Crypto investment inflows hit $1.2 billion last week, marking three consecutive weeks of positive growth since September 9. This surge comes amid growing optimism in the market, fueled by bullish macroeconomic developments and other value-boosting events in the finance sector.

Additionally, September broke its typical trend of poor performance, creating the strongest starting point for Bitcoin (BTC) and the broader crypto market heading into October.

Crypto Inflows Soar to $1.2 Billion Amid Market Optimism

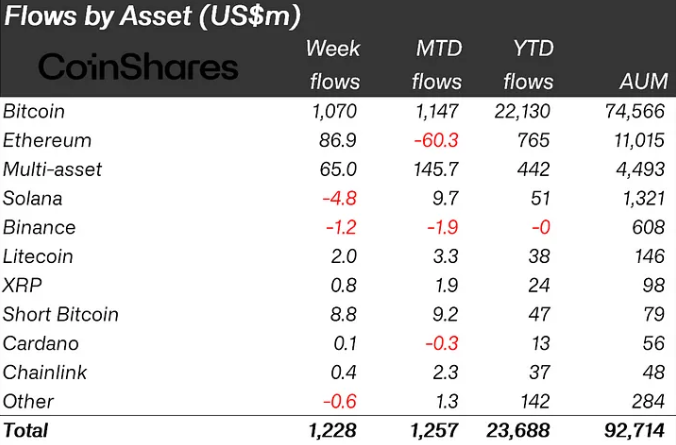

Digital asset investment products saw inflows of $1.2 billion last week, with Bitcoin leading the charge, recording $1.070 billion in positive flows. Short-Bitcoin investment products also saw inflows, totaling $8.8 million. Meanwhile, Ethereum (ETH) ended a five-week outflow streak, with inflows reaching $87 million, reflecting a resurgence of positive sentiment.

The US leads from a regional standpoint with $1.17 billion, and the latest CoinShares report attributes inflows to positive economic data in the country.

“We believe the regional disparities are due in part to the timing of when ETPs were launched in Europe versus the US, as well as general attitudes toward new assets. Bitcoin ETPs were launched between 2015 and 2019 in Europe, so investors have been sitting on significant gains in some cases. In the US, since Bitcoin ETPs have only been truly accessible since January this year, there are likely to be fewer sellers. This is evident in the data, with US$350 million in outflows from Germany year-to-date versus US$23.6 billion in inflows in the US,” Coinshares’ Head of Research James Butterfill told BeInCrypto.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

As BeInCrypto reported, the Federal Reserve’s 50 basis point (bps) interest rate cut in September sparked a wave of liquidity, benefiting riskier assets like Bitcoin. Combined with cooling inflation, markets are now expecting further rate cuts by the end of the year.

The report also highlights that the approval of options trading in the US has added momentum to crypto investment inflows. BlackRock’s spot Bitcoin ETF recently secured options trading approval from the US Securities and Exchange Commission (SEC), a development expected to bring more liquidity and enhance market stability.

It also opens the door for potential approval of Ethereum ETFs, a possibility widely discussed.

“Digital asset investment products saw a third consecutive week of inflows totaling $1.2 billion, which we believe is a reaction to continued expectations of dovish monetary policy in the US. The approval of options for certain US-based investment products likely boosted sentiment,” an excerpt in the report read.

Indeed, there is a generally positive sentiment in the crypto market. This saw BlackRock’s ETHA join the $1 billion ETF club in two months. It also catapulted Bitcoin and Ethereum ETF inflows to multi-week highs amid frothing hope for a market-wide recovery.

Bitcoin Scores Best September Close Ahead of Expected Bullish Q4

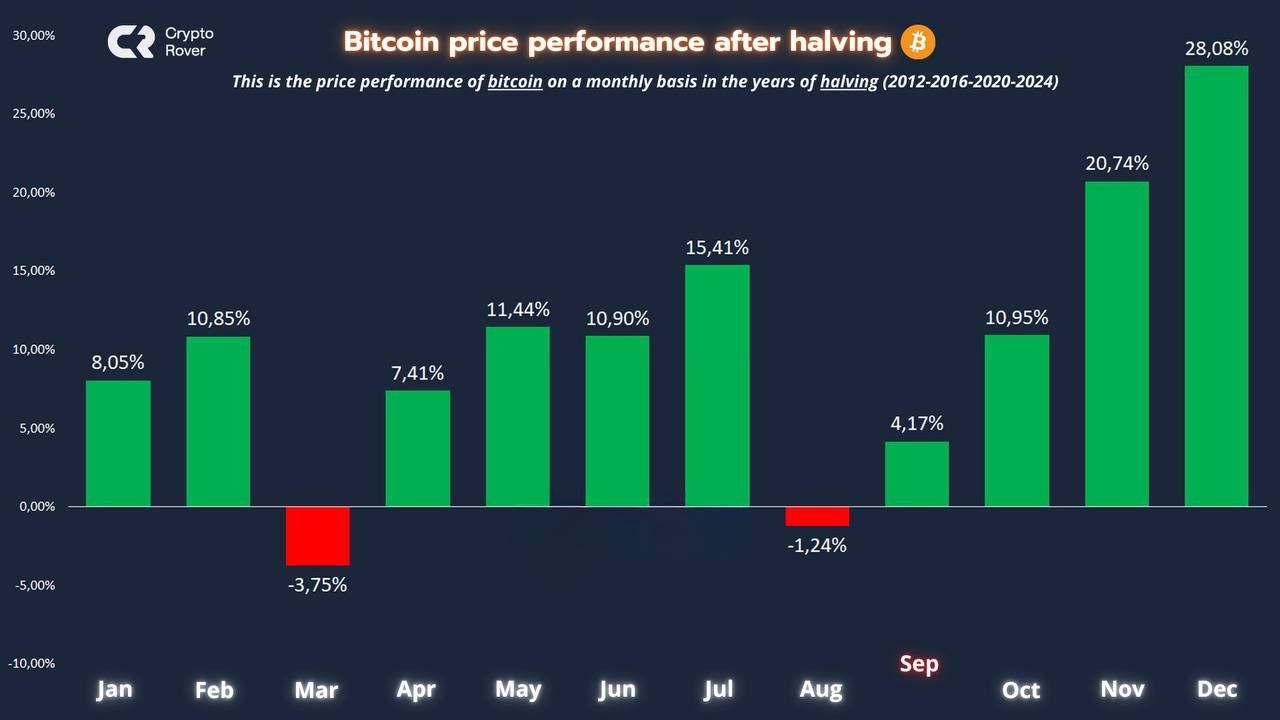

Elsewhere, hedge funds are predicting a Bitcoin rally in the fourth quarter (Q4) following the cryptocurrency’s strongest September close on record. Historically, Bitcoin has struggled in September, often posting negative returns. However, this year, it defied expectations, rising by around 20%.

ZX Squared Capital forecasts that the upcoming US elections will further boost Bitcoin, regardless of the outcome. The hedge fund argues that both political parties have failed to address rising national debt and deficits, a factor it believes will strengthen Bitcoin’s position post-election.

Similarly, analyst Crypto Rover expects Bitcoin’s best price performance to occur in Q4, citing historical patterns following halving events.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Indeed, Bitcoin has a history of rallying in Q4, especially in halving years like 2020. With traders and investors holding out for a potential all-time high in 2024 or soon after, this optimism could attract more retail interest, spark media coverage, and drive greater adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.