Cronos’ (CRO) price is anticipating a bullish outcome supported by the investors who have been HODLing their CRO.

Should the altcoin break out of the downtrend it is in, it would be able to recover the losses it noted recently.

Cronos Investors Seem Bullish

Crosnos’ price is largely dependent on its investors more than the broader market as historically, they have shown more influence on the altcoin. Even now, the whales will likely act as catalysts for initiating a recovery rally.

These large wallet holders have been accumulating for the last two weeks. The addresses holding between 100,000 to 10 million CRO have added more than 20 million CRO worth over $2 million.

Their total holdings now sit at 2.66 billion CRO, just as they did a month ago.

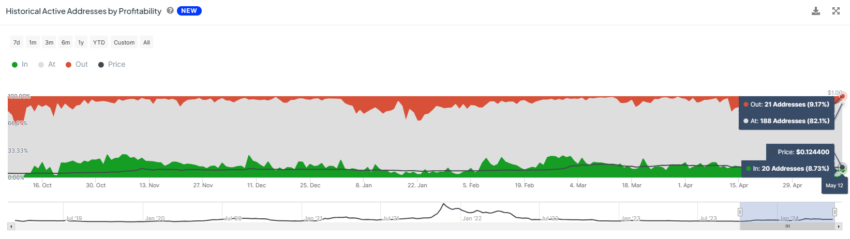

Furthermore, the retail investors are also exhibiting a positive outlook towards Crosnos’ price. Looking at the active addresses by profitability, it can be noticed that of the participating investors, less than 9% are in profit.

Usually, this cohort dominating the activity hints at potential selling at their hands. However, in the case of CRO, investors opt to sit back and await a recovery before booking profits.

Read More: Cronos (CRO): A Complete Guide to What It Is and How It Works

This should aid Cronos’ price in breaking out of the triangle.

CRO Price Prediction: Two Key Resistances

Crosnos’ price is moving within a descending triangle reversal pattern at the moment. This pattern is formed by a horizontal support line and a descending trendline, indicating a potential downtrend continuation.

However, a reversal pattern, based on market conditions and descending trading volume, suggests the opposite. It suggests that buying pressure might overcome selling pressure, possibly leading to a breakout, which is the case with CRO.

A breakout hints at a 37% rise, placing the target at $0.175, derived from the pattern. This would help the altcoin reclaim its recent losses. However, resistances at $0.133 and $0.145 would need to be flipped into support to do this.

Read More: Cronos (CRO) Price Prediction 2024/2025/2030

However, if the breakout fails, Cronos’ price could dip to the lower trend line of the pattern or below it to $0.118. This support line, if broken, would lead to an invalidation of the bullish thesis, sending CRO to $0.110.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.