More clinics are offering services to help crypto addiction. But how bad is this emerging problem?

For years society has been increasingly concerned about gambling addiction, and rightly so. Gambling addiction is responsible for untold damage to families and communities. However, experts and psychologists have identified a new and growing problem: crypto addiction.

Multiple clinics have begun offering programs to help patients with this emerging illness. Castle Craig, a Scottish residential rehab clinic established in 1988 by Peter and Dr. Margaret Ann McCann, which has since expanded internationally, is one such center. In 2016, they became one of the world’s first treatment centers to offer a program for treating dependence on crypto trading.

‘More Volatile And Exciting Than Gambling’

Anthony Marini, a senior specialist therapist at Castle Craig, believes it’s a problem going under the radar. “If you think that there is about 3% of the U.K. population addicted to gambling, then in my estimation, there is roughly 5% with a problem with crypto.”

“It’s more volatile and exciting than gambling,” he says. “We are seeing more and more people with a problem year on year.”

Anthony saw his first crypto addiction case all the way back in 2016. Since then, Castle Craig has seen over 250 patients with the problem. Including a marked increase after the collapse of FTX last year.

In many ways, crypto addiction shares many similarities with gambling addiction. (Arguably, one is a subset of the other.) Both involve high-risk investments that can lead to significant financial loss. Both also provide a rush of adrenaline as victims become obsessed with the elusive big payday.

Crypto Addiction: Just The Symptom of Another Issue?

Like gambling, crypto addiction can also lead to compulsive behavior, with individuals becoming fixated on market trends and making ever riskier trades. Angie Malltezi, CSO at Clipper DEX, agrees that this behavior can be detrimental to an individual’s financial, mental, and physical health. I asked where she would draw the line. When does it become a problem?

“I do think that crypto trading can become unhealthy, particularly if a person becomes obsessed with it to the point that it negatively impacts their daily life, financial stability, and relationships,” she says. The line where it becomes unhealthy would vary from person to person, but generally, when it starts to negatively impact other aspects of a person’s life.”

However, Malltezi makes an interesting – if not controversial – point. Crypto addiction, like other addictions, is the symptom of an external stressor. A take that not everyone will agree with.

“Scientific research has shown that emotional stress is a consistent trigger for addictive behaviors; as such it would be more beneficial to society and a better use of financial resources to invest in social infrastructure that helps people recover from the underlying factors that has caused their addiction – this could be childhood trauma, lack of a community or emotional support system, amongst other factors that contribute to significant stressors in our lives.”

Is Crypto Addiction The Same Everywhere? Almost Certainly Not.

Addiction can also mean different things depending on where you live and what’s happening around you. For example, some things that people might get addicted to might not be seen as a problem in other places. Also, when a doctor looks for addiction, they might look for different signs than a judge would look for.

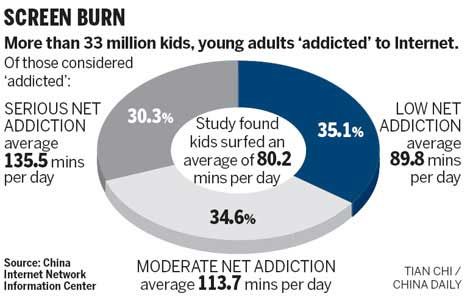

In China, the last decade or so has seen a moral panic around internet addiction. At least 33 million are hooked on Web gaming and other entertainment, according to the China Internet Network Information Center. In 2019, minors were limited to 90 minutes of gameplay on weekdays and banned from playing between 10 p.m. and 8 a.m. In 2021, the restrictions were tightened to only one hour of gameplay per day on Fridays, weekends, and public holidays.

Depending on the survey, time spent on the internet before 2019 was not vastly different than in the West. Yet, policymakers and civil society seem

It begs the question, is addiction the same everywhere? Individual researchers have argued that, in many respects, China’s definitions and understanding of addiction are socially constructed. (Well, of course, right?) So, is one person’s risky bet on Bitcoin another’s tell-tale sign of dependence?

Frankly, crypto has yet to be around long enough for us to really understand the issue entirely. Another limiting factor is the context in which it takes place. When many of us trade crypto, it is in the privacy of our own homes or our smartphones. In those cases, privacy makes our behavior harder to monitor.

How Much Of A Problem Is It?

While individuals may suffer greatly from an addiction to crypto trading, not everyone is convinced that it is a huge issue. “Crypto trading isn’t uniquely addictive and doesn’t strike me as a more significant societal problem than gambling or other potentially addictive activities,” says Scott M. Lawin, CEO, and COO of Candy Digital.

“As in these areas, basic risk-taking maxims apply: never risk more than you can afford to lose, do your research before you get involved, and learn to recognize the signs of addiction in yourself and others.”

Does he think the industry should signpost the dangers of trading more? “While there are no obligations, like any new financial market or asset class, leaders in the crypto/NFT industry would be well served to highlight the potential risks of its products to continue to educate and onboard the next wave of users and build awareness and trust with customers, investors, and regulators.”

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.