These three crypto analysts failed to make accurate predictions for the crypto market in June, particularly regarding the Bitcoin (BTC) price.

It can be difficult to time or predict the correct movements in the market; even some of the best in the business get it wrong. BeInCrypto looks at crypto analysts who were unfortunately incorrect in their analysis of Bitcoin in June.

AltreetBet’s Bearish Count Does Not Materialize

A crypto analyst specializing in Elliott Wave theory @AltstreetBet believed that the downward movement that began in April was the start of a bearish trend reversal. He tweeted a chart that shows the price falling to a new yearly low.

While the reasons behind the idea are somewhat sound, the decrease never materialized. The decrease since the April high seemed corrective due to the considerable overlap and the wedge-shaped pattern.

After the breakout, the price reached a new yearly high. This completely invalidated (red line) the possibility of a bearish trend reversal.

Therefore, in this case, the wave count given by AltstreetBet did not transpire as predicted. Rather, the exact opposite occurred, and the BTC price initiated a bullish trend reversal.

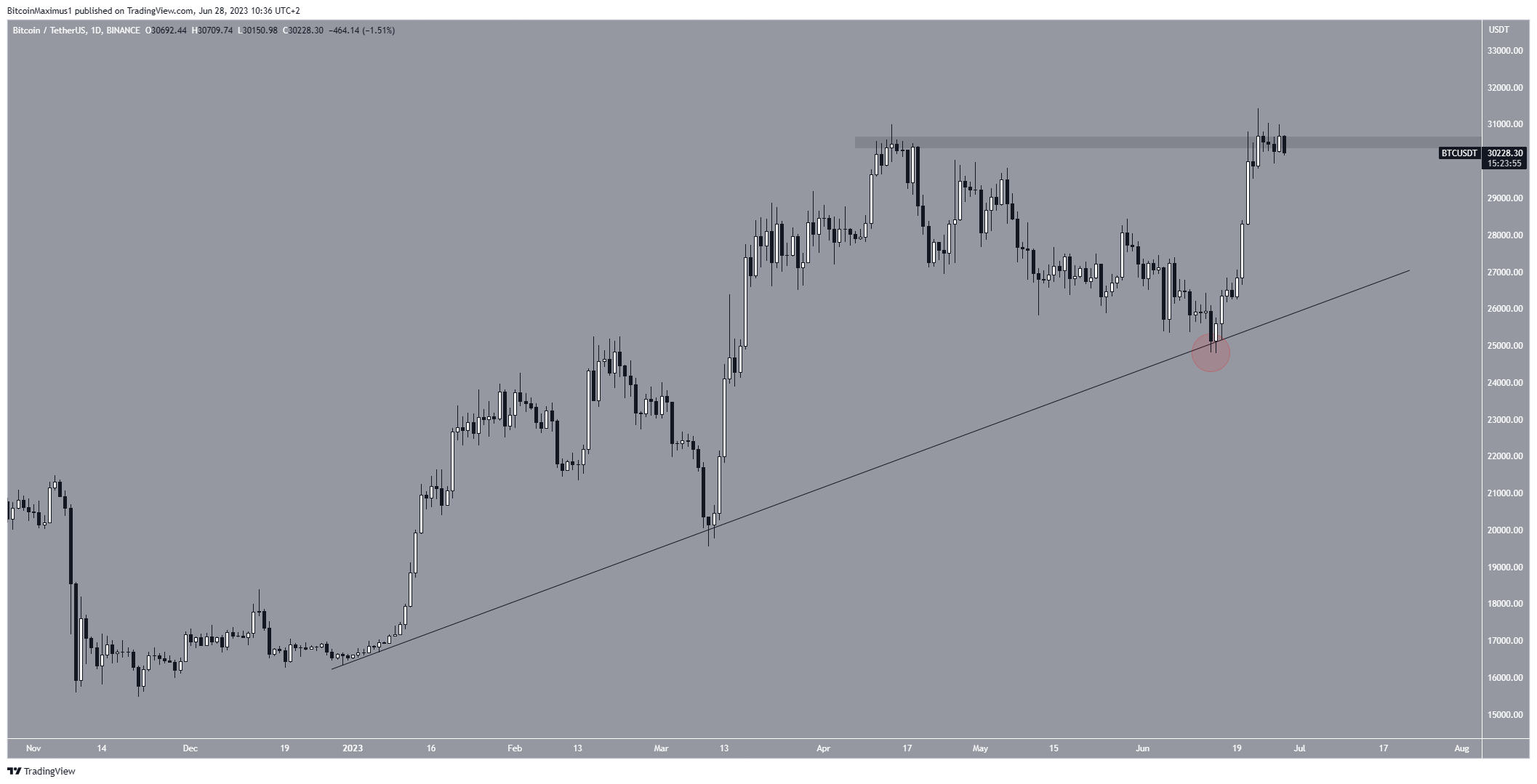

Ascending Support Line Breakdown is Illegitimate

Finally, a well-known analyst with a bearish bias, @Profit8lue, tweeted a broken ascending support line. Since the line had been in place since the beginning of the year, he predicted a decrease to $25,000 and then $22,000.

