Despite positive Crypto.com news, the Crypto.com (CRO) price fell sharply on Jan. 30 and could be mired in a corrective pattern.

After bearish Crypto.com news two weeks ago in the form of layoffs, last week brought some positive CRO news. The cryptocurrency exchange announced that it is now certified with ISO 27017 for could security and ISO 27018 for the protection of privacy.

Both of these certifications are firsts for a digital asset platform. Despite this news, CRO, the native token of the Crypto.com exchange, decreased sharply on Jan. 30.

CRO Price Shows Weakness

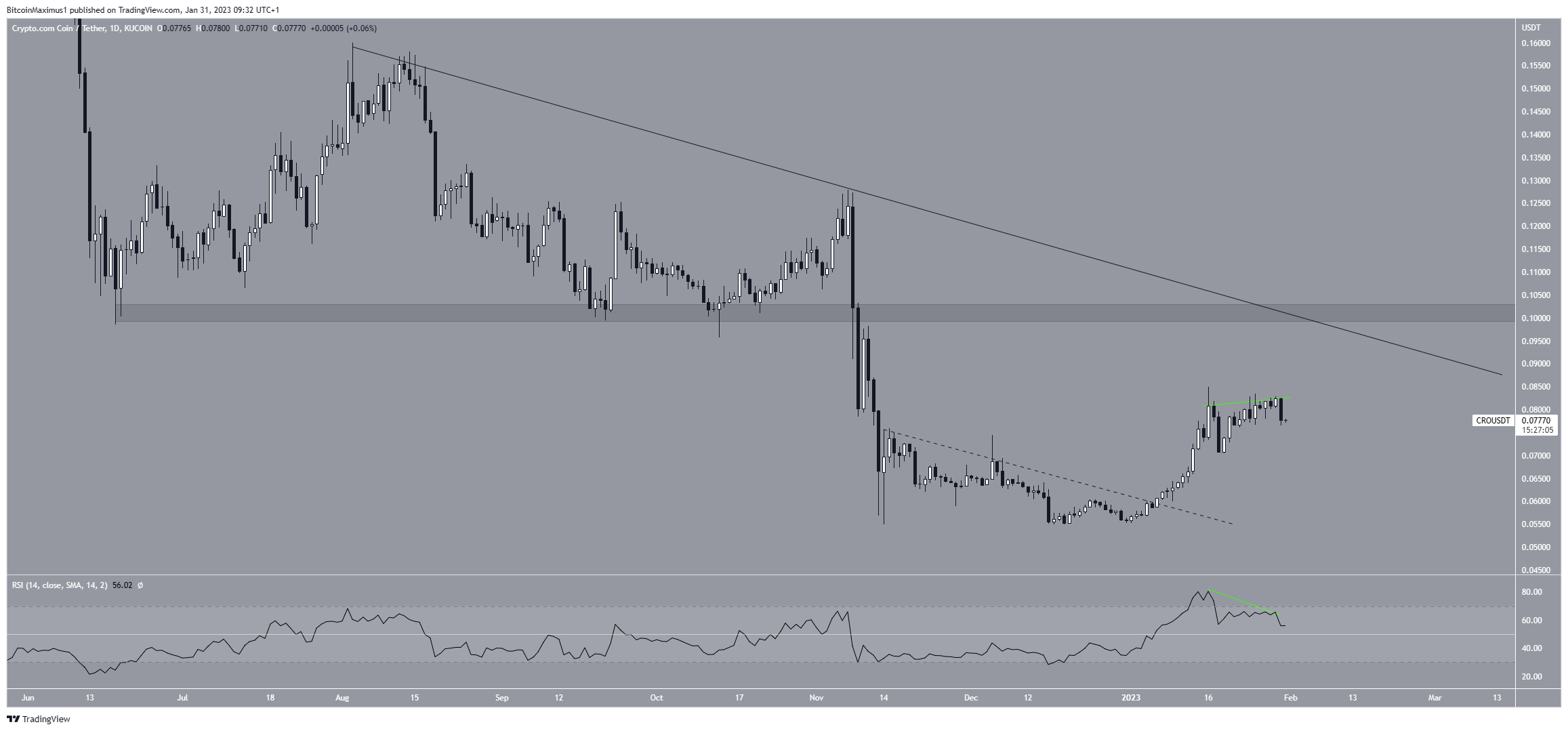

The CRO price broke out from a short-term descending resistance line on Jan. 6. It accelerated its rate of increase afterward leading to a high of $0.085 on Jan. 16. After a brief drop, the CRO price returned to the same level in Jan. 29.

However, the daily RSI has generated bearish divergence since the first high. Such divergences often precede downward movements. Moreover, the price created a bearish engulfing candlestick on Jan. 30 and began the current downward trend, falling sharply over the past 24 hours.

The main resistance area is at $0.101, created by a horizontal resistance and a long-term descending resistance line. The CRO coin trend can only be considered bullish once the price breaks out from this confluence of resistance levels.

