Navigating the regulatory environment of the cryptocurrency industry worldwide can be a daunting task for companies. With high stakes, non-compliance can lead to severe legal ramifications, including potential criminal charges for crypto founders and senior executives.

Nicola Massella, a Web3 Lawyer at Storm Partners, shared invaluable insights with BeInCrypto on how crypto companies can avoid compliance pitfalls.

Understanding AML Compliance

Anti-Money Laundering (AML) standards are critical for the cryptocurrency industry. Massella emphasized that adhering to these standards is not optional.

“AML concerns have been at the forefront for regulators since Bitcoin’s early days. Therefore, ahering to AML standards is paramount,” Massella noted.

The European Union, for instance, initially regulated “virtual currencies” primarily to mitigate AML risks. Today’s crypto industry boasts advanced tools for wallet screening and transaction analysis.

Blockchain’s immutability and transparency offer an opportunity to surpass traditional financial systems in preventing AML threats. Crypto platforms must fully embrace these technologies to elevate their compliance standards.

While some argue that AML compliance contradicts crypto’s decentralization and autonomy principles, Massella countered this view. Preventing illicit activities is essential for the mainstream acceptance of cryptocurrencies. He highlighted zero-knowledge proofs as a promising innovation that balances AML prevention with privacy and decentralization.

Crafting Effective Contracts

Crafting contracts in the crypto industry presents unique challenges due to the innovative nature of transactions like token sales and DeFi liquidity provision. These contracts often involve parties from different countries and are executed online, adding complexity.

One critical aspect is the enforceability of remedies in case of a breach. Engaging with entities lacking substantial assets can render court decisions ineffective. Traditional courts may also struggle with crypto-related disputes due to a lack of established precedents.

Massella advised against using generic contract templates or reusing contracts from acquaintances. Crypto-related agreements require a lawyer with in-depth field knowledge to tailor contracts to each deal’s unique characteristics.

“My foremost advice to crypto entrepreneurs is to steer clear of generic contract templates or reusing contracts from acquaintances as a cost-saving measure,” Massella told BeInCrypto.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

Moreover, he emphasized that dispute resolution strategies in the crypto industry are similar to other commercial contexts. The initial step involves evaluating the client’s position and potential for settlement. This is followed by negotiations with the other party’s legal representatives to reach a mutually agreeable resolution.

For consumer-related disputes, additional factors come into play. Reputation holds significant weight in the crypto industry. Platforms may not be legally obligated to compensate users for losses due to hacking or system malfunctions, but doing so can enhance customer trust and brand integrity.

Maintaining a professional demeanor and separating emotions from business decisions is crucial. For crypto entrepreneurs, focusing on constructive engagement and growth rather than conflicts is key.

Structuring a Crypto Company

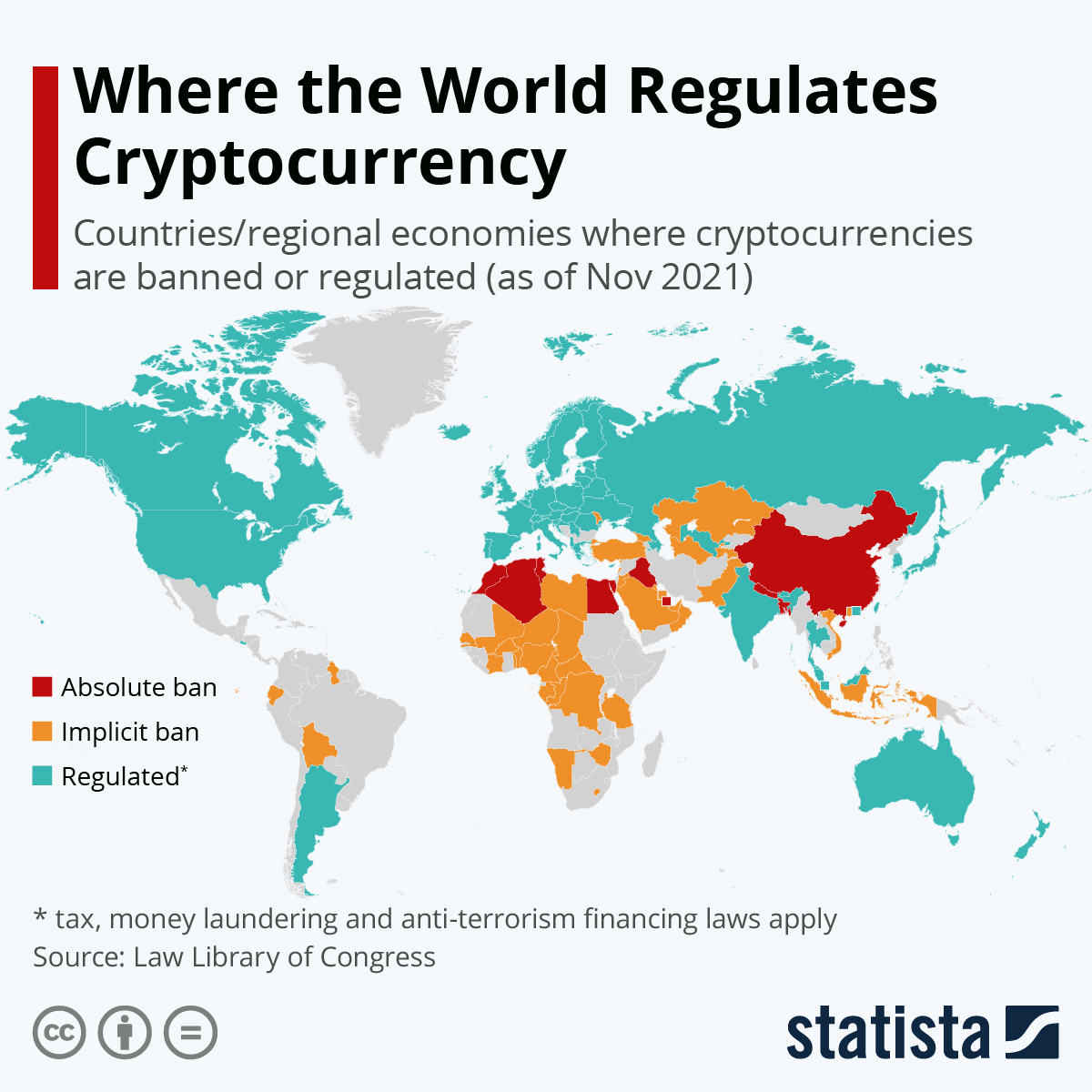

When structuring a crypto company, especially with an eye toward mergers and acquisitions, several factors must be considered. The regulatory environment tailored to each crypto project’s specific activities is vital. Compliance with relevant regulations is essential, as the legal framework governing Web3 varies significantly across jurisdictions.

Corporate structures in the crypto industry are often complex, involving multiple entities across various jurisdictions. This complexity is a response to the diverse legal and regulatory environments worldwide. Entrepreneurs must navigate this to ensure compliance with each jurisdiction’s laws and regulations.

Understanding the regulatory environment’s impact on the deal’s feasibility and structure is crucial in mergers and acquisitions. Legal due diligence, company valuation, operational integration, and future growth prospects all hinge on regulatory compliance.

Additionally, the crypto industry often involves foundations and associations in its corporate structures. These entities can be beneficial in connection with token-based organizations, safeguarding the rights and interests of token holders.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

In summary, avoiding compliance pitfalls in the crypto industry requires a deep understanding of AML standards, effective contract crafting, robust dispute resolution strategies, and a comprehensive approach to company structuring. With these expert tips, crypto companies can navigate the regulatory environment more effectively and position themselves for long-term success.