However, the tweet turned out to be premature since it was given at the exact bottom (red circle). The BTC price did not close below the ascending support line; it bounced anew and increased to a new yearly high on June 23.

This failed prediction outlines the importance of waiting for the period’s close before determining the future trend.

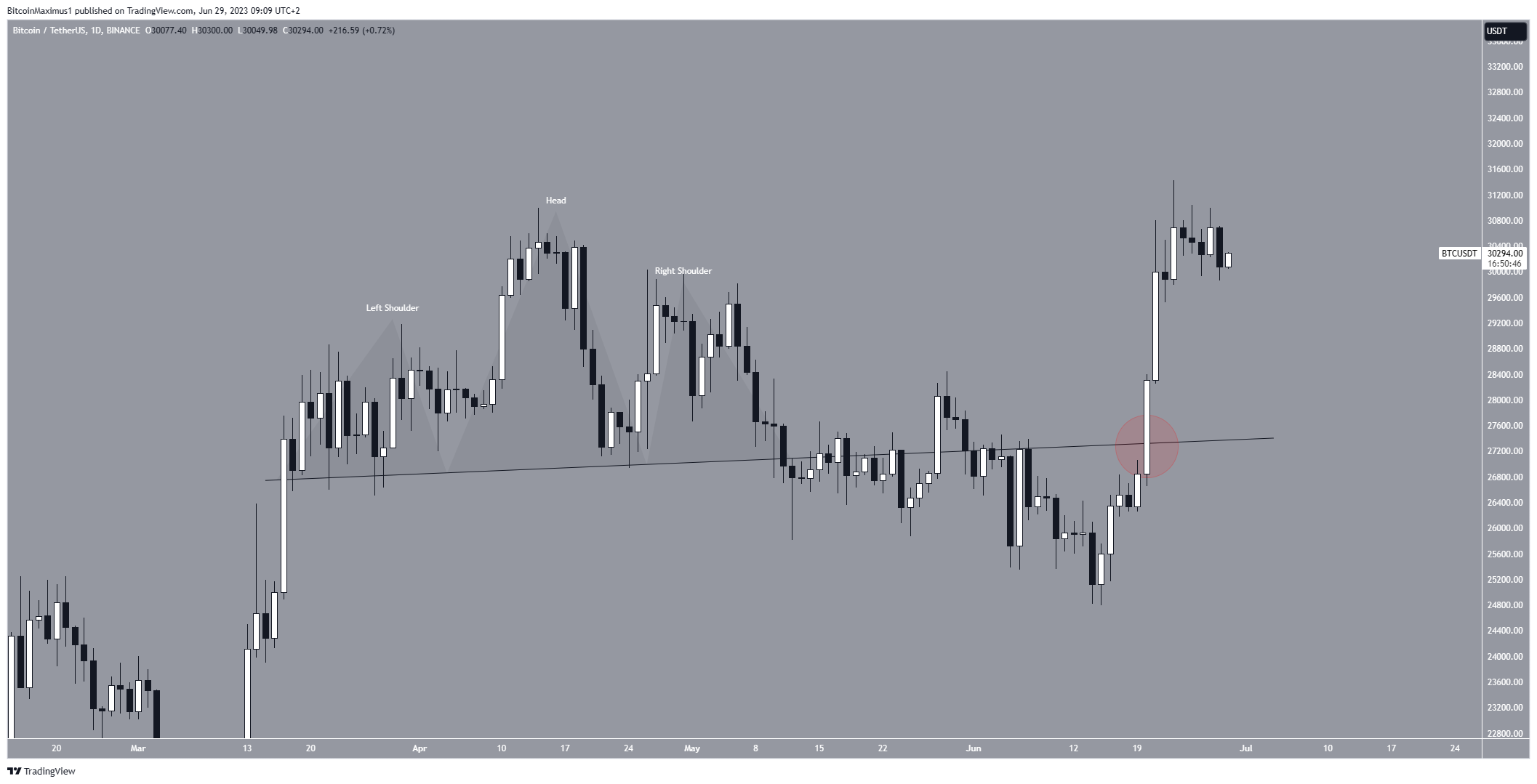

Head And Shoulders Neckline Does Not Create Reaction

Well-known crypto analyst @Anbessa100 tweeted a Bitcoin chart showing the price retesting the neckline of a head and shoulders pattern. At the time, this seemed like a regular retest that was followed by a downward movement.

However, the BTC price smashed through the neckline without reacting to it whatsoever (red circle), reaching a new yearly high on June 23.

While the decrease did not transpire, it is worth mentioning that Anbessa stated that a Bitcoin price close above the neckline would mean that the trend is bullish, while a fake out and decrease will mean that new lows will follow.

Thus, since the price broke out, the analysis suggests that the trend will be bullish in the future.

For BeInCrypto’s latest crypto market analysis, click here.