CRO Price Prediction for Feb: Upward Movement Will Follow Drop

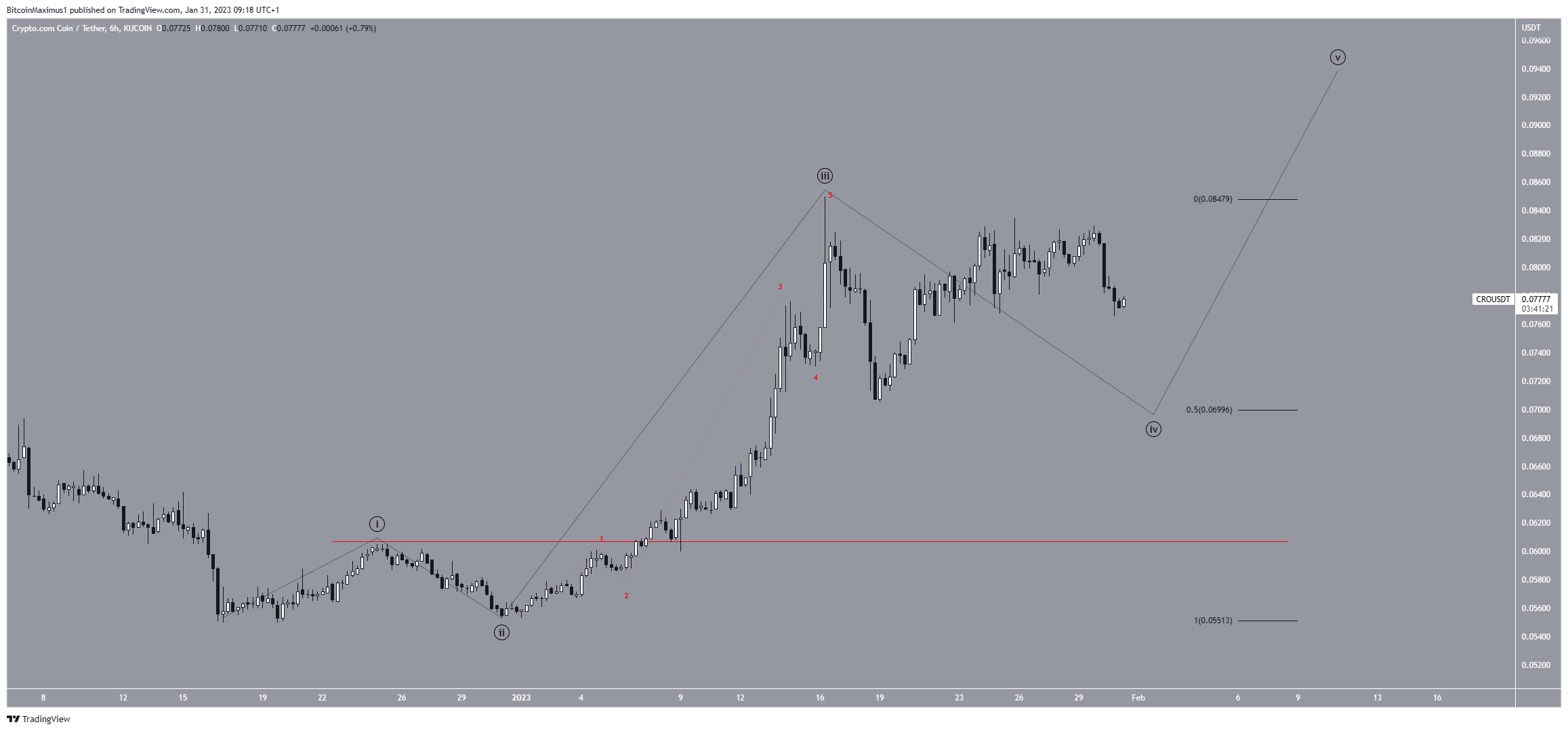

The short-term six-hour chart’s technical analysis indicates that the CRO price is most likely in wave four of a five-wave upward movement (black). The sub-wave count is displayed in red, meaning that wave three extended.

If the count is correct, the CRO price will drop just below the sub-wave four lows, near the 0.5 Fib retracement support level at $0.069. Afterward, the upward movement could continue.

A potential target for the top of the upward movement would be near $0.101, created by the previously outlined confluence of resistance levels. However, a more accurate estimate can be given once wave four ends.

This bullish CRO price prediction for Feb. would be invalidated if the price fell below the wave one high (red line), which is $0.060. In that case, the Crypto.com price could fall below $0.055.

To conclude, the CRO price prediction for Feb. is bullish. Despite the possibility of an initial fall toward $0.070, the CRO price is expected to rise afterward and increase toward $0.101. However, a fall below $0.060 would invalidate this bullish outlook and send the CRO price below $0.055.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.