Bitcoin (BTC) has fallen by 2.5%, and crypto liquidations have reached nearly $140 million in the past 24 hours. But why are traders still greedy?

Bears have overtaken the crypto market, as Bitcoin is down by nearly 2.5% to $28,600. While the price of Bitcoin and major altcoins are down, the market sentiments have a different story to tell.

Traders Greedy Despite Liquidations

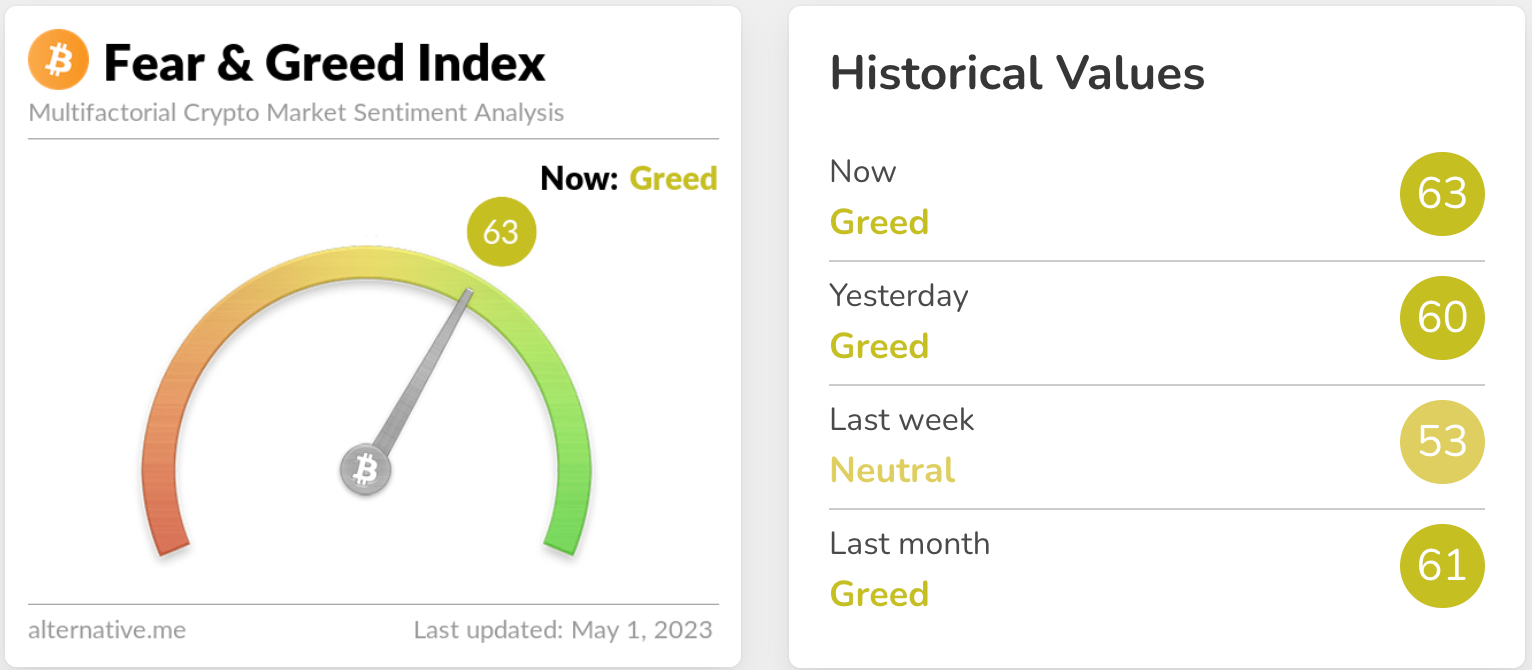

As of writing, the Crypto Fear and Greed index stands at 63 points, which indicates greedy sentiment in the market. Alternative.me measures the index by analyzing emotions and sentiments in the market through multiple sources.

