The Crypto.com (CRO) price broke out from a descending resistance line despite overwhelmingly bearish news.

Firstly, on Jan. 11, the firm announced that it would delist Tether (USDT) for Canadians in order to comply with the Canadian Securities Administrators (CSA). Two days later, more negative Crypto.com news surfaced. The exchange announced that it would lay off 20% of its workforce, resuming the recent wave of job cuts following the collapse of FTX.

Despite these two negative pieces of news, the CRO price has performed admirably this year, increasing by roughly 45%.

Crypto.com Price Jumps by 45%

The CRO price has increased since Dec. 20, 2022. It created a higher low on Dec. 30 and accelerated its rate of increase afterward. Since then, it has moved upwards by 45%.

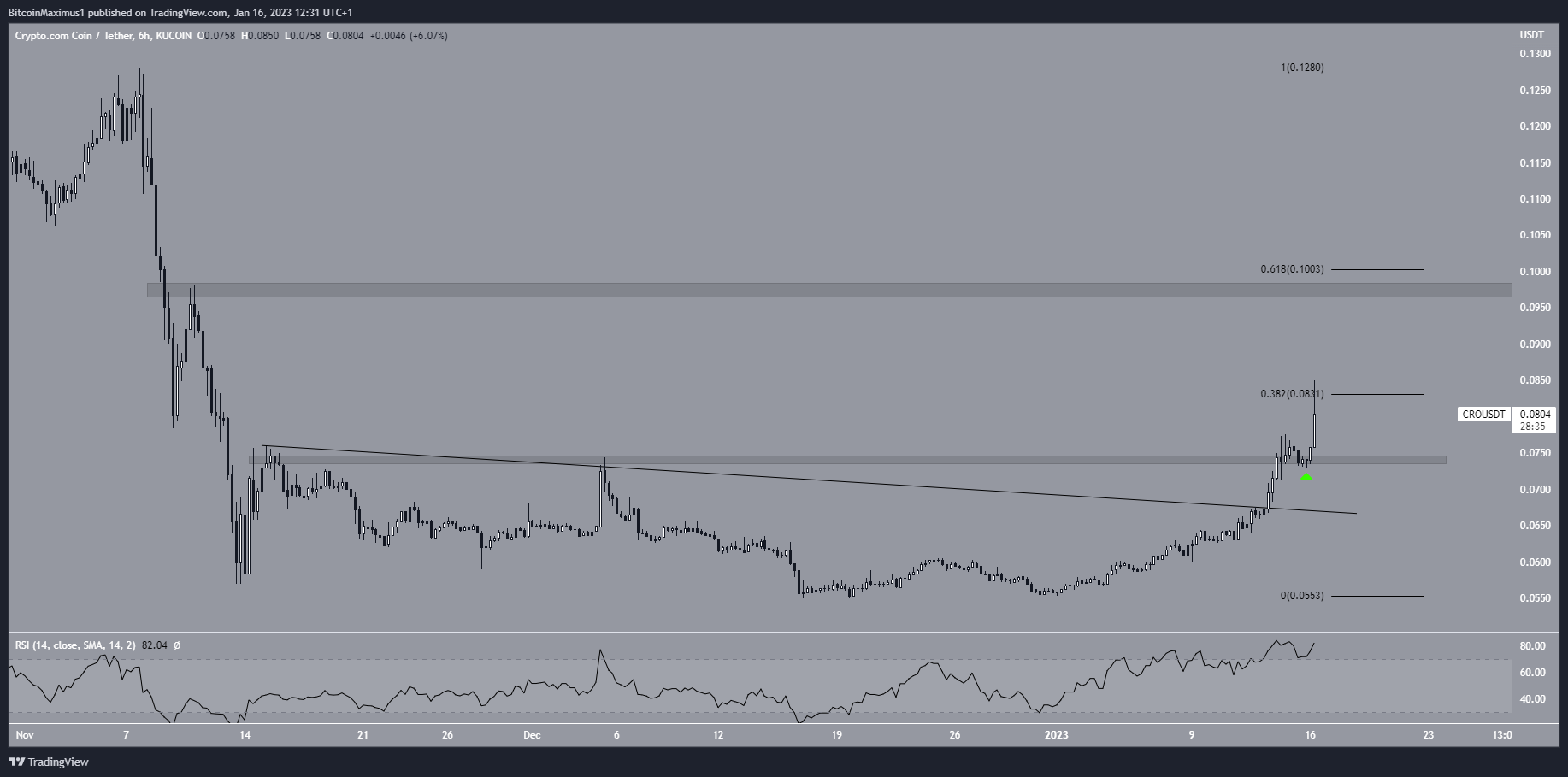

On Jan. 13, the Cypto.com price broke out from a descending resistance line. It then moved above the $0.074 resistance area two days later. On Jan. 16, the CRO price validated the line as support (green icon) and then bounced. This led to a high of $0.085.

Currently, the CRO price faces resistance from the 0.382 Fib retracement resistance level. However, the main resistance area is close to $0.10, created by a horizontal resistance area and the 0.618 Fib retracement resistance level.

Even though the RSI is overbought, it has not generated any bearish divergence. As a result, the upward movement may continue, leading the CRO price to the $0.100 resistance area.

On the other hand, a close below the $0.074 support area would invalidate this bullish hypothesis.

Short-Term CRO Price May Bounce Before Completing Wave Five

The technical analysis from the short-term two-hour chart shows that the CRO price is likely in wave four of a five-wave upward movement (black). The sub-wave count is given in red, showing that the Crypto.com price completed sub-wave five over the last 24 hours.

If the count is correct, the CRO price will decrease toward the sub-wave four region at $0.072 before bouncing and completing the fifth wave. The most likely target for the top of the fifth wave would be at $0.10, aligning with the previously outlined resistance area.

A decrease below the wave one high (red line) at $0.060 would invalidate this bullish wave count.

To conclude, the most likely CRO price forecast is an increase toward at least $0.100. Whether the price breaks out from this level or gets rejected could determine the future trend. On the other hand, a decrease below $0.060 would invalidate this bullish price projection.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.