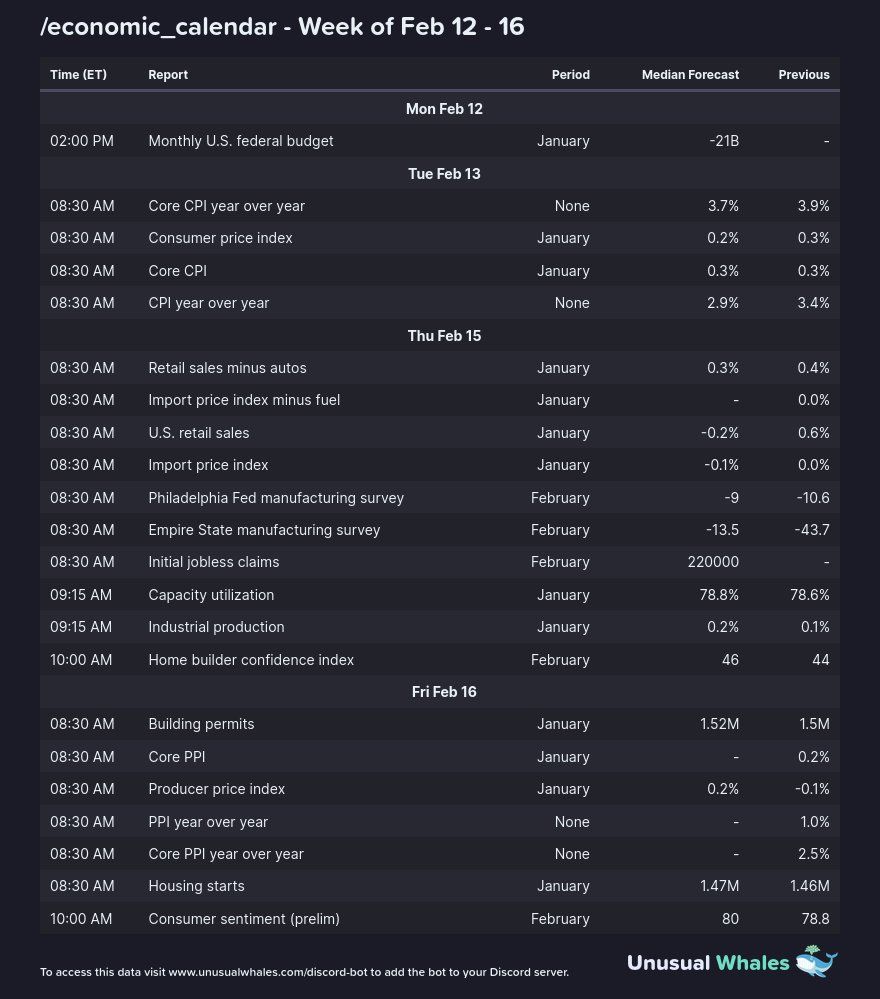

A busy week lies ahead regarding economic events with key CPI reports and several Federal Reserve speeches. Crypto markets have been at their highest level for almost two years, but are they about to break out?

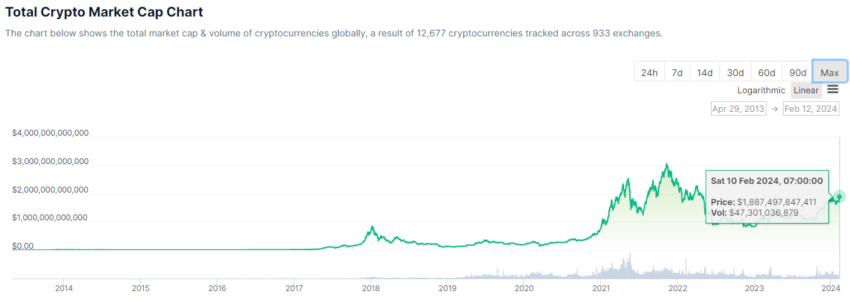

Macroeconomics outlet The Kobeissi Letter listed the key economic events for the United States for the week beginning February 12. It follows a weekend of gains for Bitcoin and crypto markets, which are approaching $2 trillion in total market capitalization.

Upcoming Economic Indicators: Core CPI, Retail Sales, and PPI

Tuesday will see the release of the core CPI report or consumer price index, one of the two key indicators used to measure inflation.

Investors pay close attention to this as it reflects the price trends in the economy and shapes consumer spending and business outlooks. It also directly affects the Federal Reserve’s policy rate decisions.

Moreover, January’s Retail Sales will be released on Thursday. This report provides data on the amount of consumer spending on various durable and non-durable goods. It essentially gauges the economy’s overall health and consumer spending habits.

Friday will see the release of the Producer Price Index (PPI) for the previous month. This report reflects prices for producers and manufacturers and is seen as a good pre-indicator of inflationary pressures.

Friday also sees last month’s Consumer Sentiment Index and preliminary Consumer Inflation Expectations. These reports provide the results of a monthly survey of consumer confidence levels and views of long-term inflation.

Additionally, the level of confidence affects consumer spending, which contributes about 70% of the US GDP.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Investors have been confident over the past week, as seen in US stock markets. The S&P500 hit new record highs at the end of last week, topping 5,000 points for the first time.

In addition to all the economic reports, several Fed speakers will make comments this week. These include Fed Governors Michelle Bowman and Christopher Waller and Fed Vice Chair for Supervision Michael Barr.

Crypto Market Impact

Crypto markets are currently at their highest total capitalization since April 2022. The figure tapped $1.9 trillion following a 1% gain during the Monday morning Asian trading session.

Bitcoin hit an intraday high of $48,729 on February 12 before retreating to $48,144 at the time of writing. The asset is up 13.5% over the past seven days.

Ethereum has been slower to react, declining slightly over the past 24 hours to $2,500.

Most altcoins are in the red following a week of solid gains, most of which were held over the weekend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.