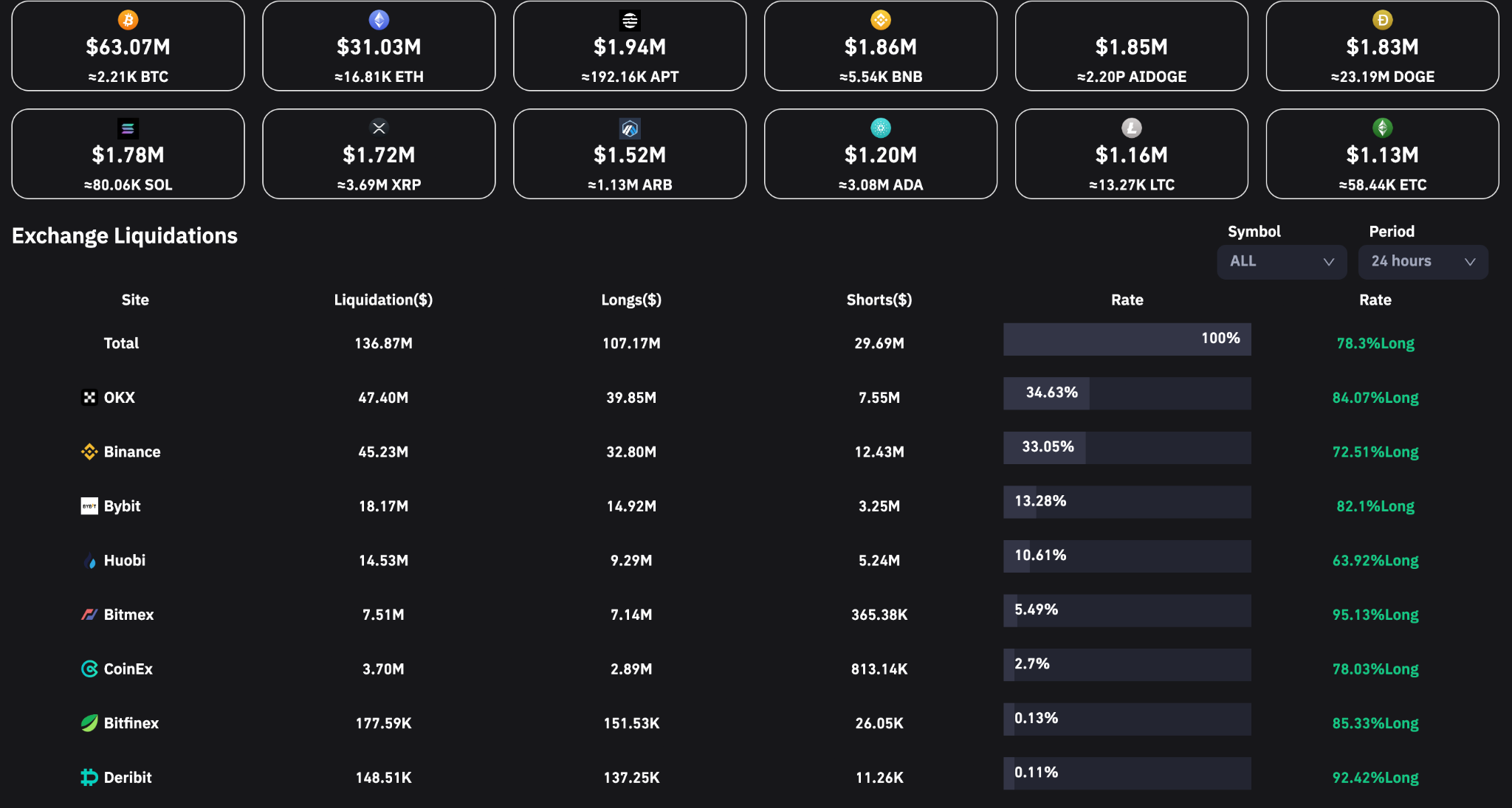

But in contrast, the bearish movement in the market has liquidated $136.85 million worth of trades in the past 24 hours. According to Coinglass, 32,738 traders faced liquidation, while the OKX exchange liquidated a single trade worth $5.62 million.

Out of the total liquidations, 78.3% were long positions worth around $107.17 million.

Quantitative Easing Due to Banking Collapses

The U.S. banking crisis has consumed the 14th largest bank in the nation – First Republic Bank. According to Reuters, JPMorgan Chase & Co. have acquired assets and certain liabilities of First Republic Bank.

Today, the 84 branches of the bank will reopen as branches of JPMorgan.

Crypto influencer Hitesh Malviya believes there is a high possibility of quantitative easing due to the U.S. banking crisis. He told BeInCrypto:

First Republic Bank has fallen down recently, making the U.S. banking crisis worse. There is a high possibility of quantitative easing through additional fiat circulation. That makes people stay long in the market as new money in circulation can make a short-term bull case for Bitcoin.

After the fall of major banks such as Silicon Valley Bank, the Federal Reserve (Fed) injected $300 million to rescue the banking system. Also, the Fed is widely expected to pause its interest rate hikes from July.

Robert Reich, a professor of public policy, believes, “The sensible thing would be for the Fed to pause rate hikes long enough to let the financial system calm down. Besides, inflation is receding, albeit slowly. So there’s no reason to risk more financial tumult.”

Got something to say about crypto liquidations or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.